Graphic:

Excerpt:

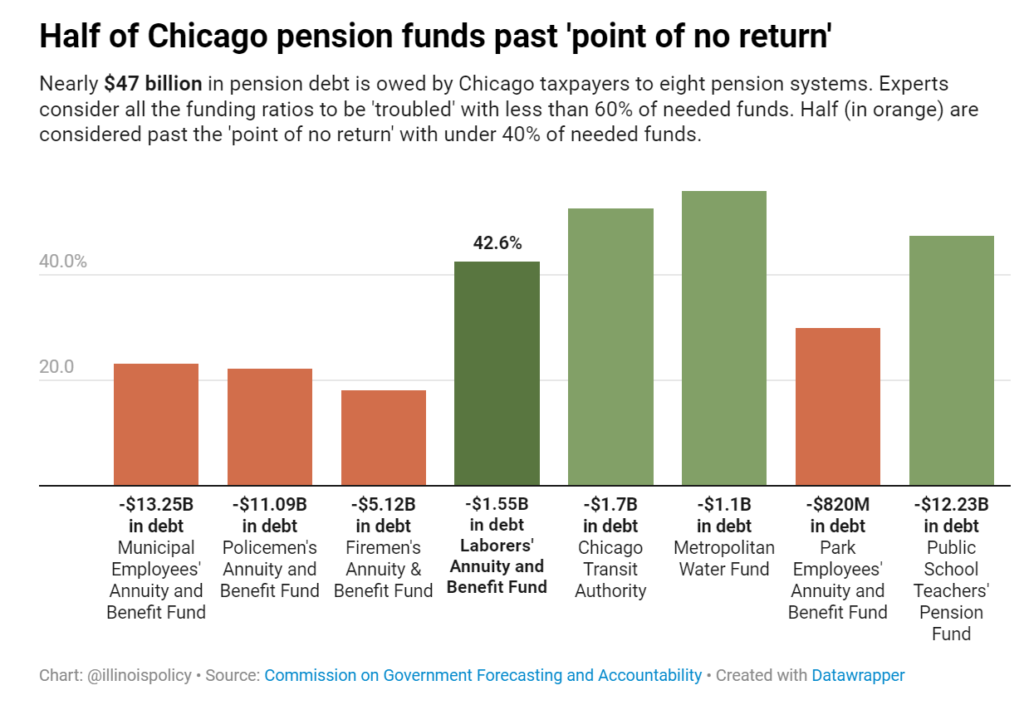

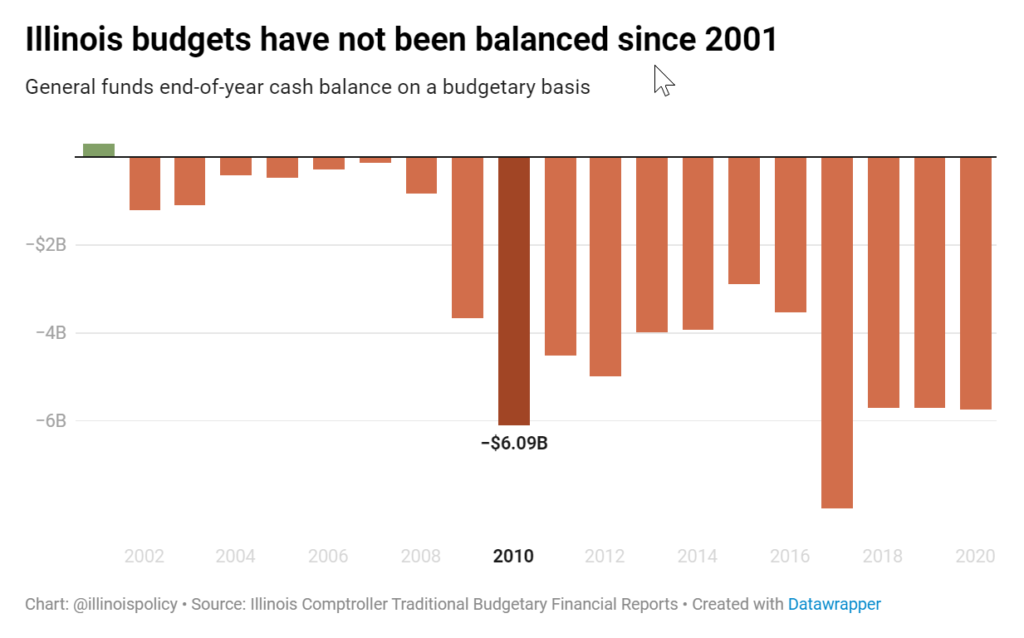

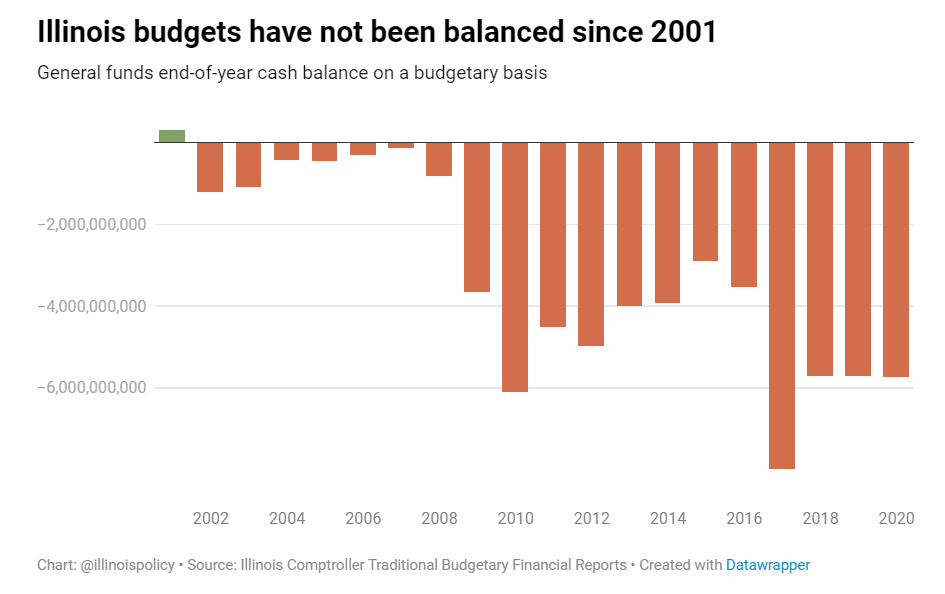

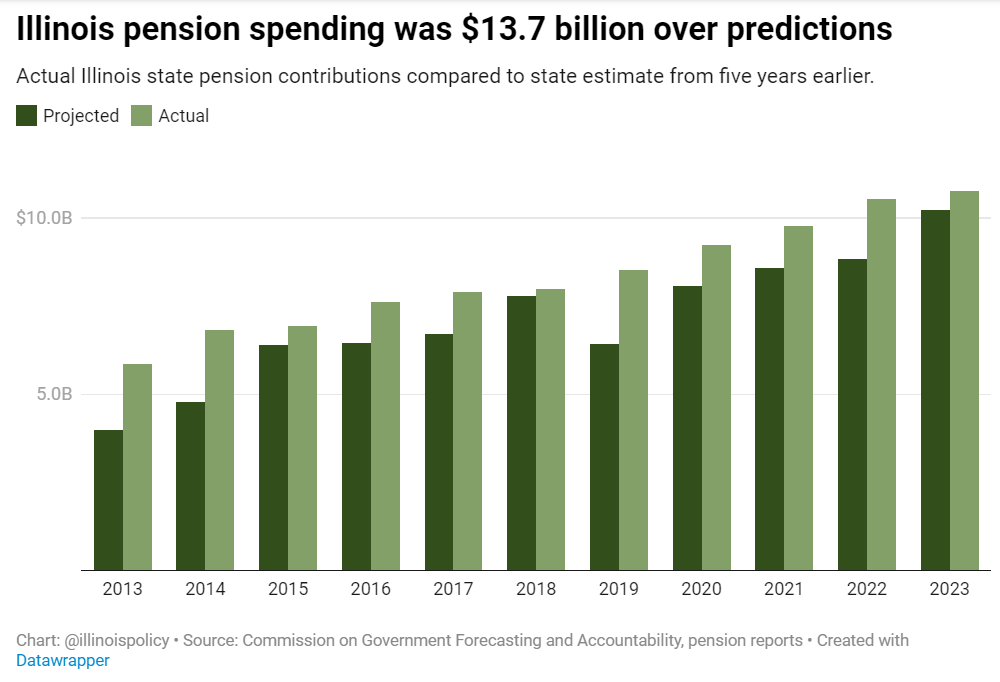

Unrealistic assumptions and missed investment returns have meant Illinois taxpayers paid $13.7 billion more for public pensions than state leaders projected five years earlier. Unless the estimates improve, taxpayers will pay an extra $21.3 billion during the next decade.

Illinois does a particularly poor job of figuring out how much money is needed to pay its public pensions: The past decade has seen the projections miss by 16%, which meant taxpayers needed to give $13.7 billion more than was estimated.

Author(s): Justin Carlson

Publication Date: 17 Jun 2022

Publication Site: Illinois Policy Institute