Excerpt:

Leaders of the finance industry and other businesses in New York are pushing President Joe Biden and Senate Majority Leader Chuck Schumer to bring back the full state and local tax deduction.

Schumer, who is up for reelection in 2022, has heard from business leaders across New York on multiple calls in recent weeks. Some of these people have also held talks with advisors to Biden.

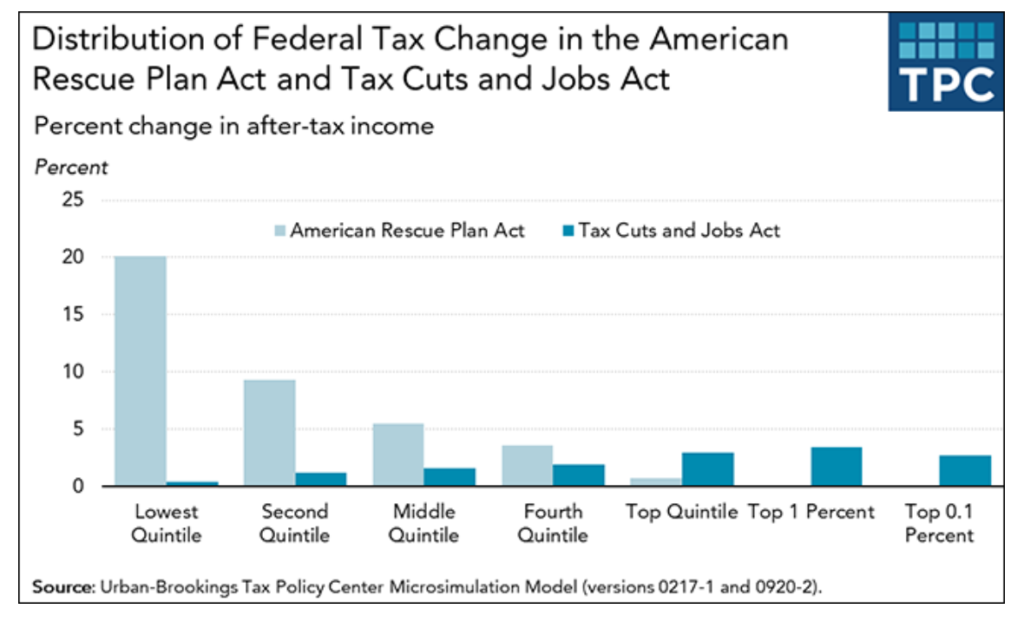

The so-called SALT deduction was capped at $10,000 by former President Donald Trump’s tax reform bill, which became law in late 2017.

Author(s): Brian Schwartz

Publication Date: 29 March 2021

Publication Site: CNBC