Link: https://finance.yahoo.com/news/australian-155-billion-pension-merger-222035563.html

Graphic:

Excerpt:

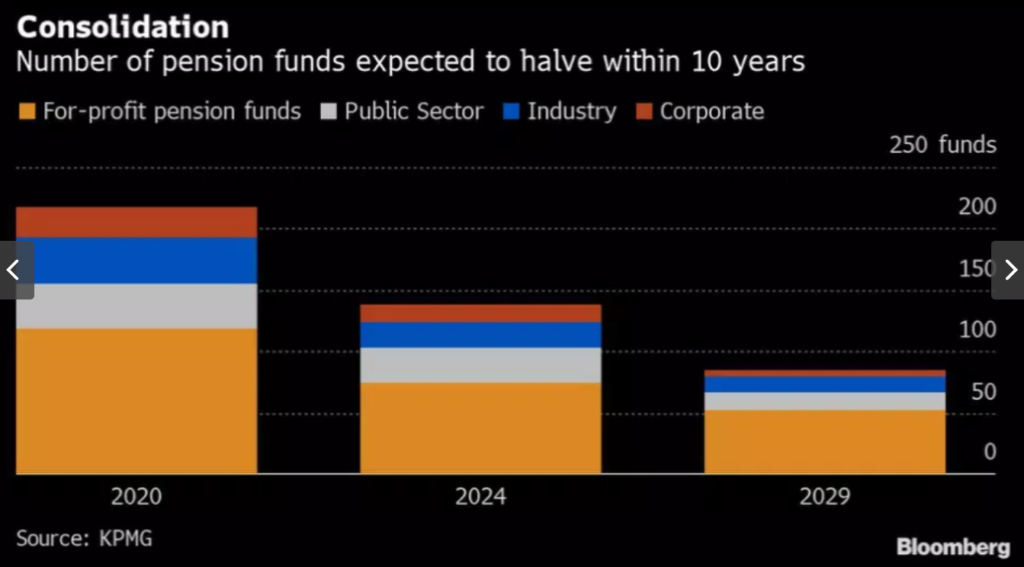

Two of Australia’s largest pension funds moved a step closer to creating a A$200 billion ($155 billion) giant as the world’s fourth-biggest pension pot consolidates.

QSuper and Sunsuper Pty. have signed a deal to merge, the two funds said in a joint statement Monday. The Brisbane-based funds will combine by September to create the country’s second-largest pension fund.

…..

QSuper has about A$120 billion in funds under administration and looks after the retirement savings for Queensland state government employees. Sunsuper has about A$80 billion in savings for employees of corporations including Unilever Plc and Virgin Australia.

Author(s): Matthew Burgess, Bloomberg

Publication Date: 14 March 2021

Publication Site: Yahoo Finance