Link: https://www.wsj.com/amp/articles/return-of-the-irs-scandal-11623191964

Excerpt:

Less than half a year into the Biden Presidency, the Internal Revenue Service is already at the center of an abuse-of-power scandal. That news broke Tuesday when ProPublica, a website whose journalism promotes progressive causes, published information from what it said are 15 years of the tax returns of Jeff Bezos, Warren Buffett and other rich Americans.

Leaking such information is a crime, since under federal law tax returns are confidential. ProPublica says it received the files from “an anonymous source” and doesn’t know who provided them, how they were obtained, or what the source’s motives are.

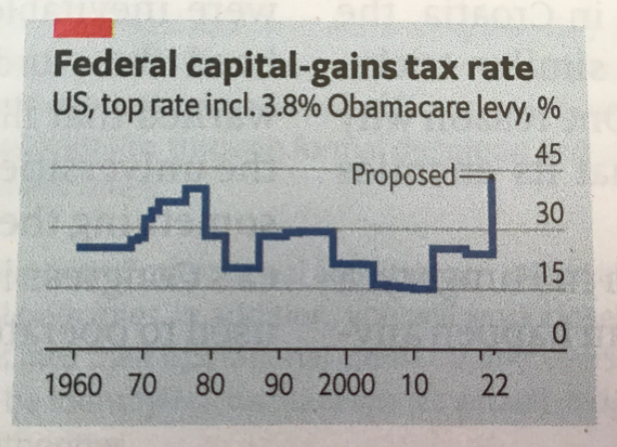

Allow us to fill in that last blank. The story arrives amid the Biden Administration’s effort to pass the largest tax increase as a share of the economy since 1968. The main Democratic argument for a tax hike is that the rich should pay their “fair share.” The ProPublica story is a long argument that somehow the rich don’t pay enough. The timing here is no coincidence, comrade.

….

This still leaves the real scandal, which is that someone leaked confidential IRS information about individuals to serve a political agenda. This is the same tax agency that pursued a vendetta against conservative nonprofit groups during the Obama Administration. Remember Lois Lerner?

This is also the same IRS that Democrats now want to infuse with $80 billion more to chase a fanciful amount of uncollected taxes. As part of this effort, Mr. Biden wants the IRS to collect “gross inflows and outflows on all business and personal accounts from financial institutions.” Why? So the information can be leaked to ProPublica?

Author(s): Editorial board of WSJ

Publication Date: 8 June 2021

Publication Site: Wall Street Journal