Link: https://www.bloomberg.com/opinion/articles/2024-01-18/coinbase-trades-beanie-babies

Excerpt:

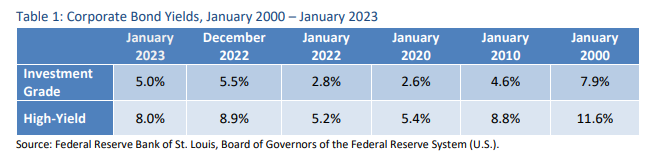

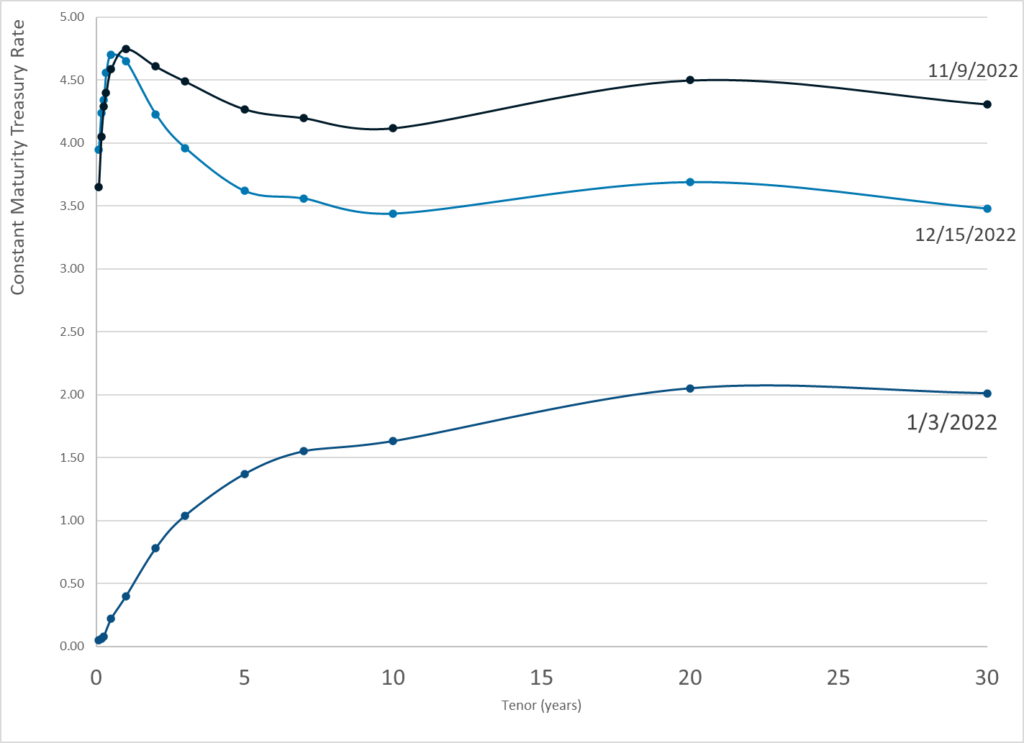

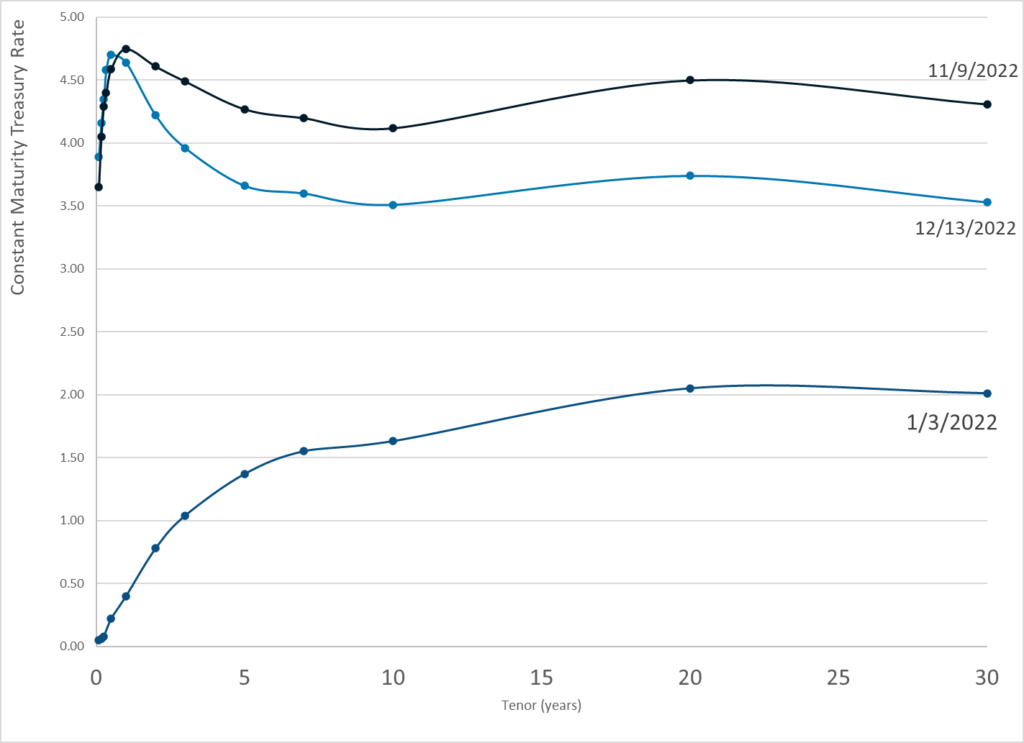

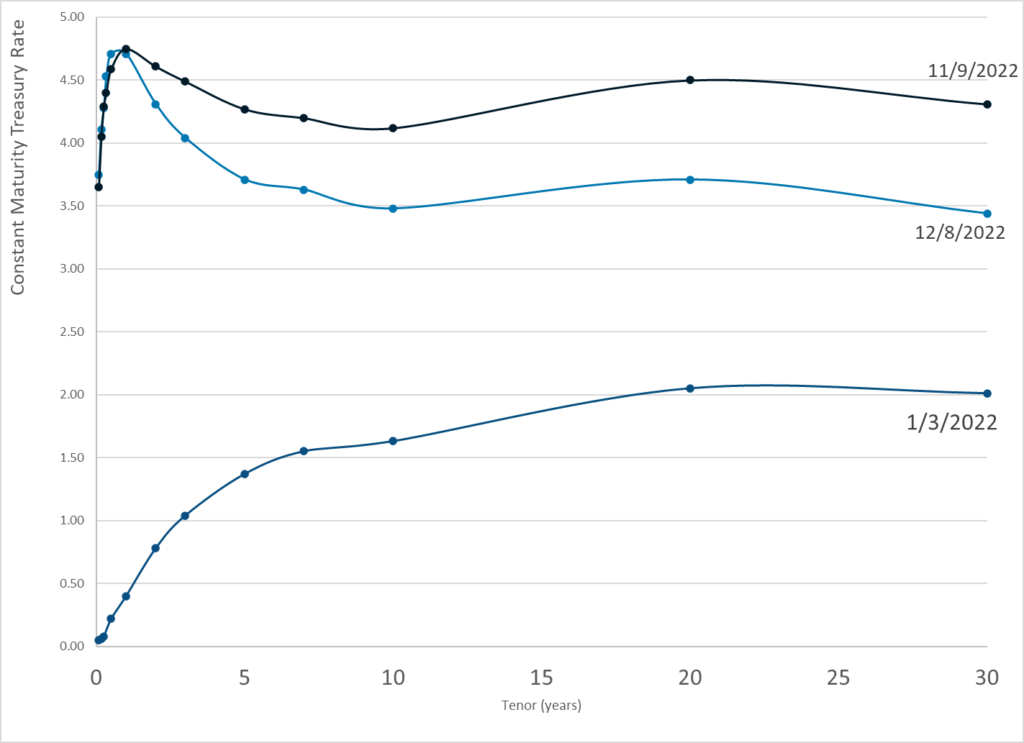

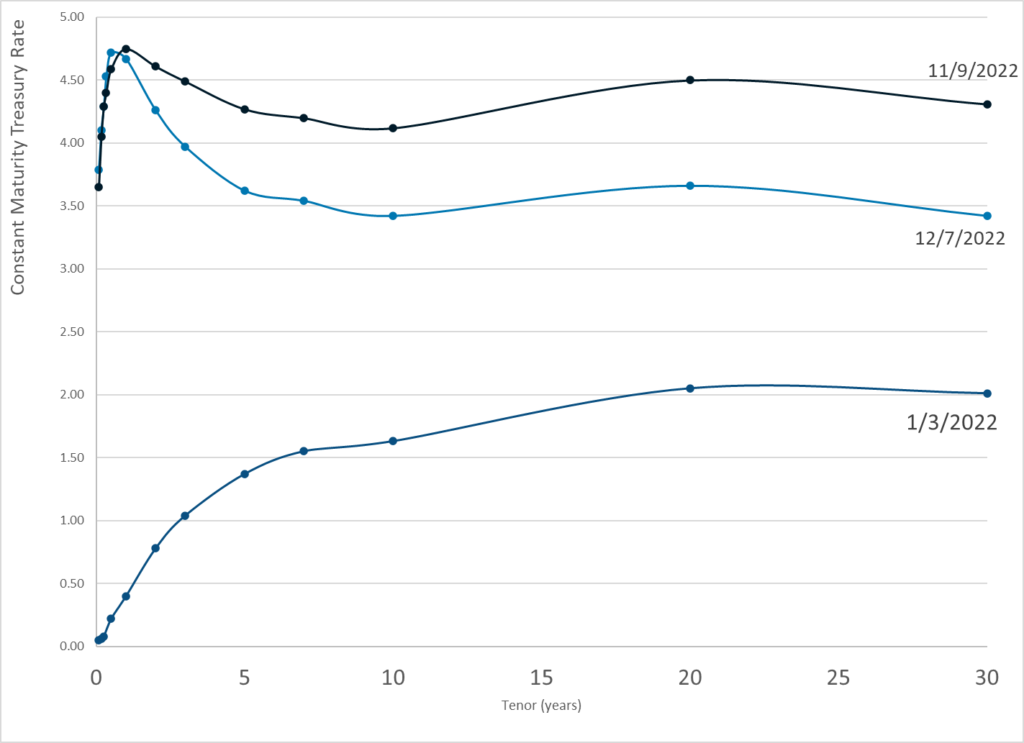

An important meta-story that you could tell about financial markets over the past few years would be that, for a long time, interest rates were roughly zero, which means that discount rates were low: A dollar in the distant future was worth about as much as a dollar today. Therefore, investors ascribed a lot of value to very long-term stuff, and were not particularly concerned about short-term profitability. Low discount rates made speculative distant-future profits worth more and steady current profits worth less.

And then interest rates went up rapidly starting in 2022, and everyone’s priorities shifted. A dollar today is now worth a lot more than a dollar in 10 years. People prioritize profits today over speculation in the future.

This is a popular story to tell about the boom in, for instance, tech startups, or crypto: “Startups are a low-interest-rate phenomenon.” In 2020, people had a lot of money and a lot of patience, so they were willing to invest in speculative possibly-world-changing ideas that would take a long time to pay out. (Or to fund startups that lost money on every transaction in the long-term pursuit of market share.) In 2022, the Fed raised rates, people’s preferences changed, and the startup and crypto bubbles popped.

