Link: https://crr.bc.edu/briefs/legacy-debt-in-public-pensions-a-new-approach/

Graphic:

Excerpt:

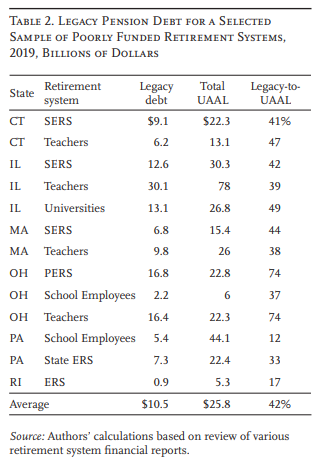

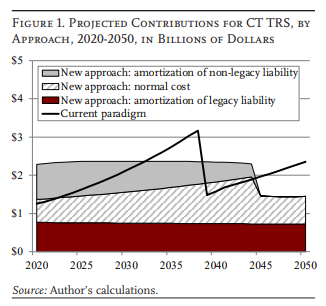

The inclusion of “legacy debt” – unfunded liabilities from long ago – with current liabilities impedes effective pension policy.

A new approach would separate legacy debt from other unfunded liabilities in order to:

spread the legacy cost over multiple generations; and

properly identify fixed vs. variable costs.

It would also use the municipal bond yield – rather than the assumed return on assets – to calculate liabilities and required contributions.

This approach, by properly allocating costs, would improve intergenerational fairness, government resource decisions, and public credibility.

Author(s): Jean-Pierre Aubry

Publication Date: June 2022

Publication Site: Center for Retirement Research at Boston College