Link: https://www.soa.org/resources/research-reports/2022/mort-improve-survey/

Report PDF: https://www.soa.org/4ad811/globalassets/assets/files/resources/research-report/2022/mort-improve-survey.pdf

Graphic:

Excerpt:

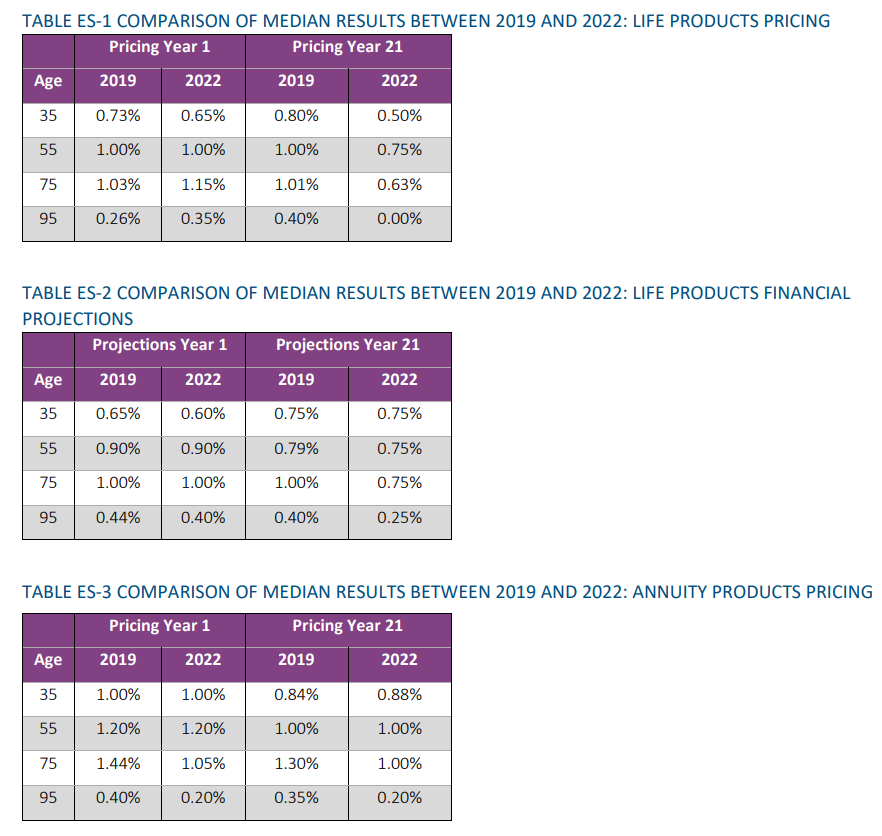

The Committee on Life Insurance Mortality and Underwriting Surveys of the Society of Actuaries sent

companies a survey in May of 2019 on mortality improvement practices as of year-end 2018. The survey

results were released in January 2022. The survey was completed by respondents prior to the onset of

COVID-19. The present report provides an opportunity to update the results for pandemic-based changes

and compare the before and after surveys.

The 2022 survey was opened in March 2022 and closed by the end of April. Thirty-five respondent

companies participated in this survey, with 29 from the U.S. and six from Canada. This group was further

divided between direct writers (26) and reinsurers (nine).

This survey focused on the use of mortality improvement and how it has changed for financial projection

and pricing modeling following the initial stages of COVID-19. Details regarding assumptions and opinions

on mortality improvement in general were asked of the respondents.

National Association of Insurance Commissioners discussions on mortality improvement factors due to

COVID-19 for reserving purposes have taken place, but this survey was conducted before any adjustments

reacting to them.

Seventy-four percent (26 of 35) of respondents indicated using durational mortality improvement

assumptions in their life and annuity pricing and/or financial projections. Moreover, of those that used

durational mortality improvement assumptions, attained age and gender were the top two characteristics

in which assumptions varied.

Respondents were asked to indicate the different limitations when applying durational mortality

improvement assumptions. The Survey found that the most common lowest and highest attained age to

which durational mortality improvement was applied were 0 and about 100, respectively. The lowest and

highest durational mortality improvement rate ranged from -1.50% (deterioration) to 2.80%

(improvement). The time period in which the mortality improvement rates were applied ranged from 10 to

120 years, but this varied between life (10/120) and annuities (30/120). The most common time period was

20 to 30 years for life; less consensus was seen for annuities. Analysis is provided in Appendix C for

instances when highlights are shared in the body of the report.

Author(s): Ronora Stryker, Max Rudolph

Publication Date: December 2022

Publication Site: SOA Research Institute