Graphic:

Excerpt:

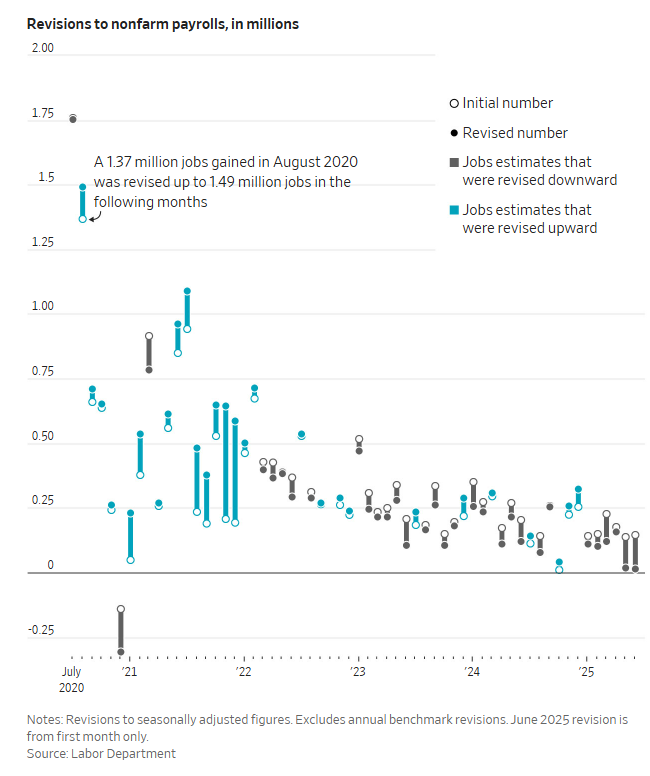

At the end of each month, the BLS uses the data it has on hand to make a first estimate. Then it updates that estimate in each of the following two months, based on late replies and a revised seasonal adjustment.

If the employers replying late happen to give different information from the first batch, as happened this summer, big revisions are likely. For example, Friday’s data showed that in May and June, there were about 109,000 fewer jobs for educators at state and local governments than previously thought. Late-responding schools were responsible for the bulk of that revision, said Omair Sharif, founder of analytics firm Inflation Insights.

“The decline in response rates for the initial release, that’s just going to make the range of revisions larger,” said Jonathan Pingle, an economist at UBS. “They’re getting a significantly larger amount of incremental information after the initial deadline.”

A year ago, when he was running for his second term, Trump was enraged by a different BLS revisions process—a twice-a-year benchmarking that reconciles the monthly figures with a comprehensive set of state-level data that, in theory, includes just about every employer in the country. Using this bigger data set gives the BLS a direct look at the number of companies that have been founded and have gone out of business, a blind spot in the bureau’s month-to-month data.

Author(s): Matt Grossman

Publication Date: 4 Aug 2025

Publication Site: WSJ