Link: https://mishtalk.com/economics/nahb-housing-sentiment-and-present-conditions-crash-to-covid-19-lows

Graphic:

Excerpt:

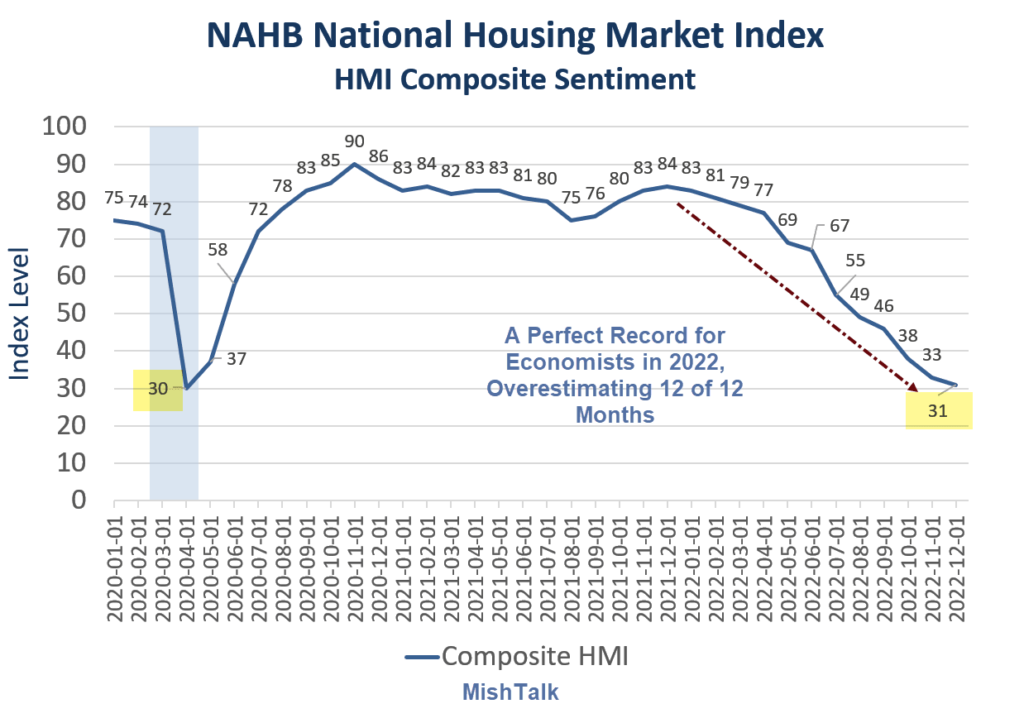

Please consider the NAHB/Wells Fargo Housing Market Index (HMI) for December 2022.

The NAHB/Wells Fargo Housing Market Index (HMI) is based on a monthly survey of NAHB members designed to take the pulse of the single-family housing market. The survey asks respondents to rate market conditions for the sale of new homes at the present time and in the next six months as well as the traffic of prospective buyers of new homes.

Bloomberg Econoday Consensus Outlook

“Spiraling downward, the housing market index has missed Econoday’s consensus every month this year. November’s 33 was 3 points short of the consensus. December’s consensus is 34.“

December’s 31 was also 3 points lower than consensus and 1 point lower than the entire consensus range of 32-35.

Well done! Perfection for 12 months is very difficult.

Author(s): Mike Shedlock

Publication Date: 19 Dec 2022

Publication Site: Mish Talk