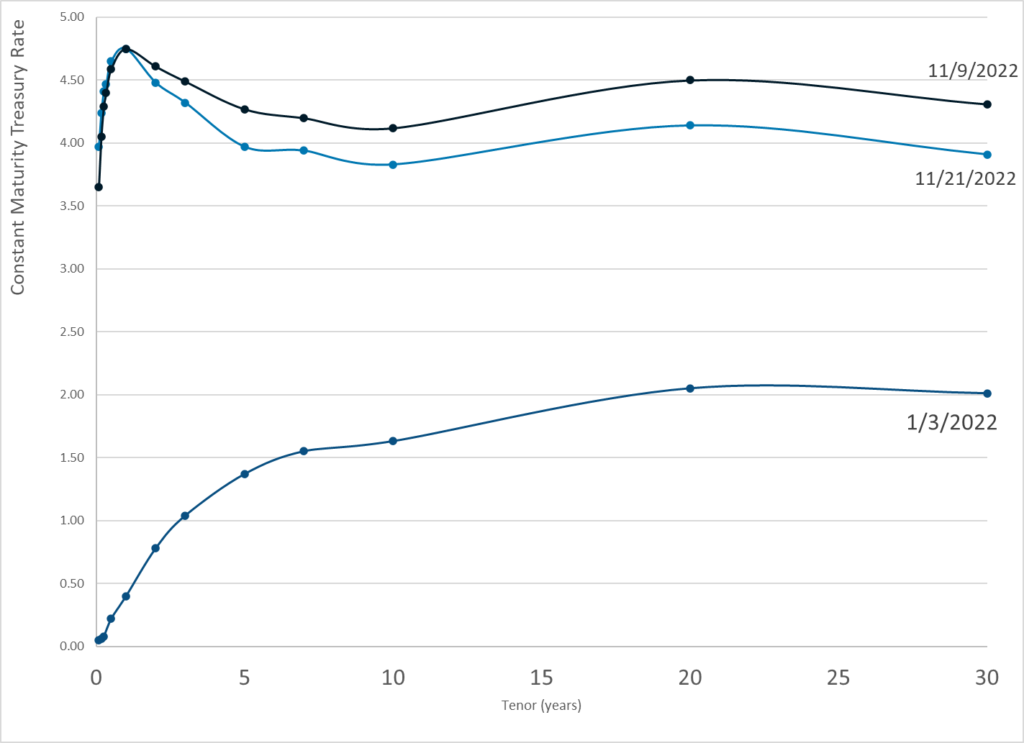

Graphic:

Publication Date: 21 Nov 2022

Publication Site: Treasury Dept

All about risk

Graphic:

Publication Date: 21 Nov 2022

Publication Site: Treasury Dept

Link: https://mishtalk.com/economics/the-3-month-t-bill-yield-inverts-with-the-30-year-long-bond

