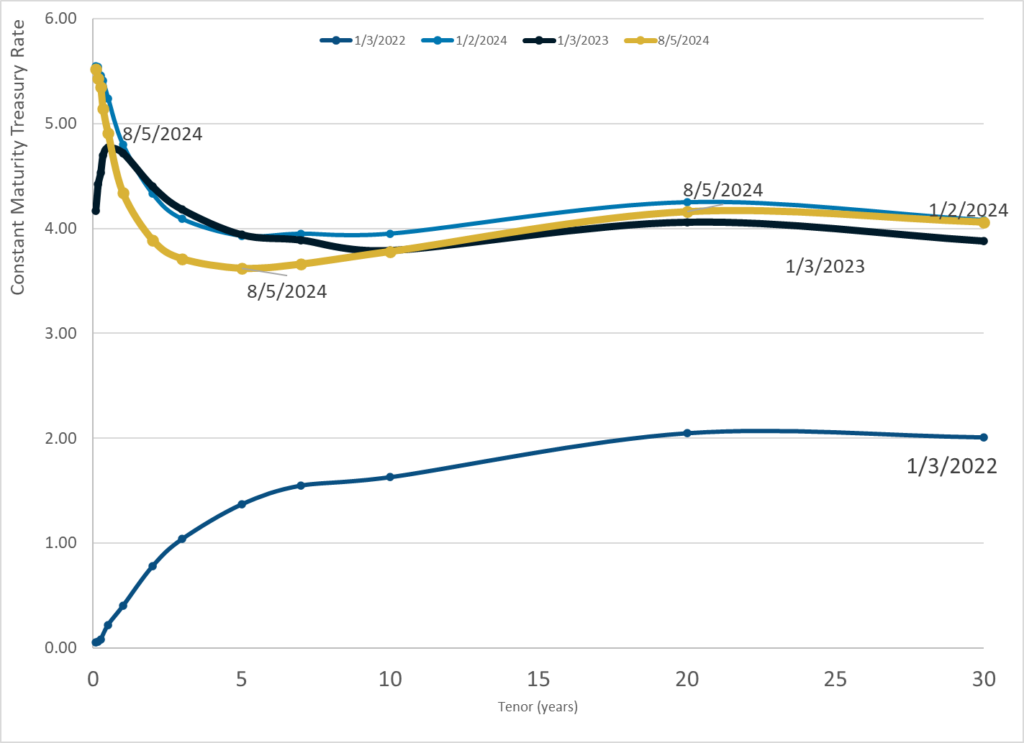

Graphic:

