Link:https://www.ai-cio.com/news/looks-like-politicians-will-extend-illinois-pension-buyout-program/

Excerpt:

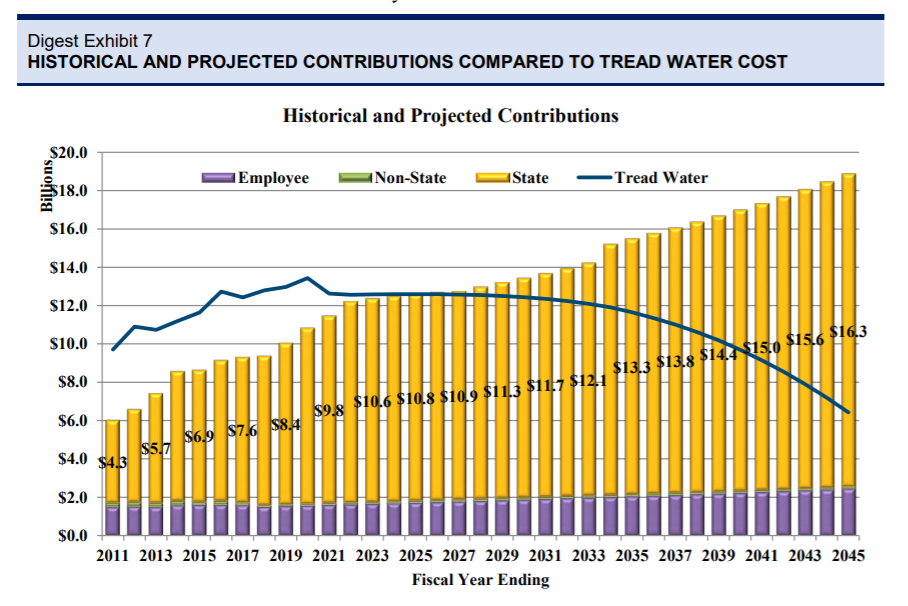

In 2019, the state of Illinois introduced a pension buyout system that allowed pension plan holders to receive a lump sum of cash now as opposed to keeping their money invested in the pension system. The payments are funded by a state bond issue of $1 billion.

Now, however, politicians are concerned the funding for this program will run out of money. Illinois state Representative Bob Morgan introduced a fast-tracked bill that is currently pending in the state House to renew this program for another two years and authorize another $1 billion in funding.

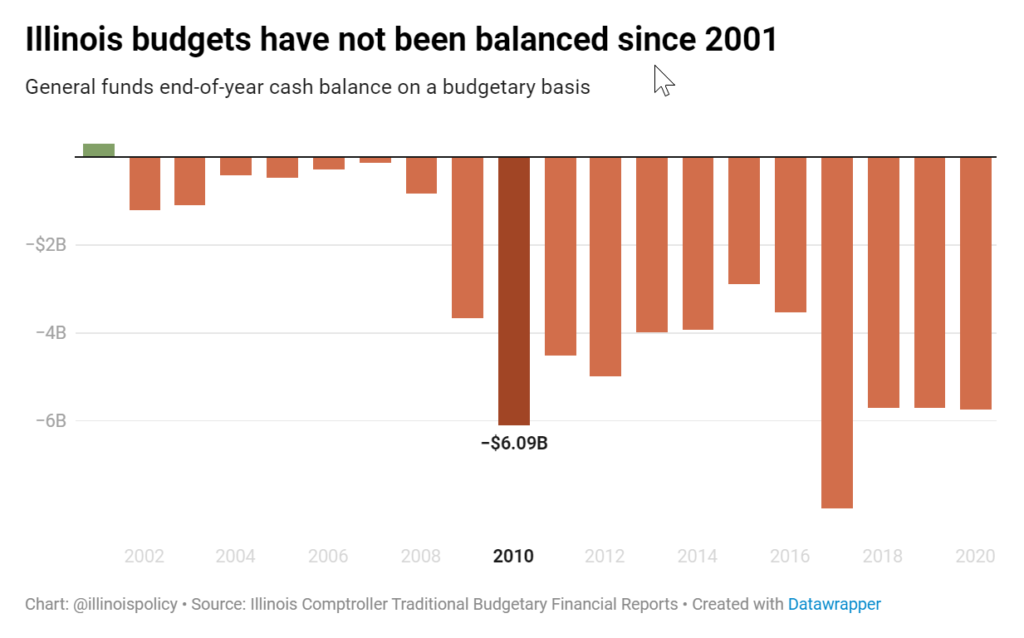

With over $130 billion in unfunded liabilities statewide, the state of Illinois has been actively searching for ways to help alleviate its financial burdens.

Author(s): Anna Gordon

Publication Date: 28 Jan 2022

Publication Site: ai-CIO