Graphic:

Excerpt:

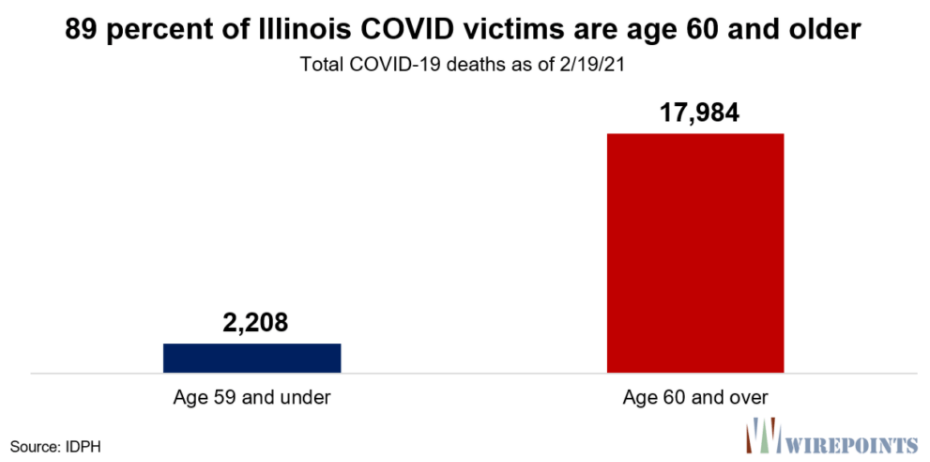

The state’s current vaccination category, 1B, includes the 1.9 millions over the age of 65, as well as the 1.3 million younger people who are first-responders or “essential workers” such as teachers, grocery store workers and transit workers. To date, about 150,000 Illinoisans aged 65 and over have been fully vaccinated, while nearly 390,000 residents aged 16-64 are already inoculated.

But groups both inside and outside that list have been demanding they take top priority. Everyone from politicians to teachers to bartenders to transit workers to librarians and more. That is patently absurd. There are a limited number of vaccines and if everybody is at the front of the line, then no one is. That’s why getting the elderly vaccinated has been so problematic.

…..

As long as we’re vaccinating the line jumpers who are younger than 60, we’re vaccinating the wrong people. Every needle in the arm of a younger Illinoisan – barring frontline health care workers – leaves an elderly Illinoisan at great risk.

Author(s): Ted Dabrowski and John Klingner

Publication Date: 22 February 2021

Publication Site: Wirepoints