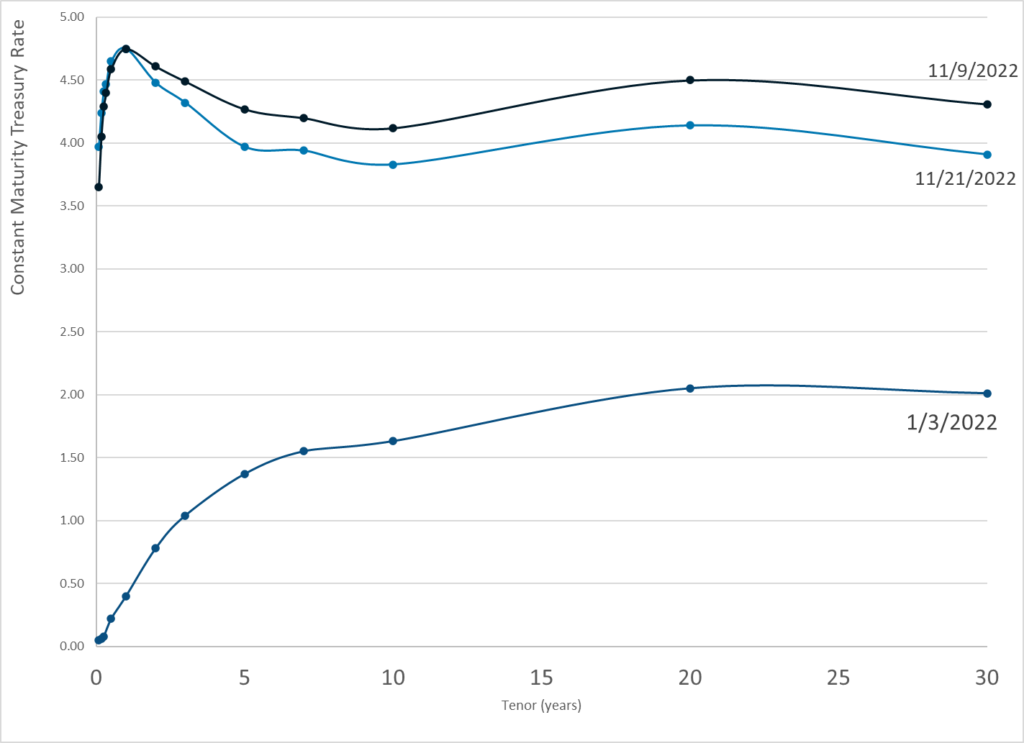

Graphic:

Excerpt:

The 3-Month T-Bill yield hit 4.22% early this morning. At that time the 3-Month to 30-Year inversion was about 9 basis points.

The chart above still shows the inversion, just a bit less.

So much for the idea the Fed would steepen the curve.

Author(s): Mike Shedlock

Publication Date: 1 Nov 2022

Publication Site: Mish Talk

Excerpt:

Executives are hoping that Fed interest rate increases could increase the yields on insurers’ huge investment portfolios.

Higher rates could be a good thing for Prudential, the company’s vice chairman told analysts.

MetLife’s CEO said higher short-term rates could mean a flatter yield curve that would be less favorable to life insurers.

Author(s): Allison Bell

Publication Date: 4 Feb 2022

Publication Site: Think Advisor

Link:https://www.nationalreview.com/2022/02/why-interest-rates-could-drive-a-debt-crisis/

Excerpt:

The average interest rate paid by Washington on its debt has fallen from 8.4 percent to 1.5 percent over the past three decades. However, economic variables tend to fluctuate, and only a fool would assume that a current economic trend will last forever. In the past, economic forecasts and markets told us that high inflation and high unemployment cannot happen simultaneously, that the late-1990s tech-stock bubble wouldn’t burst, and that national housing prices can never fall. Just last year, the Federal Open Market Committee consistently underestimated current-year inflation by three full percentage points. Interest-rate forecasts have proven spectacularly wrong for 50 years.

But now, economic commentators assure us that soaring federal debt is affordable because interest rates will remain low forever.

By contrast, the Congressional Budget Office projects that rates will nudge up to 4.6 percent over three decades. That is easily possible. After all, a broad range of studies show that the projected 100 percent of GDP increase in federal debt over the next three decades should, by itself, add three percentage points to interest rates. Added federal debt over the past 15 years also put upward pressure on interest rates, but this was offset by low productivity, baby-boomer savings, and Federal Reserve policies that pushed rates downward. For interest rates to remain low, those offsetting factors would have to accelerate much further to counteract the three-percentage point effect of future debt.

