Graphic:

Excerpt:

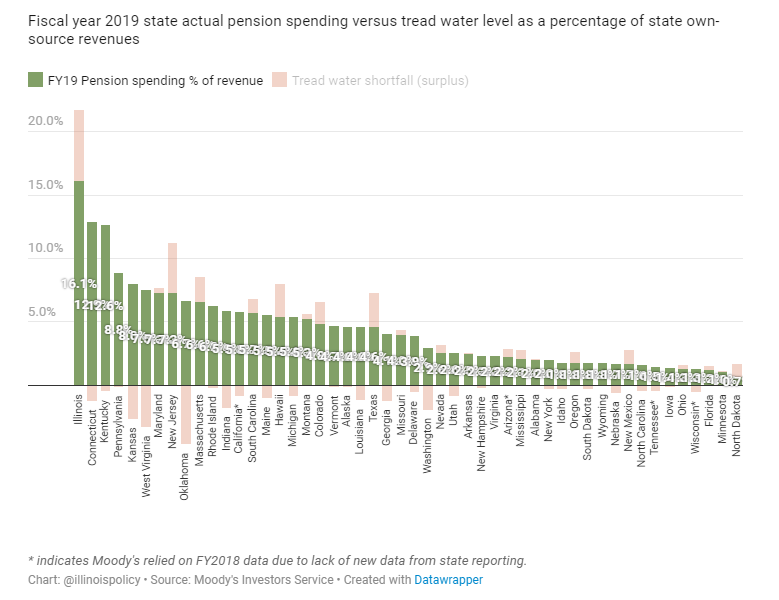

Pension debt increased $7.1 billion to $144.4 billion in fiscal year 2020, according to the Commission on Government Forecasting and Accountability, or COGFA, the fiscal analysis unit for the General Assembly. The total cost of that debt burden to taxpayers in fiscal year 2022 will be nearly $11.6 billion, including:

$9.4 billion in direct contributions from general revenue sources

$1.1 billion in “other state funds”

$797.9 million in debt service costs on previously issued pension obligation bonds

$264.8 million towards the Chicago Teachers’ Pension Fund, or CTPF

Pensions will consume 28.5% of the budget. That is based on $38.5 billion in expected general revenue for fiscal year 2022, adding in that $1.1 billion from “other state funds” – which would go to critical programs were it not being used for pension debt.

Author(s): Adam Schuster

Publication Date: 17 December 2020

Publication Site: Illinois Policy Institute