Publication Date: 5 Aug 2024

Publication Site: Treasury Dept

All about risk

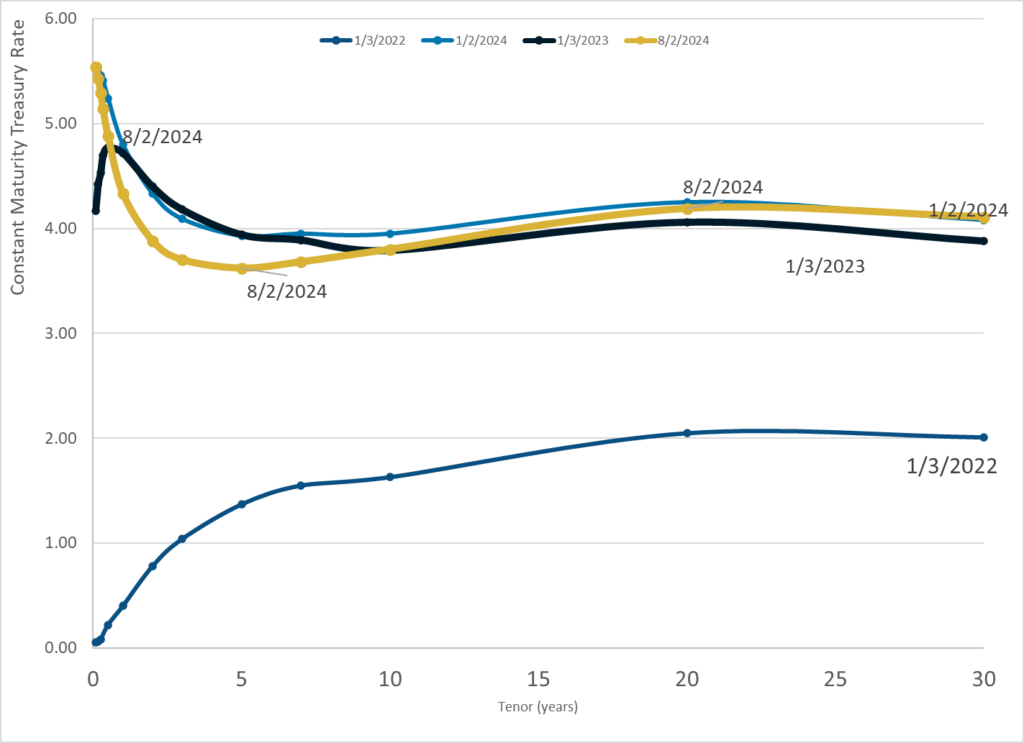

Graphic:

Publication Date: 5 Aug 2024

Publication Site: Treasury Dept

Link: https://mishtalk.com/economics/big-changes-in-fed-interest-rate-cut-expectations-this-year-and-next/

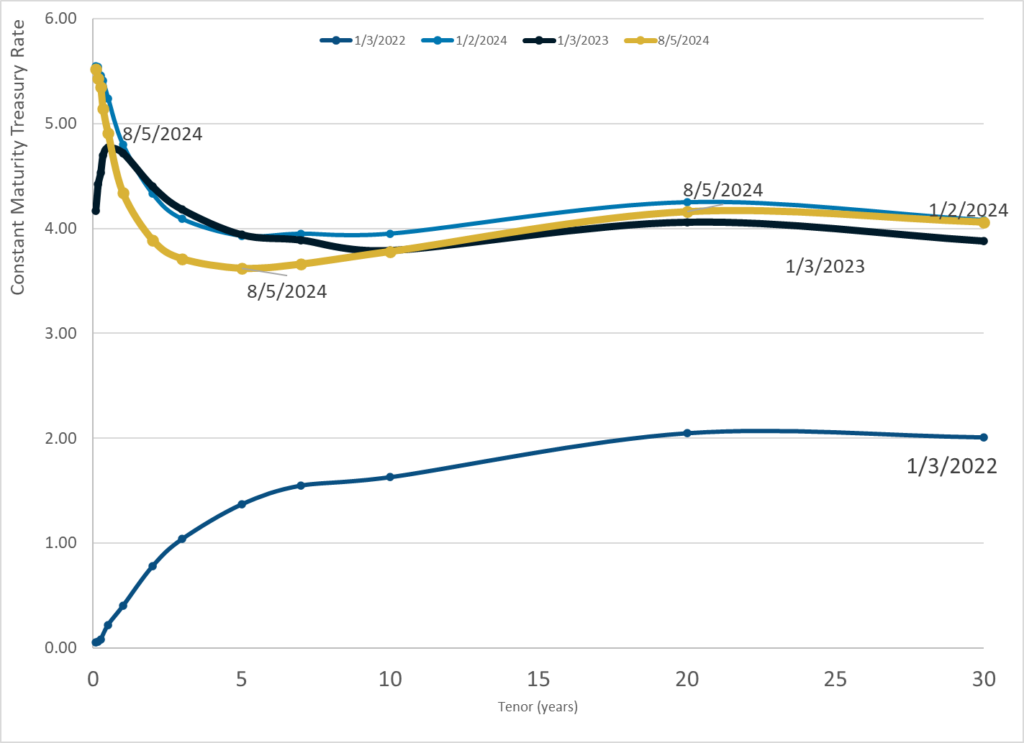

Graphic:

Excerpt:

I captured rate cut expectations before and after the Friday jobs reports. Let’s take a look.

The current rate is 5.25%-5.50% effectively 5.37%.

Those odds were smack in the middle of volatility.

The CME website now shows data as of August 1 (no change on Friday), so they have something messed up.

The chart above reflects the huge volatility we saw in bond yields on Friday.

….

Are too many cuts priced in or not enough?

That’s the question. I expect two cuts in September. Looking out to next year, I think too many cuts are priced in.