Author(s): Brian Riedl

Publication Date: 4 Feb 2022

Publication Site: National Review

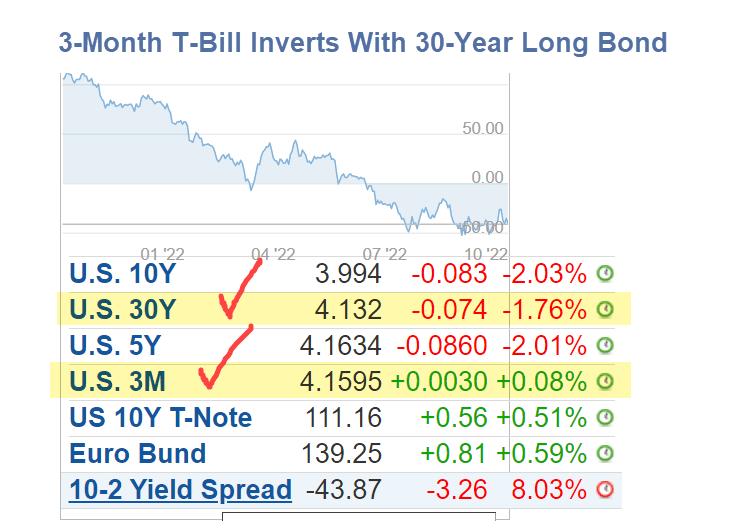

Graphic:

Excerpt:

How many rate hikes are coming? The Fed thinks 6 by the end of 2023. I am unconvinced the Fed gets in any hikes in 2022 and certainly not 6 by the end of 2023.

These ridiculous predictions assume there will not be another recession in “the longer run”.

Central banks like to pretend they will hike, but by the time comes, they have delayed so long they find an excuse to no do so.

Possible excuses: A recession, stock market plunge, another pandemic, global warming, global cooling, or an asteroid crash.

Central banks will find some excuse to delay hikes. But the most likely excuse is a recession or stock market crash.

Author(s): Mike Shedlock

Publication Date: 16 Dec 2021

Publication Site: Mish Talk

Link: https://www.kansascityfed.org/documents/8337/JH_paper_Sufi_3.pdf

Graphic:

Excerpt:

