Graphic:

Excerpt:

LIMRA discussed its FraudShare program in this June 2022 story, and the statistics were striking.

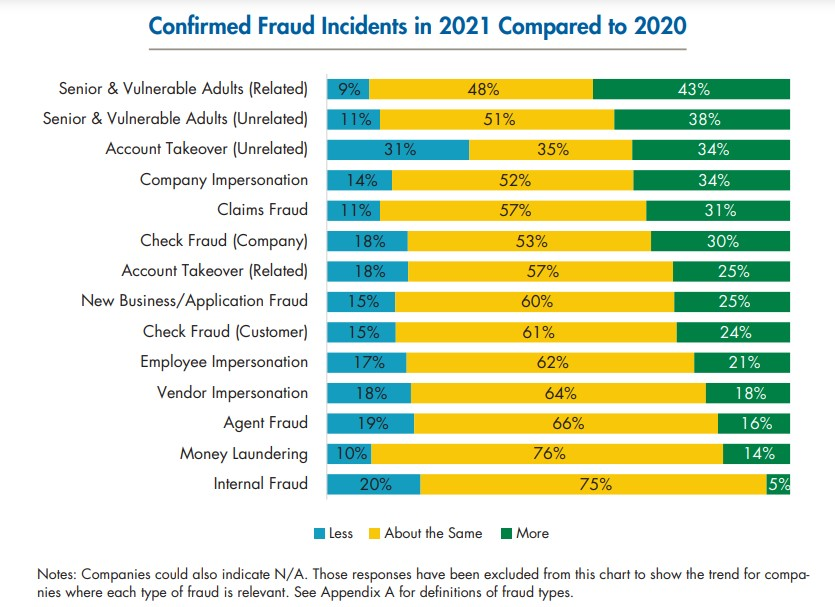

More than a third (34%) of companies reported increases in account takeover attempts in 2021 as compared to the previous year, according to LIMRA. Account takeovers occur when someone takes ownership of an online account without the owner’s knowledge, often with stolen credentials. In addition to account takeovers attempts, 34% of companies saw increases in company impersonation and 31% had increases in claims fraud.

A LIMRA report showed that fraud incidents increased in 2021 in all but two categories of fraud. (Please note that fraud “incidents” shown in the chart below are attempts and do not indicate that the account takeover attempts were successful.)

Author(s): John Hilton, InsuranceNewsNet

Publication Date: 30 Dec 2022

Publication Site: The Wealth Advisor