Graphic:

Excerpt:

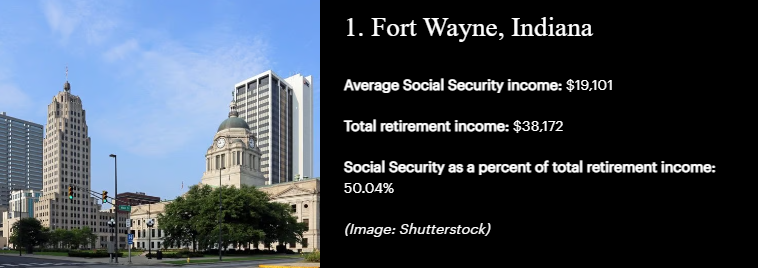

A new report from SmartAsset finds that Social Security benefits comprise 41.7% of a retiree’s total income of $50,780, on average. That percentage is even higher for retirees in some cities, where benefits can make up half of overall retirement income.

To find out where retirees rely most on Social Security, SmartAsset examined data for Social Security income as a percentage of overall retirement income in the 100 U.S. cities with the largest population of residents ages 65 and older.

Author(s): Michael S. Fischer

Publication Date: 26 Apr 2023

Publication Site: Think Advisor