Graphic:

Excerpt:

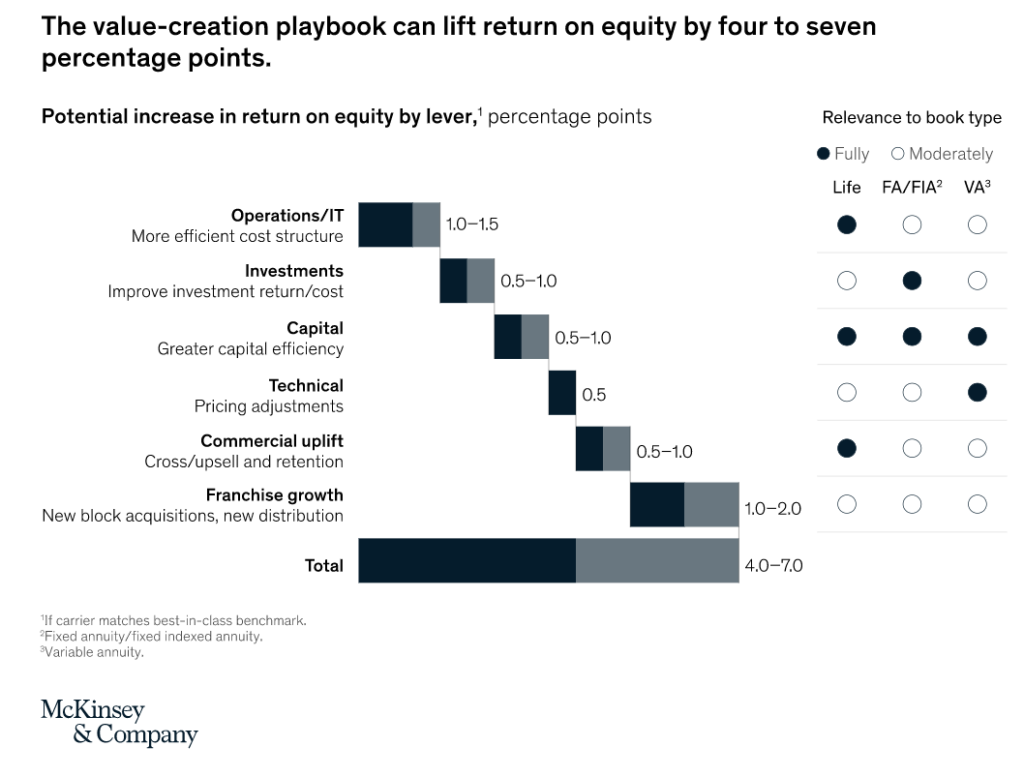

Once they’ve acquired a book, firms can turn their attention to driving value. Building on our guidelines for closed-book value creation, owners have six levers that can collectively improve ROE by up to four to seven percentage points (exhibit):

- Investment performance: optimization of the SAA and delivery of alpha within the SAA

- Capital efficiency: optimization of balance-sheet exposures—for example, active management of duration gaps

- Operations/IT improvement: reduction of operational costs through simplification and modernization

- Technical excellence: improvement of profitability through price adjustments, such as reduced surplus sharing

- Commercial uplift: cross-selling and upselling higher-margin products

- Franchise growth: acquiring new blocks or new distribution channels

Most PE firms view the first lever, investment performance, as the main way to create value for the insurer, as well as for themselves. This lever will grow in importance if yields and spreads continue to decline. Leading firms typically have deep skills in core investment-management areas, such as strategic asset allocation, asset/liability management, risk management, and reporting, as well as access to leading investment teams that have delivered alpha.

Capital efficiency is also well-trod ground, and for private insurers it presents a greater opportunity given their different treatment under generally accepted accounting principles, (GAAP), enabling them to apply a longer-term lens and reduce the cost of hedging. However, most firms have yet to explore the other levers—operations and IT improvement, technical excellence, commercial uplift, and franchise growth—at scale. Across all these levers, advanced analytics can enable innovative, value-creating approaches.

Author(s): Ramnath Balasubramanian, Alex D’Amico, Rajiv Dattani, and Diego Mattone

Publication Date: 2 February 2022

Publication Site: McKinsey