Excerpt:

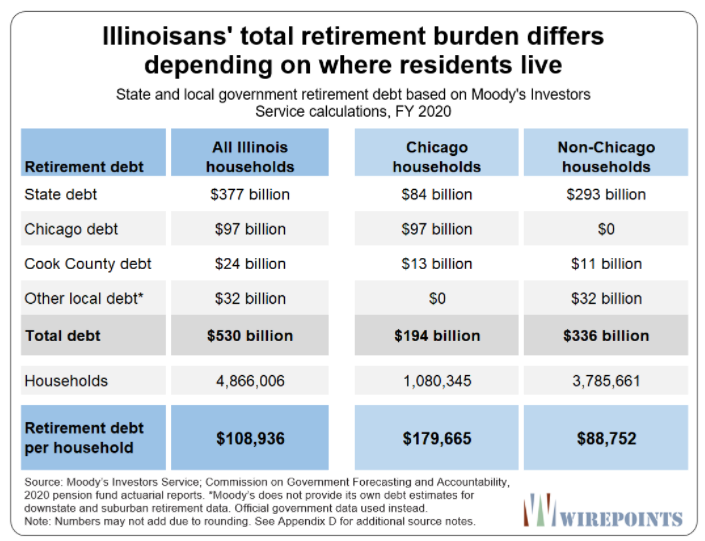

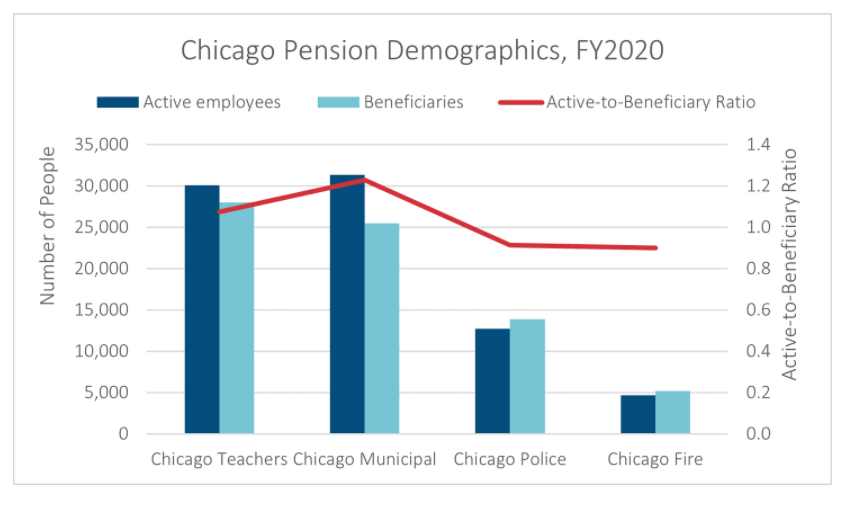

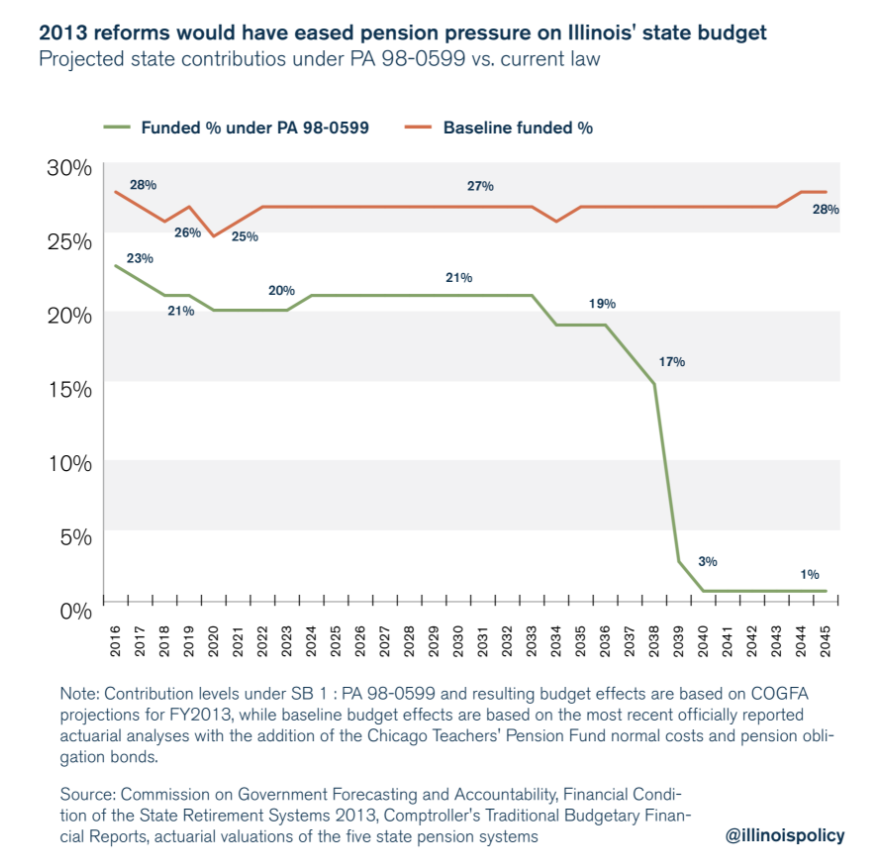

You may recall earlier this year when the General Assembly passed a bill that Gov. JB Pritzker signed to increase certain pension benefits for Chicago firefighters. The new law is expected to cost Chicago some $850 million and could drop the funded status from what was an already abysmal 18% down to an even-worse 16%.

Well, it appears that Illinois Senate leadership didn’t even bother to talk to Chicago Mayor Lori Lightfoot before mandating that additional burden.

The Chicago Tribune has released Lightfoot email and text messages it obtained on a number of matters. One went from Lightfoot to Senate President Don Harmon. “A courtesy call regarding the fire pension bill would have been helpful, particularly since there is no funding for it,” Lightfoot said. “When that pension fund collapses, I will be talking a lot about this vote.”

Author(s): Mark Glennon

Publication Date: 31 Dec 2021

Publication Site: Wirepoints