I suppose, though, that you could tell a similar story about environmental investing? Climate change is, plausibly, a very large and very long-term threat to a lot of businesses. If you just go around doing everything normally this year, probably rising oceans won’t wash away your factories this year. But maybe they will in 2040. Maybe you should invest today in making your factories ocean-proof, or in cutting carbon emissions so the oceans don’t rise: That will cost you some money today, but will save you some money in 2040. Is it worth it? Well, depends on the discount rate. If rates are low, you will care more about 2040. If rates are high, you will care more about saving money today.

We have talked a few times about the argument that some kinds of environmental investing — the kind where you avoid investing in “dirty” companies, to starve them of capital and reduce the amount of dirty stuff they do — can be counterproductive, because it has the effect of raising those companies’ discount rates and thus making them even more short-term-focused. And being short-term-focused probably leads to more carbon emissions. (If you make it harder for coal companies to raise capital, maybe nobody will start a coal company, but existing coal companies will dig up more coal faster.)

But that argument applies more broadly. If you raise every company’s discount rate (because interest rates go up), then every company should be more short-term-focused. Every company should care a bit less about global temperatures in 2040, and a bit more about maximizing profits now. Maybe ESG was itself a low-interest-rates phenomenon.

Anyway here’s a Financial Times story about BlackRock Inc.:

BlackRock will stress “financial resilience” in its talks with companies this year as the $10tn asset manager puts less emphasis on climate concerns amid a political backlash to environmental, social and governance investing.

With artificial intelligence and high interest rates rattling companies globally, BlackRock wants to know how they are managing these risks to ensure they deliver long-term financial returns, the asset manager said on Thursday as it detailed its engagement priorities for 2024.

