Link: https://www.ssa.gov/OACT/TRSUM/index.html

Graphic:

Excerpt:

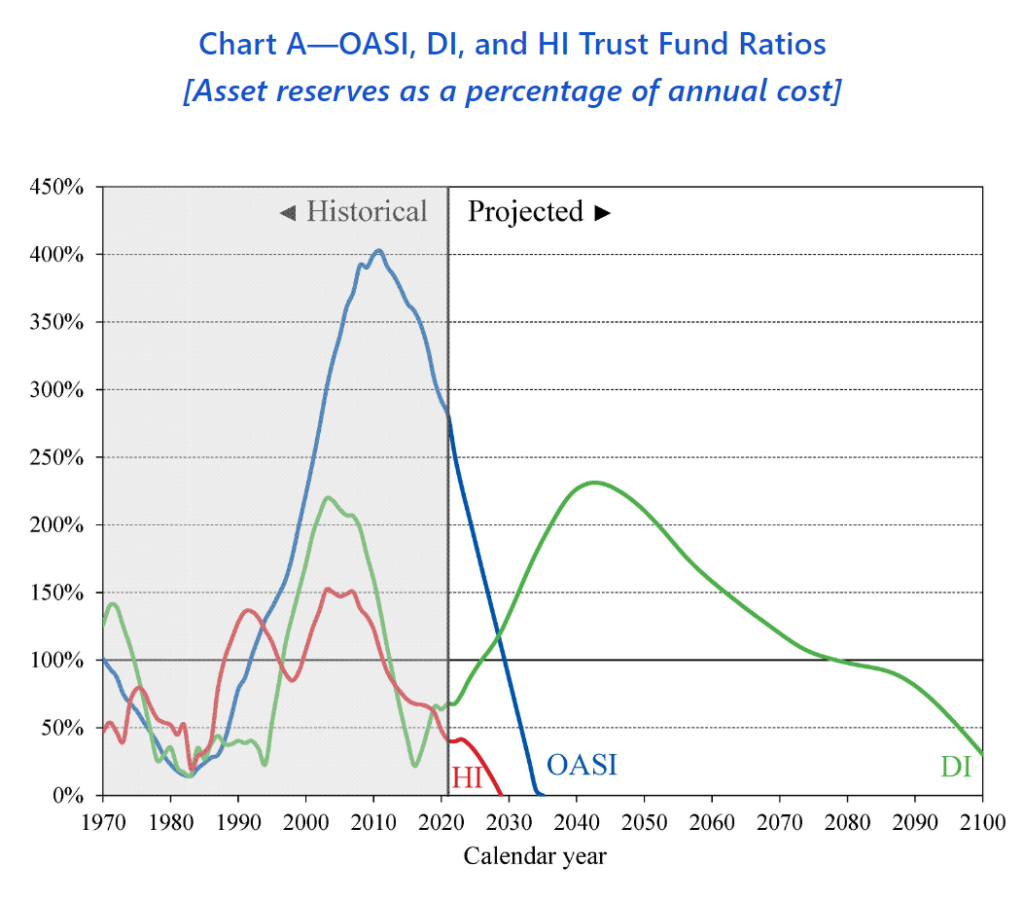

• The Old-Age and Survivors Insurance (OASI) Trust Fund, which pays retirement and survivors benefits, will be able to pay scheduled benefits on a timely basis until 2034, one year later than reported last year. At that time, the fund’s reserves will become depleted and continuing tax income will be sufficient to pay 77 percent of scheduled benefits.

• The Disability Insurance (DI) Trust Fund, which pays disability benefits, is no longer projected to be depleted within the 75-year projection period. By comparison, last year’s report projected that it would be able to pay scheduled benefits only until 2057.

• The OASI and DI funds are separate entities under law. The report also presents information that combines the reserves of these two funds in order to illustrate the actuarial status of the Social Security program as a whole. The hypothetical combined OASI and DI funds would be able to pay scheduled benefits on a timely basis until 2035, one year later than reported last year. At that time, the combined funds’ reserves will become depleted and continuing tax income will be sufficient to pay 80 percent of scheduled benefits.

• The Hospital Insurance (HI) Trust Fund, or Medicare Part A, which helps pay for services such as inpatient hospital care, will be able to pay scheduled benefits until 2028, two years later than reported last year. At that time, the fund’s reserves will become depleted and continuing total program income will be sufficient to pay 90 percent of total scheduled benefits.

• The Supplemental Medical Insurance (SMI) Trust Fund is adequately financed into the indefinite future because current law provides financing from general revenues and beneficiary premiums each year to meet the next year’s expected costs. Due to these funding provisions and the rapid growth of its costs, SMI will place steadily increasing demands on both taxpayers and beneficiaries.

• For the sixth consecutive year, the Trustees are issuing a determination of projected excess general revenue Medicare funding, as is required by law whenever annual tax and premium revenues of the combined Medicare funds will be below 55 percent of projected combined annual outlays within the next 7 fiscal years. Under the law, two such consecutive determinations of projected excess general revenue consitute a “Medicare funding warning.” Under current law and the Trustees’ projections, such determinations and warnings will recur every year through the 75-year projection period.

Publication Date: accessed 9 June 2022

Publication Site: Social Security Administration