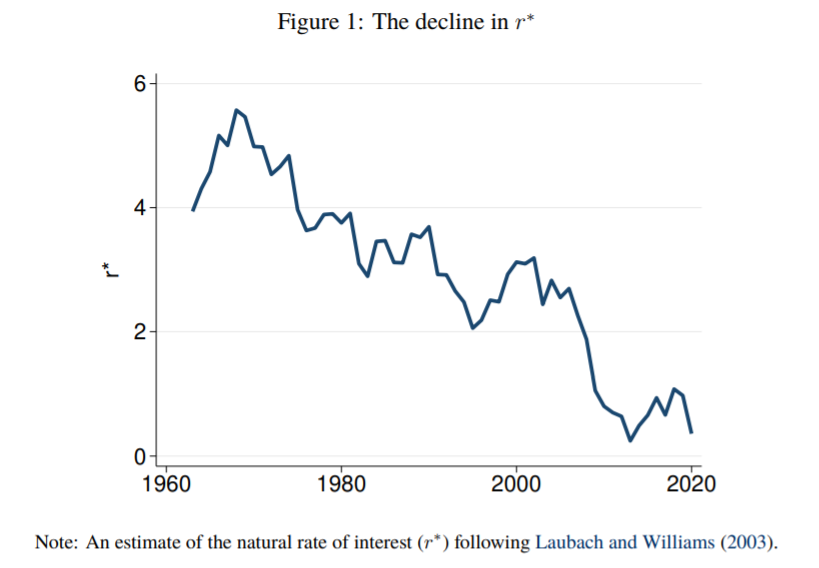

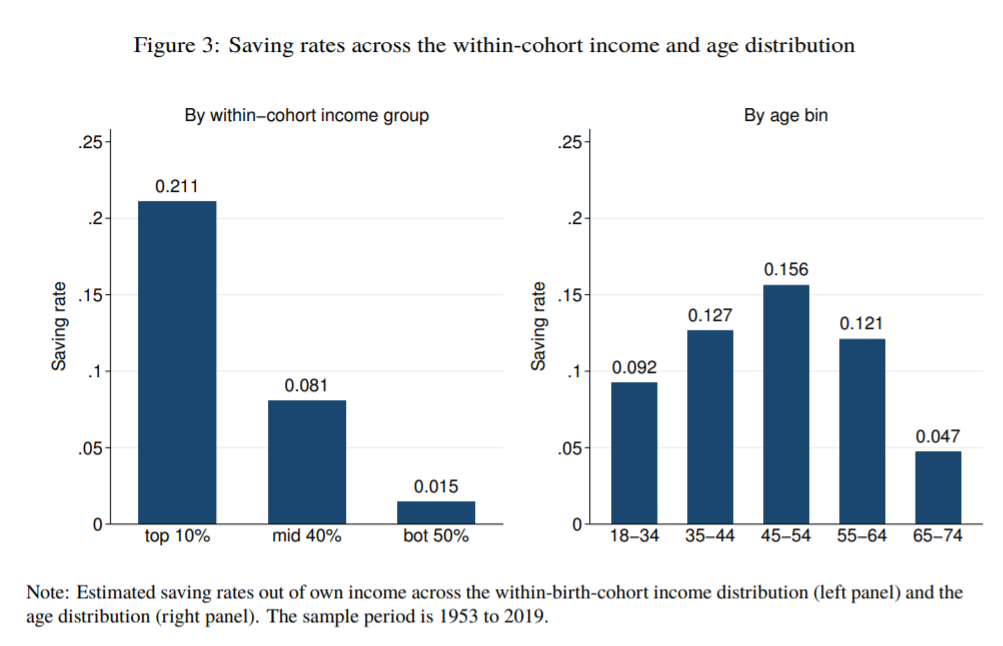

Downward pressure on the natural rate of interest (r∗) is often attributed to an increase in saving. This study uses microeconomic data from the SCF+ to explore the relative importance of demographic shifts versus rising income inequality on the evolution of saving behavior in the United States from 1950 to 2019. The evidence suggests that rising income inequality is the more important factor explaining the decline in r∗. Saving rates are significantly higher for high income households within a given birth cohort relative to middle and low income households in the same birth cohort, and there has been a large rise in income shares for high income households since the 1980s. The result has been a large rise in saving by high income earners since the 1980s, which is the exact same time period during which r∗ has fallen. Differences in saving rates across the working age distribution are smaller, and there has not been a consistent monotonic shift in income toward any given age group. Both findings challenge the view that demographic shifts due to the aging of the baby boom generation explain the decline in r∗.

.

Author(s): Atif Mian, Ludwig Straub, Amir Sufi

Publication Date: August 2021

Publication Site: Kansas City Federal Reserve

Link: https://doctorow.medium.com/inequality-not-gerontocracy-fbd7d012ba4a

Graphic:

Excerpt:

The received wisdom among economists is that the US’s historical low interests rates are driven by high savings by aging boomers who are getting ready for, or in, retirement.

The idea is boomers have salted away so much cash that banks don’t bid for their savings, so interest rates fall.

But at last week’s Jackson Hole conference, a trio of economists presented a very different explanation for low interest, one that better fits the facts.

…..

So we can’t really say that low interest rates are being caused by an aging population with high retirement savings, because while the US population is aging, it does not have high savings. Quite the contrary.

And, as Robert Armstrong points out in his analysis of the paper for the Financial Times, even in places like Japan, with large cohorts of retirees and near-retirees who do have adequate savings, rates are scraping bottom.

…..

So why are rates so low? Well, the paper says it is being caused by high levels of savings — just not aging boomers’ savings. Rather, it’s the savings of the ultra-wealthy, the 1%, who are sitting on mountains of unproductive capital, chasing returns.

Author(s): Cory Doctorow

Publication Date: 1 September 2021

Publication Site: Cory Doctorow at Medium.com

Link: https://mises.org/power-market/federal-reserves-ballooning-and-risky-balance-sheet

Excerpt:

The Fed has embarked on a massive expansionary quest in recent years. In 2020, total Reserve Bank assets rose from $4.2 trillion to $7.4 trillion amidst the pandemic and related government lockdown and fiscal “stimulus” policies. That was roughly three times the extraordinary growth in the consolidated balance sheet for the Reserve Banks in the 2008-2009 financial crisis. And in the latest weekly “H.4.1” release, total assets were up to $7.8 trillion – rising about a hundred billions dollars a month so far this year.

….