BlackRock reviews these priorities annually as it talks with thousands of companies before their annual meetings on issues ranging from how much their executives are paid to how effective their board directors are.

“The macroeconomic and geopolitical backdrop companies are operating in has changed. This new economic regime is shaped by powerful structural forces that we believe may drive divergent performance across economies, sectors and companies,” BlackRock said in its annual report on its engagement priorities. “We are particularly interested in learning from investee companies about how they are adapting to strengthen their financial resilience.”

There is a lot going on here, and it is reasonable to wonder— as the FT does — whether BlackRock’s shift from environmental concerns to high interest rates is about the political and marketing backlash to ESG. But you could take it on its own terms! In 2020, interest rates were zero, and BlackRock’s focus was on the long term. What was the biggest long-term risk to its portfolio? Arguably, climate change. So it went around talking to companies about climate change. In 2024, interest rates are high, and the short term matters more, so BlackRock is going around talking to companies about interest-rate risk.

I don’t know how AI fits into this model. For most of my life, “ooh artificial intelligence will change everything” has been a pretty long-term — like, science-fiction long-term — thing to think about. But I suppose now “how will you integrate large-language-model chatbots into your workflows” is an immediate question.

Author(s): Matt Levine

Publication Date: 18 Jan 2024

Publication Site: Bloomberg