Link:https://www.sciencedirect.com/science/article/pii/S2667319321000124

Graphic:

Abstract:

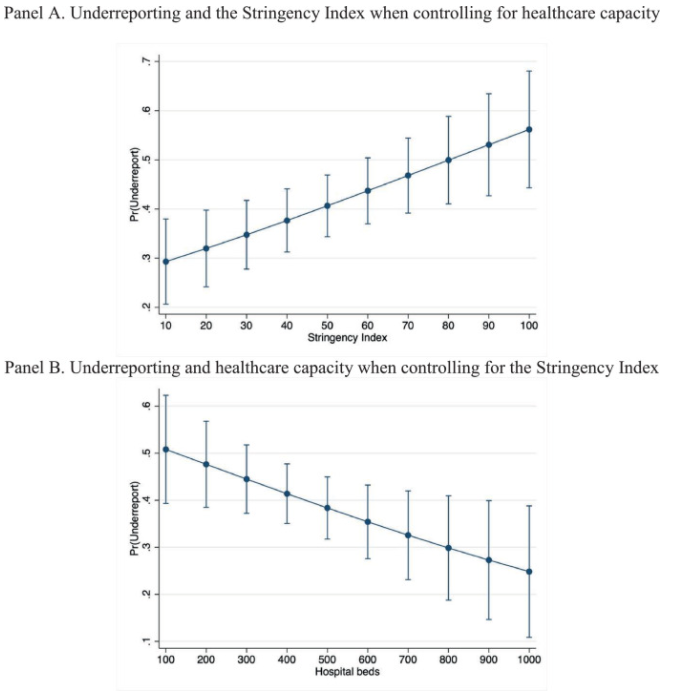

We examine whether a country’s management of the COVID-19 pandemic relate to the downward biasing of the number of reported deaths from COVID-19. Using deviations from historical averages of the total number of monthly deaths within a country, we find that the probability of underreporting of COVID-related deaths for countries with the most stringent policies was 58.6%, compared to a 28.2% for countries with the least stringent policies. Countries with the lowest ex ante healthcare capacity in terms of number of available beds underreport deaths by 52.5% on average, compared to 23.1% for countries with the greatest capacity.

https://doi.org/10.1016/j.jge.2021.100012

Author(s): Botir Kobilov, Ethan Rouen, George Serafeim

Publication Date: Summer 2021

Publication Site: Journal of Government and Economics