Link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3776071

Graphic:

Excerpt:

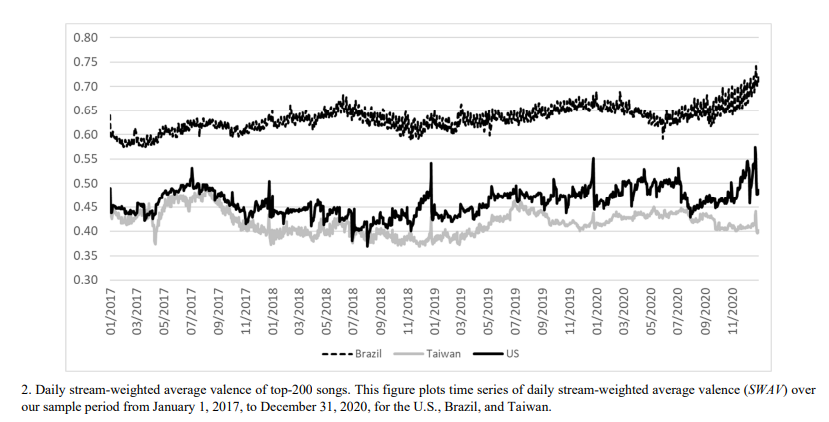

This paper introduces a real-time, continuous measure of national sentiment that is language-free and thus comparable globally: the positivity of songs that individuals choose to listen to. This is a direct measure of mood that does not pre-specify certain mood-affecting events nor assume the extent of their impact on investors. We validate our music-based sentiment measure by correlating it with mood swings induced by seasonal factors, weather conditions, and COVID-related restrictions. We find that music sentiment is positively correlated with same-week equity market returns and negatively correlated with next-week returns, consistent with sentiment-induced temporary mispricing. Results also hold under a daily analysis and are stronger when trading restrictions limit arbitrage. Music sentiment also predicts increases in net mutual fund flows, and absolute sentiment precedes a rise in stock market volatility. It is negatively associated with government bond returns, consistent with a flight to safety.

Author(s):

Alex Edmans

London Business School – Institute of Finance and Accounting; European Corporate Governance Institute (ECGI); Centre for Economic Policy Research (CEPR)

Adrian Fernandez-Perez

Auckland University of Technology

Alexandre Garel

Audencia Business School

Ivan Indriawan

Auckland University of Technology – Department of Finance

Publication Date: 14 Aug 2021

Publication Site: SSRN, Journal of Financial Economics (forthcoming)