Author(s): Mike Shedlock

Publication Date: 3 Aug 2024

Publication Site: Mish Talk

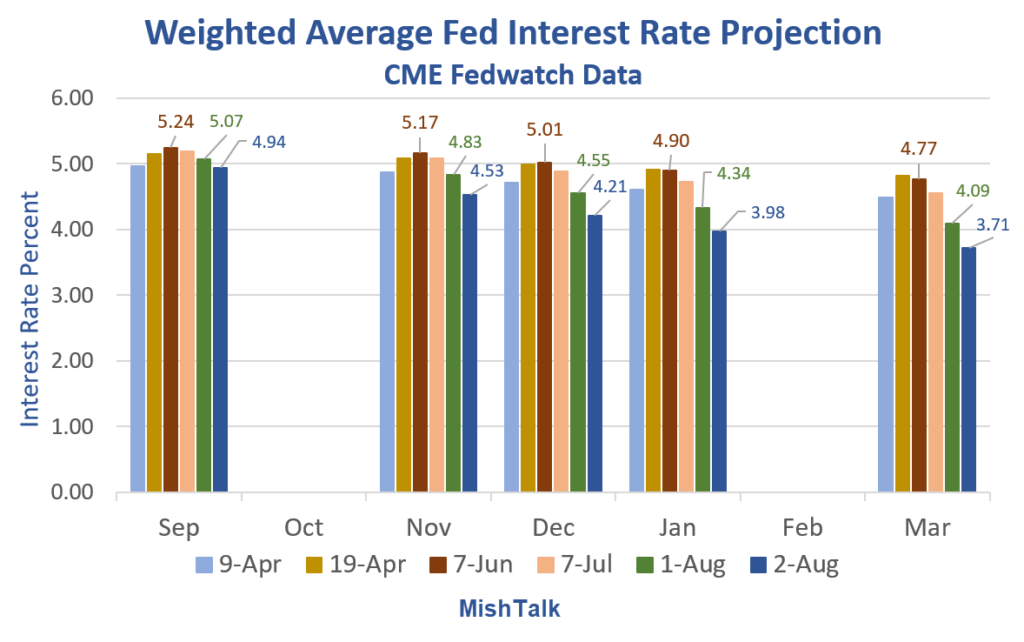

Graphic:

Publication Date: 2 Aug 2024

Publication Site: Treasury Dept

Graphic:

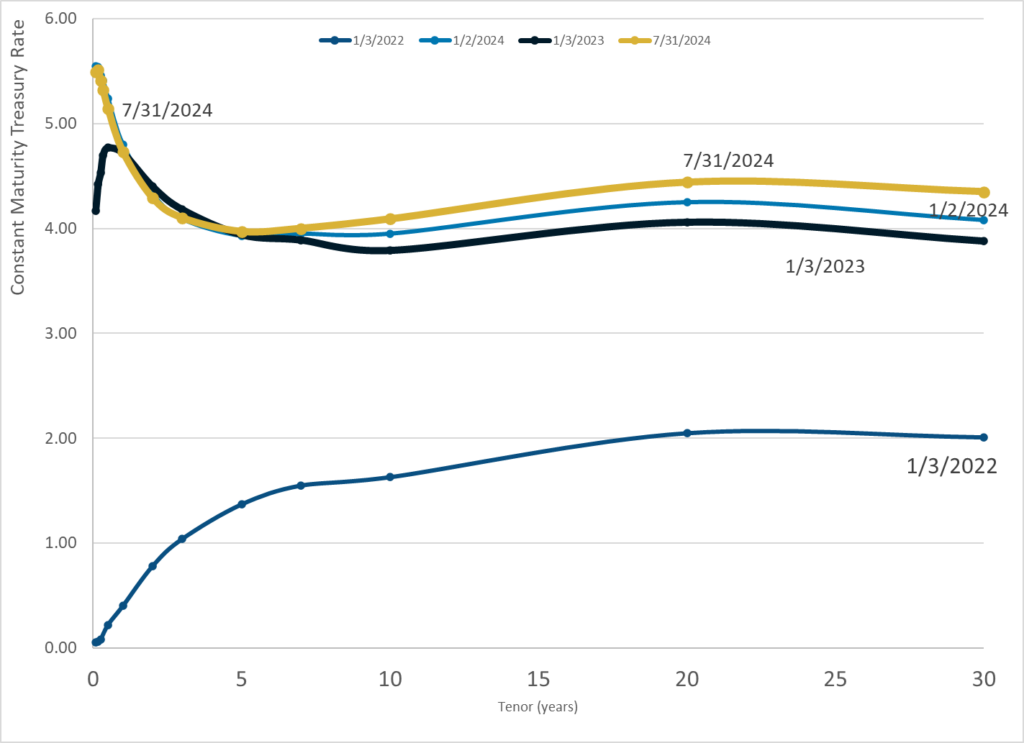

Publication Date: 31 July 2024

Publication Site: Treasury Dept

Graphic:

