Graphic:

Excerpt:

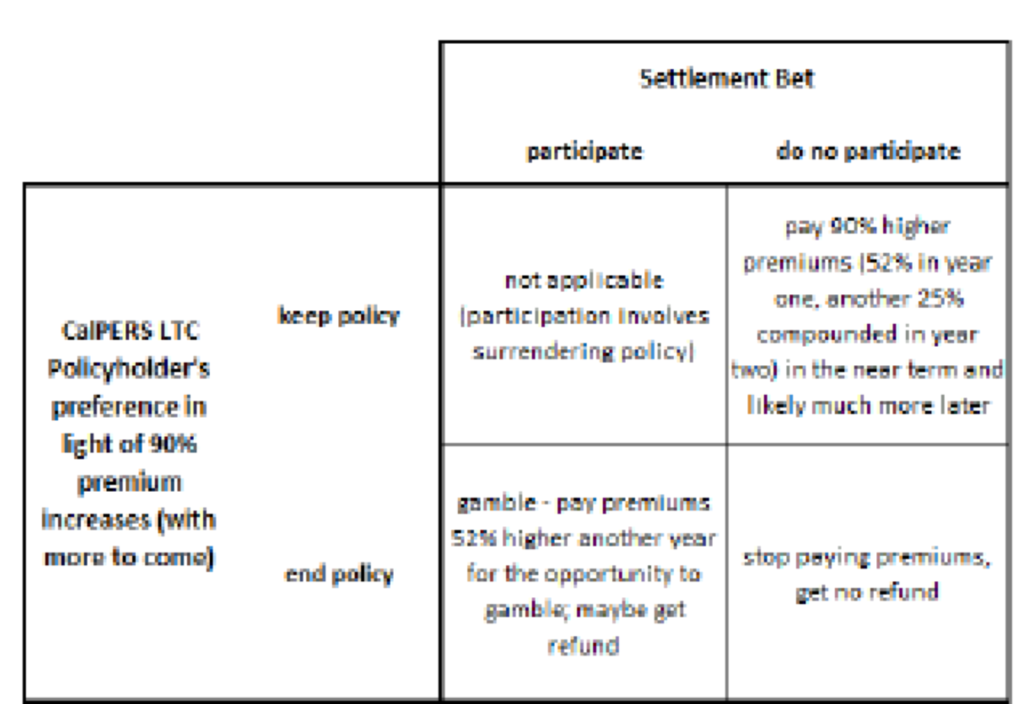

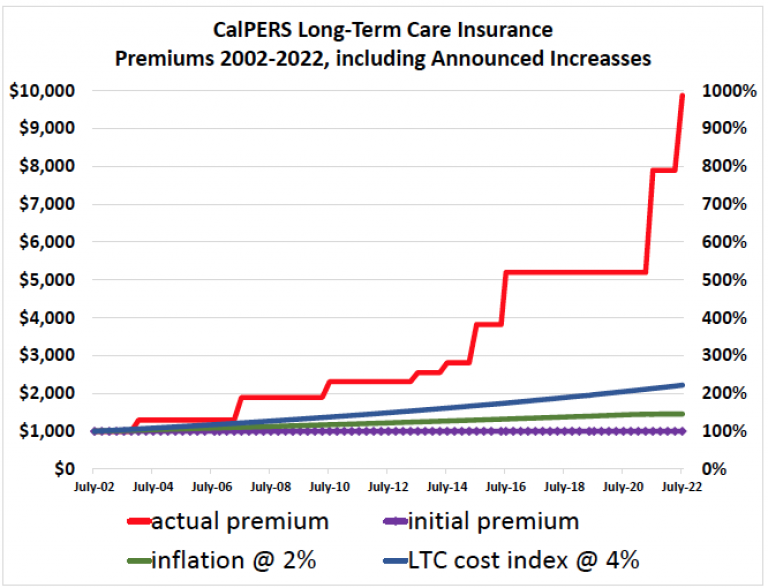

The CalPERS long-term care fiasco continues, with the board and staff taking a course of action that increases harm to policyholders by continuing to bleed them rather than put the program in bankruptcy.

