Graphic:

Excerpt:

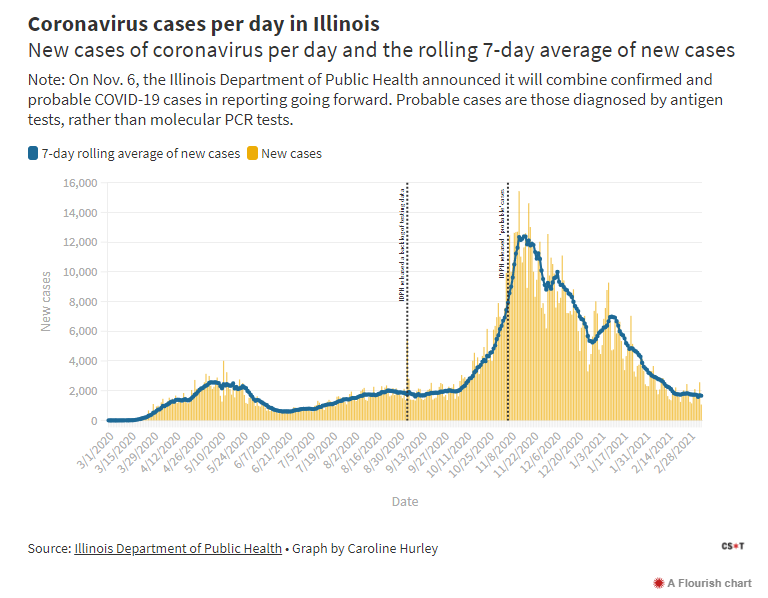

In a bid to vaccinate more people of color in neighborhoods hit hard by COVID-19, city officials Wednesday limited registration for United Center appointments to Chicagoans in a handful of South and Southwest Side neighborhoods.

Anyone who lives in the 60608, 60619, 60620, 60649 or 60652 ZIP codes can sign up for an appointment at events.juvare.com/chicago/UCPOD/ with the code “CCVICHICAGO,” or by reaching the multilingual call center at (312) 746-4835.

Chicago residents from outside those ZIP codes who try to sign up will have their appointments canceled, according to a city flyer circulated by several community groups.

Chicago will be allotted 60% of the vaccines administered at the United Center for its residents, while Cook County and the state determine rules for other residents. That’s the latest change in a signup process that has caused confusion from the start.

Author(s): Mitchell Armentrout, Brett Chase

Publication Date: 10 March 2021

Publication Site: Chicago Sun-Times