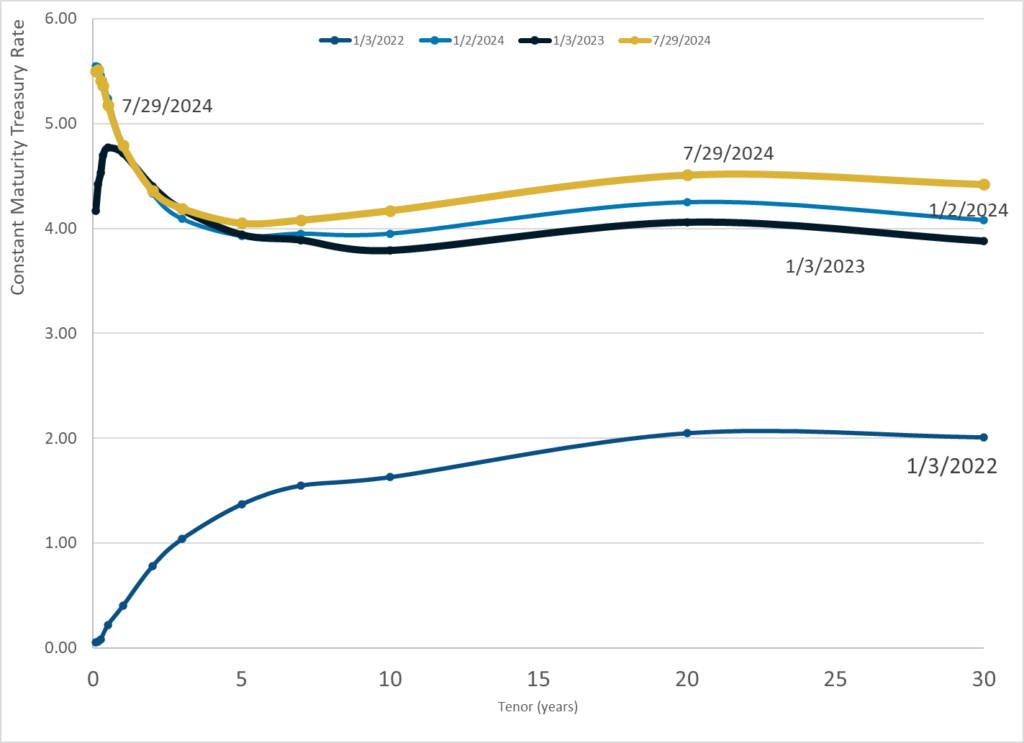

Publication Date: 29 July 2024

Publication Site: Treasury Dept

Graphic:

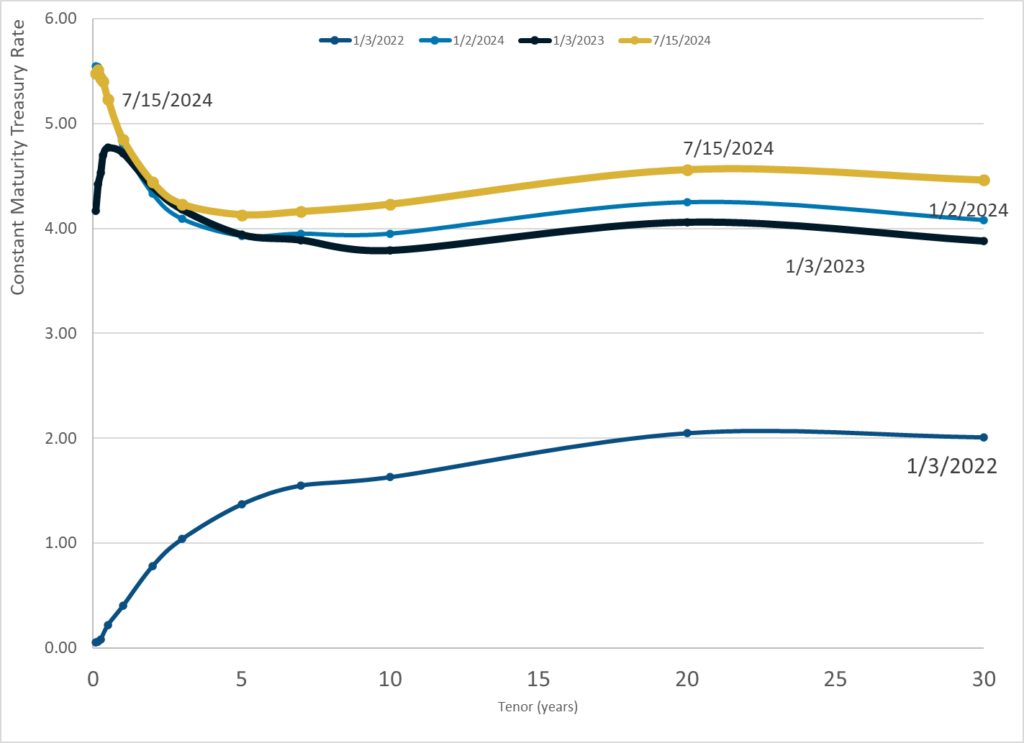

Publication Date: 15 July 2024

Publication Site: Treasury Dept

Graphic:

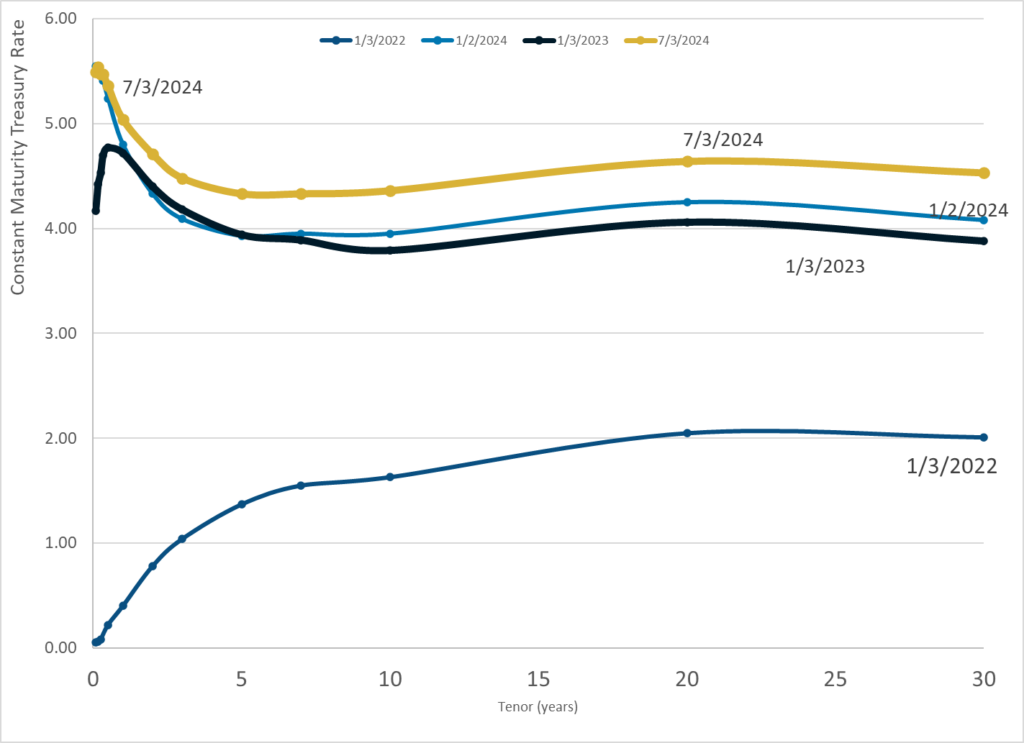

Publication Date: 3 July 2024

Publication Site: Treasury Dept

Graphic:

