Link: https://ar.casact.org/modeling-the-casualty-exposures-in-epidemics/

Graphic:

Excerpt:

A casualty actuary might be forgiven for thinking that illness and disease are what those “other” actuaries worry about.

Though risk of illness is usually considered the province of the life-health actuary, a session at the 2017 CAS Annual Meeting in Anaheim, California, showed how epidemics can affect property-casualty risks. The session also described how to approach modeling those exposures.

….

Milliman actuary Cody Webb, FCAS, began by demonstrating how big the insurance gap is, particularly in developing nations. He explained that the spectrum of losses ranges from minuscule (loss of a single strand of hair) to catastrophic (sudden, instant death) and can affect a single person or every entity in the universe across eons. But the insurable losses share some traits, Webb said, including:

- a large number of similar exposures.

- a definite loss, driven by some sort of accident.

- the ability to create an affordable premium to reimburse after such a loss.

- the ability to accurately quantify the amount of loss sustained. This is the most important shared trait.

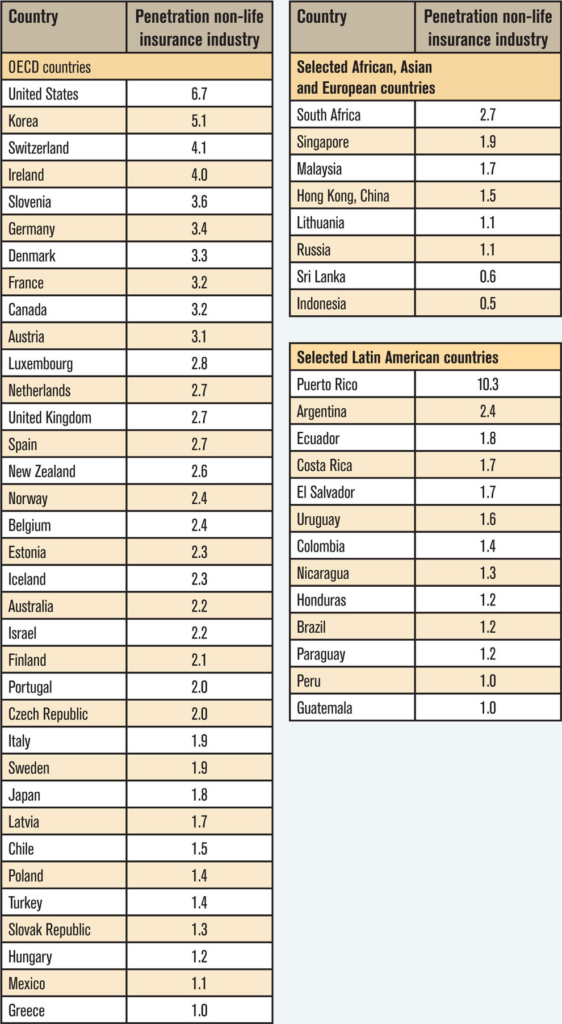

In showing a chart of property-casualty insurance as a percentage of GDP — with the wealthier countries better insured than others — Webb noted that insurance companies need to “quantify and develop products that meet all criteria of insurability.” (See chart below.)

Author(s): James P. Lynch

Publication Date: 16 Jan 2018

Publication Site: Actuarial Review, Casualty Actuarial Society