For those new to this train wreck, the public comment at the February 14 CalPERS board meeting by policy-holder and certified financial planner Lawrence Grossman provides an introduction. A key bit of background is that state legislation allowed CalPERS to jump on the long-term care insurance bandwagon in the 1990s. Most of these insurance plans have gotten into a world of hurt by underestimating the degree to which proper elder care would extend lifepsans of policy-holders and overestimating the lapse rate (lapsed policies mean the premiums paid by dropouts benefit the remaining policyholders). But CalPERS’ recklessness and incompetence were in a league of its own.

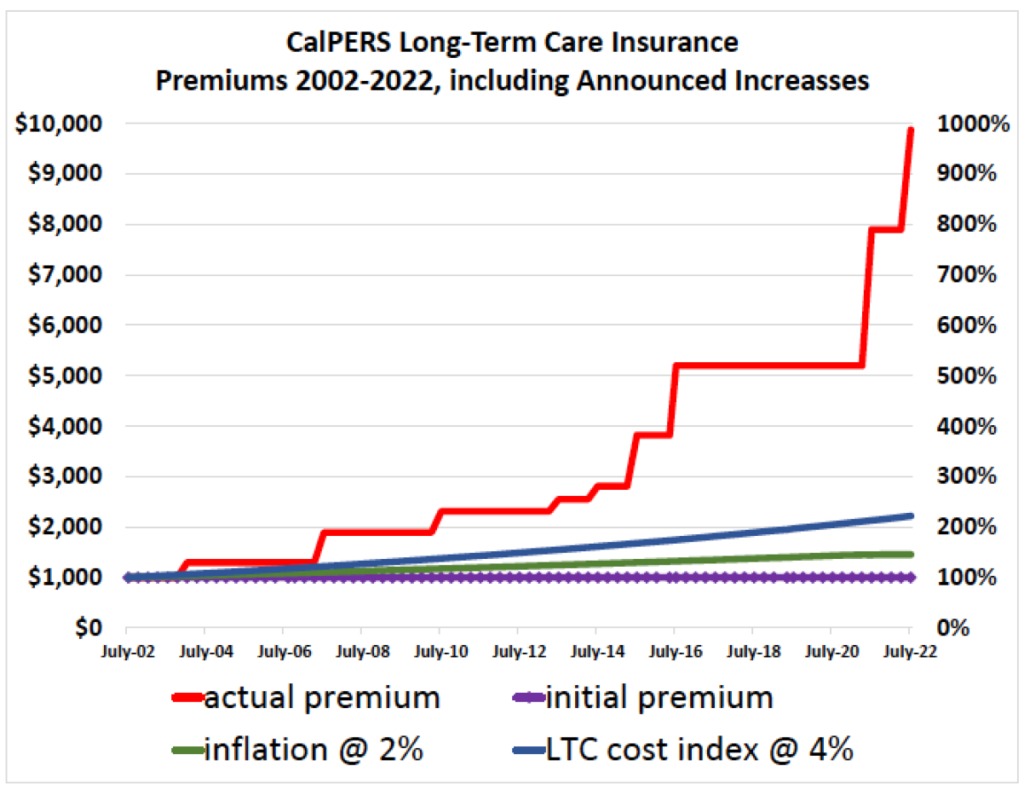

CalPERS not only considerably underpriced its policies compared to commercial competitors, but it made matters worse via giving CalPERS policyholders the options of lifetime benefits (as opposed to fixed dollar benefits) and inflation protection. Inflation protection would seem like an incredible promise for any long-term insurance scheme. Yet the policies were advertised as CalPERS policies, not those of a free-standing “CalPERS Long-Term Care Fund,” as in not backed by CalPERS or the state of California.

….

Four years later and things are going according to CalPERS’ abusive plan. Even though Judge Highberger clearly rejected CalPERS’ position that it can violate policy terms and raise premiums, CalPERS has continued to increase premiums because the court so far has issued only preliminary decisions. Note these increases are vastly in excess of those implemented by commercial carriers.

Author(s): Yves Smith

Publication Date: 15 Feb 2023

Publication Site: naked capitalism