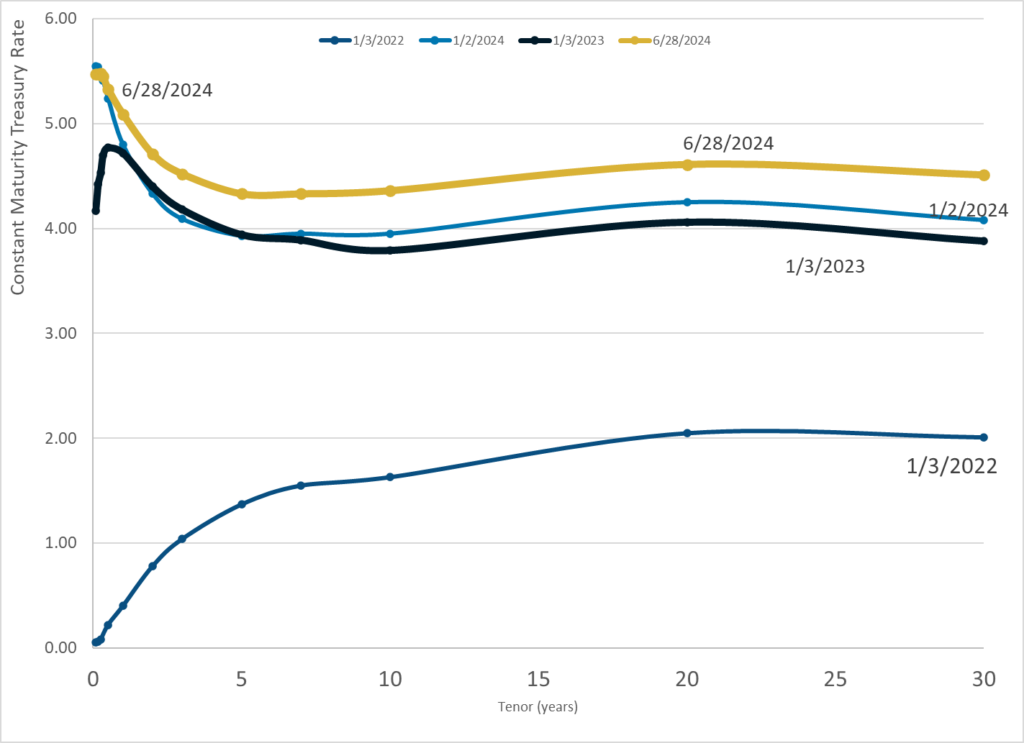

Publication Date: 28 June 2024

Publication Site: Treasury Department

Graphic:

