Link: https://www.dailyposter.com/p/the-american-rescue-plans-money-cannon

Graphic:

Excerpt:

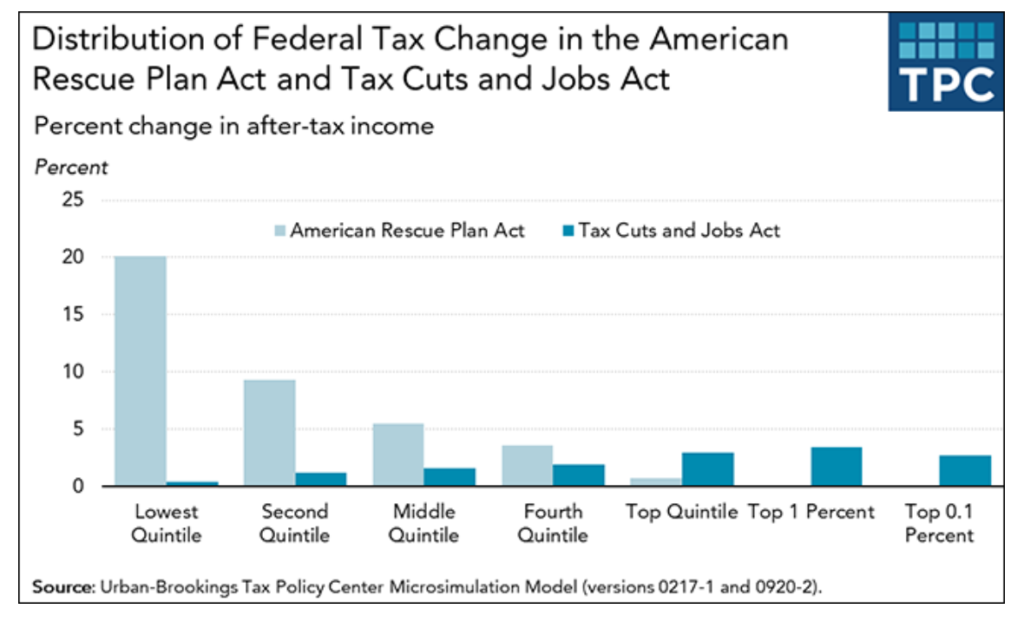

As a spending bill, the ARP’s impact cannot be overstated. It is the mirror opposite of the Trump tax cuts, targeting most of its benefits to the bottom end of the income ladder, rather than the top. It will send stimulus checks up to $1,400 to an estimated 280 million Americans, continue additional $300 weekly unemployment benefits until the end of August, and distribute up $3,600 to families per child through monthly payments over one year beginning on July 1.

These three measures are expected to increase the incomes of the poorest 20 percent of Americans by an average of 33 percent, while the poorest 60 percent could see their incomes increase by an average of 11 percent, according to estimates from the Institute on Taxation and Economic Policy. One estimate suggests that the legislation will slash child poverty in half.

Author(s): David Sirota, Julia Rock, Andrew Perez

Publication Date: 11 March 2021

Publication Site: The Daily Poster