Graphic:

Excerpt:

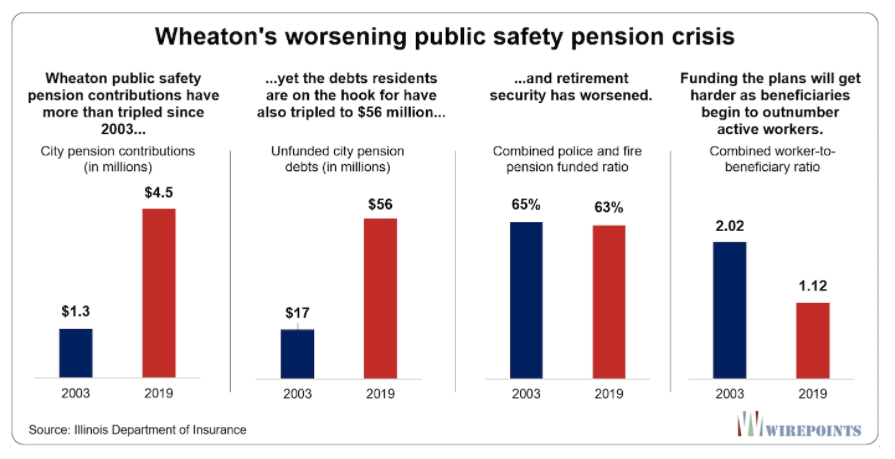

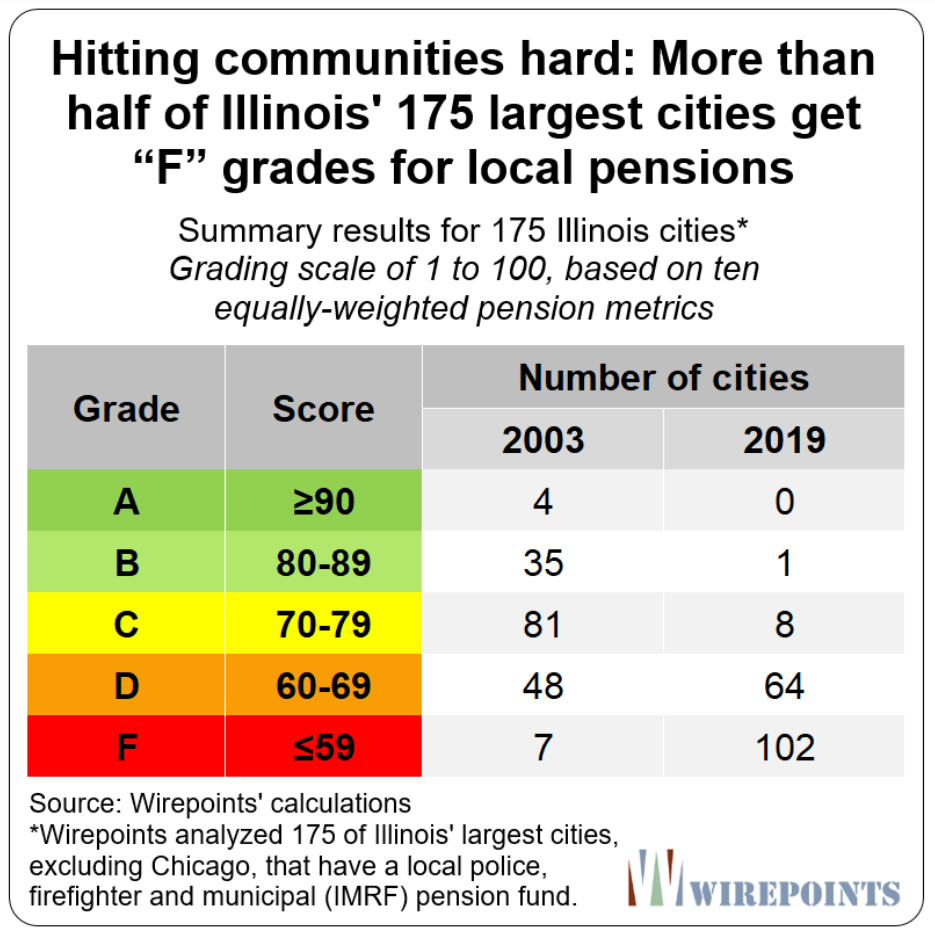

Workers’ retirement security has declined in an alarming number of Illinois cities. In 2003, just 21 of 175 cities analyzed had less than 60 cents on hand for every dollar they needed to fund future benefits of their city workers. By 2019, 99 of the 175 cities were below 60 percent funded. A 60 percent funding level is often seen as a point of no return from which pension funds can’t recover.

City taxpayers have increasingly paid more to pensions over the past 16 years, and yet the pension shortfalls they are on the hook for are far larger today. Pension contributions of the 175 cities have nearly quadrupled to $960 million in 2019 from $250 million in 2003, and yet local pension shortfalls still tripled to $11.8 billion, up from $3.4 billion in 2003.

Pension costs as a share of city budgets have doubled, crowding out spending on core government services. City pension contributions as a share of general budgets have doubled to 17 percent in 2019 from 8 percent in 2003.

Most local pension funds have turned upside down – they now have more retirees drawing benefits than active workers contributing. In 2003, only 15 cities had more pensioners drawing benefits than active workers making contributions into the fund. In 2019, that number rose to 112 cities.

Publication Date: 5 May 2021

Publication Site: Wirepoints