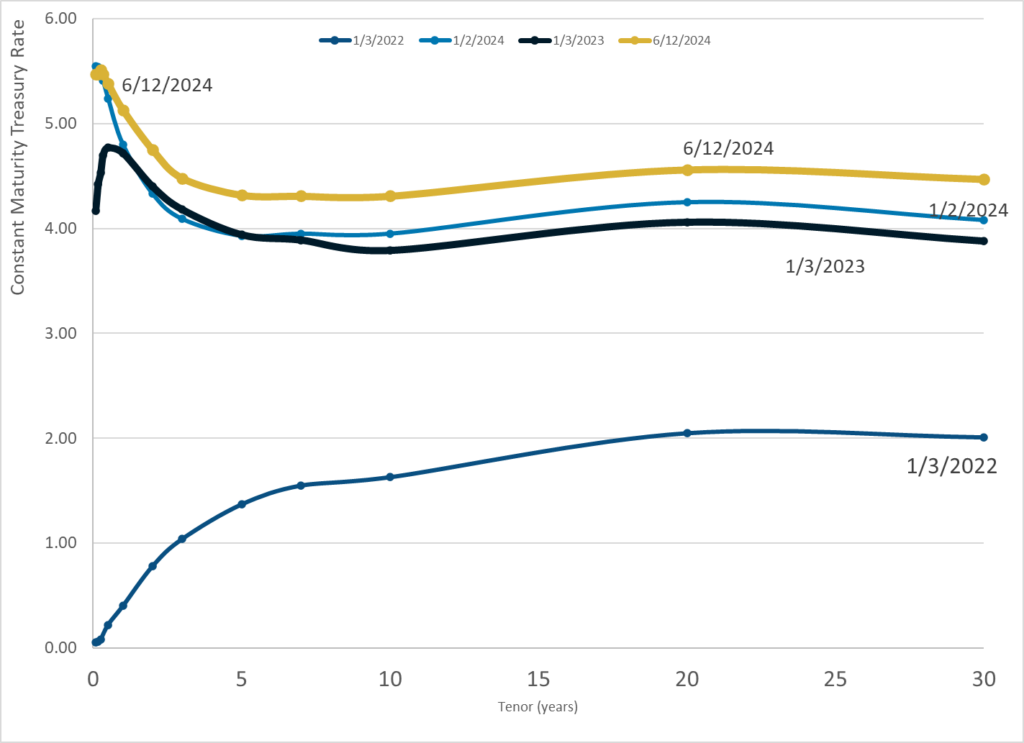

Publication Date: 12 June 2024

Publication Site: Treasury Dept

Graphic:

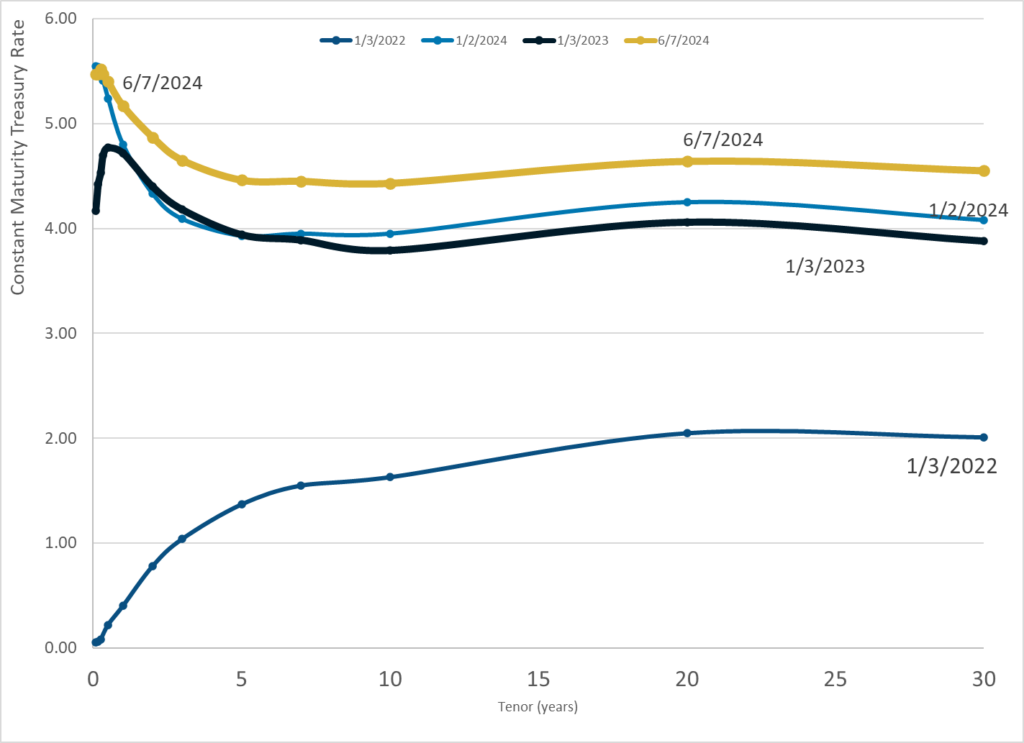

Publication Date: 7 June 2024

Publication Site: Treasury Dept

Graphic:

Publication Date: 5 June 2024

Publication Site: Treasury Dept

Link: https://mishtalk.com/economics/bonds-yields-jump-again-wiping-out-the-may-treasury-rally/

Graphic:

Excerpt:

Yield on the 10-year treasury is 4.59 percent on May 29, right where it started the month. A quarter-point rally on hopes of rate cuts vanished today.

Yields are still lower than the 2024 intraday peak of 4.74 percent, but they are nearly 70 basis points higher than the start of the year as rate cut after rate cut hopes keep getting priced out.

Minneapolis Federal Reserve President Neel Kashkari says he wants to see “many more months” of positive inflation numbers before interest rates start to come down — and refused to rule out a rate hike if needed.

Author(s): Mike Shedlock

Publication Date: 29 May 2024

Publication Site: Mish Talk