Methodology: https://www.propublica.org/article/how-we-calculated-the-true-tax-rates-of-the-wealthiest

On legality etc: https://www.propublica.org/article/why-we-are-publishing-the-tax-secrets-of-the-001

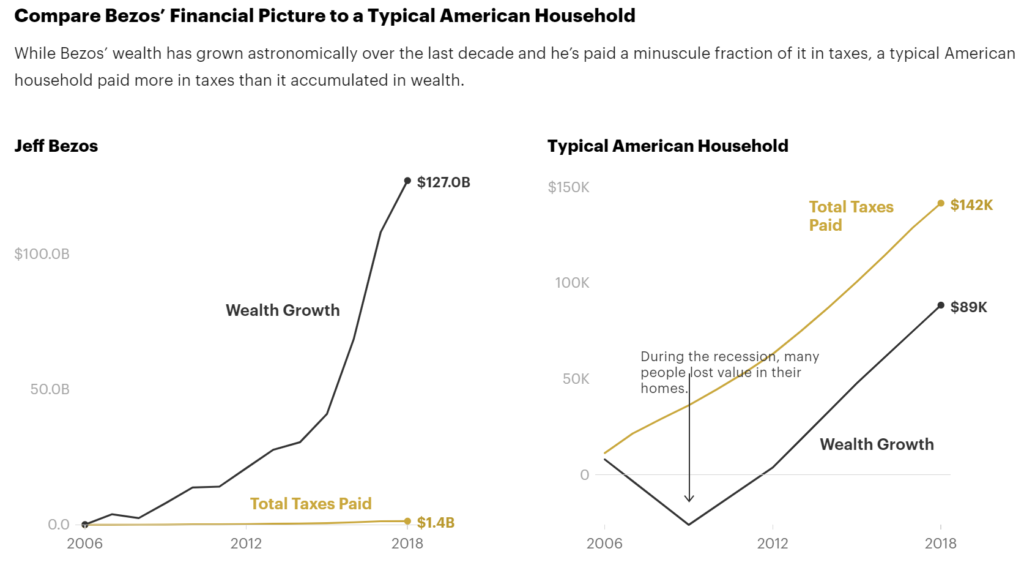

Graphic:

Excerpt:

ProPublica has obtained a vast cache of IRS information showing how billionaires like Jeff Bezos, Elon Musk and Warren Buffett pay little in income tax compared to their massive wealth — sometimes, even nothing.

….

In 2011, a year in which his wealth held roughly steady at $18 billion, Bezos filed a tax return reporting he lost money — his income that year was more than offset by investment losses. What’s more, because, according to the tax law, he made so little, he even claimed and received a $4,000 tax credit for his children.

His tax avoidance is even more striking if you examine 2006 to 2018, a period for which ProPublica has complete data. Bezos’ wealth increased by $127 billion, according to Forbes, but he reported a total of $6.5 billion in income. The $1.4 billion he paid in personal federal taxes is a massive number — yet it amounts to a 1.1% true tax rate on the rise in his fortune.

Author(s): Jesse Eisinger, Jeff Ernsthausen, Paul Kiel

Publication Date: 8 June 2021

Publication Site: ProPublica