Link: https://www.chicagofed.org/publications/economic-perspectives/2021/1

Graphic:

Excerpt:

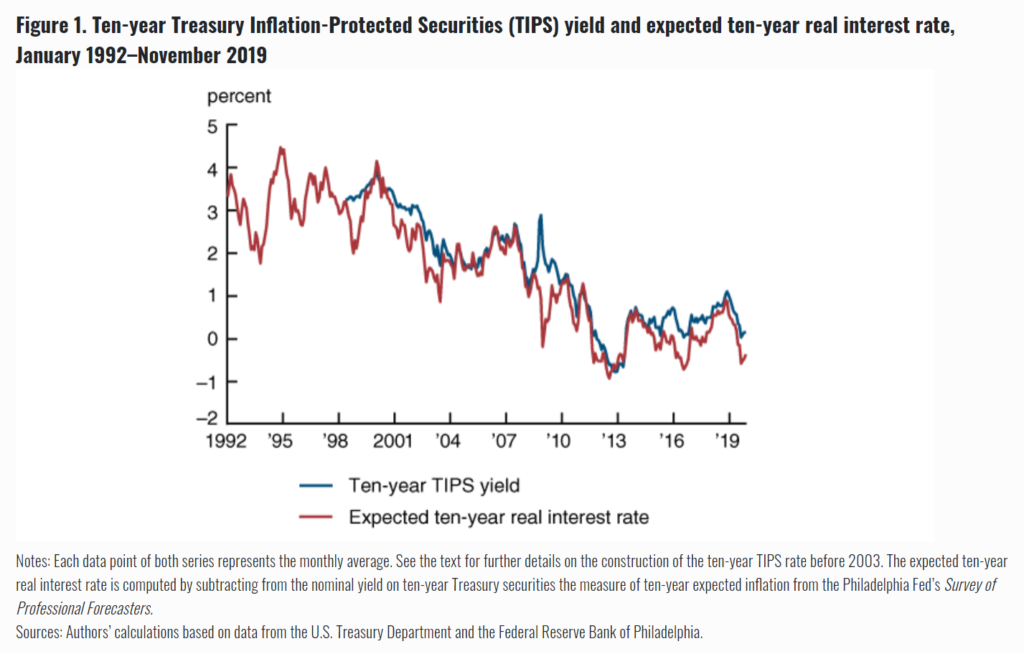

The first observation in the United States motivating the GSG hypothesis is the protracted decline in long-term real interest rates, as shown in figure 1. This figure depicts both a Treasury Inflation-Protected Securities (TIPS) rate and an expected long-term real interest rate, computed by subtracting from the nominal yield on ten-year Treasury securities the measure of ten-year expected inflation from the Survey of Professional Forecasters (SPF).8 From 2003 on, the TIPS rate is for the ten-year TIPS. Before 2003, we use a 30-year TIPS rate, data for which are available starting in 1998, subtracting 40 basis points from it to reflect the average term premium observed in the years when both the ten-year and 30-year TIPS are available. At the time Bernanke first articulated the GSG hypothesis, much of the focus was on Greenspan’s conundrum—that is, the continuing drop in long-term rates in 2004–05 despite repeated hikes in short-term rates during a strong economy. However, with the benefit of hindsight, the much longer-run, apparently secular nature of the drop in long-term real interest rates is evident. Very roughly, it seems fair to say that the ten-year real interest rate in the United States declined about 150 basis points between the latter half of the 1990s (when it averaged around 3.5 percent) and the prelude to the global financial crisis (when it averaged around 2 percent), and then it fell another 200 basis points commencing with the collapse of Lehman Brothers in September 2008 and continuing to the present. While the first drop of 150 basis points is very plausibly a consequence of capital inflows, the post-crisis drop of 200 basis points is unlikely to be attributable primarily to the GSG;9 instead, that second drop suggests a somewhat parallel story of weak domestic investment in the United States.

Author(s): Robert Barsky , Matthew Easton

Publication Date: March 2021

Publication Site: Federal Reserve Bank of Chicago