Today, short and long-term interest rates on government bonds rest near historic lows, important in part because the Fed massively expanded its purchases of government bonds. But low interest rates can’t be taken for granted, particularly if we get significantly higher inflationary expectations — which appear to have begun to sprout in recent weeks.

If we get significantly higher interest rates for that reason, the Reserve Bank balance sheet impact from losses on securities assets would arrive if the losses become “realized” – a realistic prospect if the Federal Reserve reverses course and starts selling off securities as a means of conducting monetary policy amidst higher inflationary expectations.

Author(s): Bill Bergman

Publication Date: 28 May 2021

Publication Site: Mises Institute

Link: https://www.washingtonpost.com/business/2021/03/03/democrats-stimulus-spending-inflation/

Excerpt:

To hear it from liberal economists, progressive activists and Democratic politicians, there is no longer any limit to how much money government can borrow and spend and print.

In this new economy, we no longer have to worry that stock prices might climb so high, or companies take on so much debt, that a financial crisis might ensue. In this world without trade-offs, we can shut down the fossil fuel industry and transition to a zero-carbon economy without any risk to employment and economic growth. Nor is there any amount of infrastructure investment that could possibly exceed the capacity of the construction industry to absorb it.

Rest assured that the economy won’t miss a beat no matter how far or fast the minimum wage is raised. And whatever benefits are required by the always struggling middle class can be financed by raising taxes on big corporations and the undeserving rich.

Author(s): Steven Pearlstein

Publication Date: 3 March 2021

Publication Site: Washington Post

Link: https://www.wsj.com/articles/u-s-treasury-yields-fall-after-notching-big-gains-last-week-11614619970

Excerpt:

Yields on most U.S. government bonds fell Monday, showing further signs of stabilizing after soaring to multi-month highs last week.

The yield on the benchmark 10-year Treasury note settled at 1.444%, according to Tradeweb, down from 1.459% Friday.

Shorter-dated yields also headed lower, in a reversal from last week when investors bet that the Federal Reserve will start raising interest rates earlier than previously anticipated in response to an expected burst of economic growth and inflation.

The five-year yield settled at 0.708%, from 0.775% Friday. Yields fall when bond prices rise.

Author(s): Sebastian Pellejero and Sam Goldfarb

Publication Date: 1 March 2021

Publication Site: Wall Street Journal

Link: https://www.wsj.com/articles/bond-market-tumult-puts-lower-for-longer-in-the-crosshairs-11614517200

Excerpt:

A wave of selling during the past two weeks drove the yield on the benchmark 10-year Treasury note, which helps set borrowing costs on everything from corporate debt to mortgages, to above 1.5%, its highest level since the pandemic began and up from 0.7% in October.

….

Traders said concerning dynamics were evident in a Treasury auction late last week. Demand for five- and seven-year Treasurys was weak Thursday heading into a $62 billion auction of seven-year notes and nearly evaporated in the minutes following the auction, which was one of the most poorly received that analysts could remember.

The seven-year note was sold at a 1.195% yield, or 0.043 percentage point higher than traders had expected — a record gap for a seven-year note auction, according to Jefferies LLC analysts. Primary dealers, large financial firms that can trade directly with the Fed and are required to bid at auctions, were left with about 40% of the new notes, about twice the recent average.

Author(s): Julia-Ambra Verlaine, Sam Goldfarb

Publication Date: 28 February 2021

Publication Site: Wall Street Journal

Excerpt:

State and local government pension systems are increasingly dependent on investment returns, and at risk of increasingly volatile results, as funding levels remain depressed and systems increasingly start to pay out more than they take in, according to a new report from Moody’s.

The credit-ratings agency anticipates higher volatility and lower returns across asset classes in 2021 compared to 2020, even as many pension sponsors have spent the past few years lowering their assumed returns from previous loftier targets that they rarely hit.

“With persistently low interest rates for high-grade fixed-income securities, public pension systems continue to rely on highly volatile equities and alternatives to meet return targets, posing a material credit risk for some governments,” the Moody’s analysts wrote.

Author(s): Andrea Riquier

Publication Date: 25 February 2021

Publication Site: MarketWatch