Link: https://reason.org/data-visualization/2022-public-pension-forecaster/

Graphic:

Excerpt:

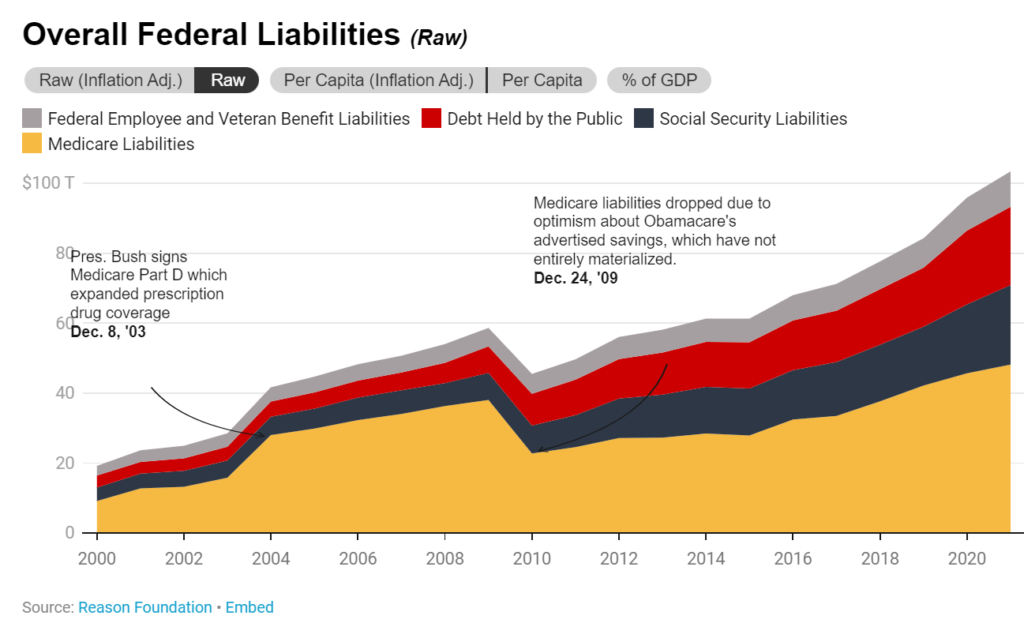

According to forecasting by Reason Foundation’s Pension Integrity Project, when the fiscal year 2022 pension financial reports roll in, the unfunded liabilities of the 118 state public pension plans are expected to again exceed $1 trillion in 2022. After a record-breaking year of investment returns in 2021, which helped reduce a lot of longstanding pension debt, the experience of public pension assets has swung drastically in the other direction over the last 12 months. Early indicators point to investment returns averaging around -6% for the 2022 fiscal year, which ended on June 30, 2022, for many public pension systems.

Based on a -6% return for fiscal 2022, the aggregate unfunded liability of state-run public pension plans will be $1.3 trillion, up from $783 billion in 2021, the Pension Integrity Project finds. With a -6% return in 2022, the aggregate funded ratio for these state pension plans would fall from 85% funded in 2021 to 75% funded in 2022.

Author(s): Truong Bui, Jordan Campbell, Zachary Christensen

Publication Date: 14 July 2022

Publication Site: Reason