Graphic:

Excerpt:

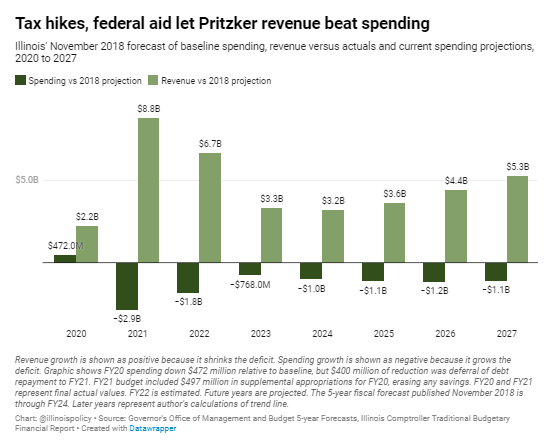

The timing on Wednesday was impeccable. I was looking at the price of oil, which was up four percent that day and about to pass $100/barrel. Energy stocks were up over one percent despite a horrible day for the rest of the market.

That’s when an email popped up with a story in Crain’s headlined “Chicago moving to divest from fossil fuels.”

….

So, with inflation raging, gasoline moving towards $4.00/gallon and Russia murdering Ukrainians with the help of American oil purchases, Chicagoans can take comfort knowing that the city will refuse to invest in oil and other fossil fuel production and thereby “will be sending a message that Chicago is permanently leaving dirty energy in the past and welcoming a clean energy future for generations to come.”

That’s from Chicago Treasurer Melissa Conyears-Ervin. She and members of the City Council, with Mayor Lori Lightfoot’s support, are pushing for an ordinance to mandate that the city divest its funds from fossil fuel companies, as Crain’s reported.

In fact Conyears-Ervin had already made oil and gas divestment office policy. The new ordinance would make the change permanent going forward. Her office has already removed $70 million in fossil fuel-associated bonds from the city’s portfolio, she says.

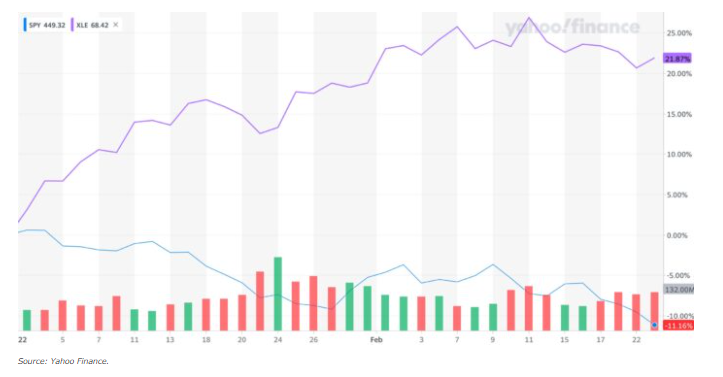

How wise has it been lately to be shunning fossil fuel investments? Here’s a chart comparing performance year-to-date of the S&P 500 to XLE, an ETF basket of mostly oil and gas companies. While the market in general is down some 10% the oil and gas stocks are up over 21%.

Author(s): Mark Glennon

Publication Date: 25 Feb 2022

Publication Site: Wirepoints