Link:https://www.washingtonpost.com/opinions/2022/02/04/maryland-is-wasting-its-pensioners-money/

Excerpt:

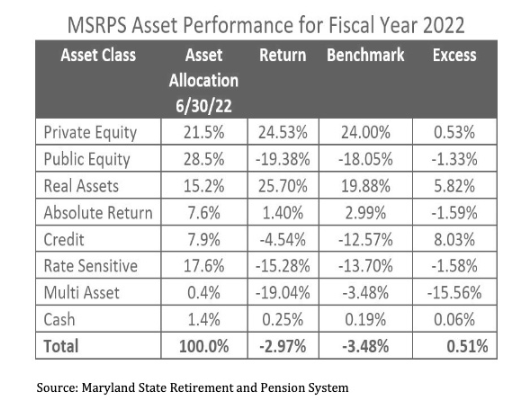

Seven hundred and forty-four million dollars. That is the amount of Wall Street fees paid by the Maryland state pension plan for investment advice in fiscal 2021.

Over the past 10 years, the fees totaled roughly $4.5 billion, or about 15 percent of the plan’s earnings. For that kind of money, you would think the state gets only the prime stock and bond picks from its advisers, but, during that time, Maryland, as with most other states, failed to beat the returns of a simple 60 percent stocks/40 percent bonds index. Many large institutional investors, including public pension plans, use this 60/40 index as a barometer to gauge their portfolios’ results. They structure their portfolios to avoid a 100 percent exposure to the sometimes volatile stock market. If their results are better than the index for a given year, they claim success. Many mutual funds attract smaller individual retail and 401(k) retirement accounts by copying the index and charging low fees for passive management.

….

This drainage damages the financial security of public workers in Maryland and other states, and it forces greater taxpayer contributions to the plans. The ongoing situation has a secondary effect as well: The massive wealth transfer — from public workers and average taxpayers — to a small coterie of Wall Street money managers fosters a new plutocracy, successful at obscuring the problem and blocking reform.

The obvious fix for public plans is to shift from expensive fee investments to low-fee indexing, a tactic endorsed by none other than Warren Buffett, the noted value investor and philanthropist. For large public plans, including Maryland’s, this shift, if implemented, would be gradual. Extricating the fund from its long-term contractual commitments and replacing them with passive investments is going to take time.

Author(s): Jeff Hooke

Publication Date: 4 Feb 2022

Publication Site: Washington Post