Link: https://mishtalk.com/economics/how-many-rate-hikes-does-the-market-now-expect-of-the-fed

Graphic:

Excerpt:

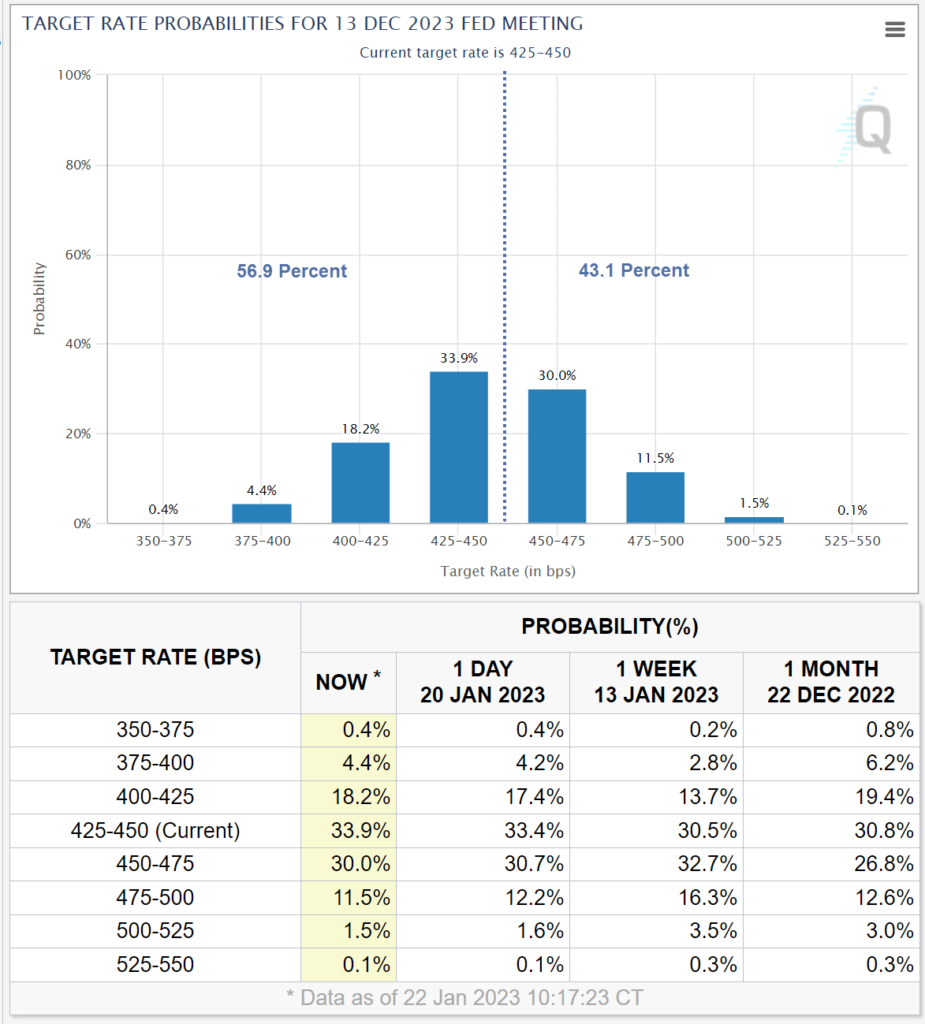

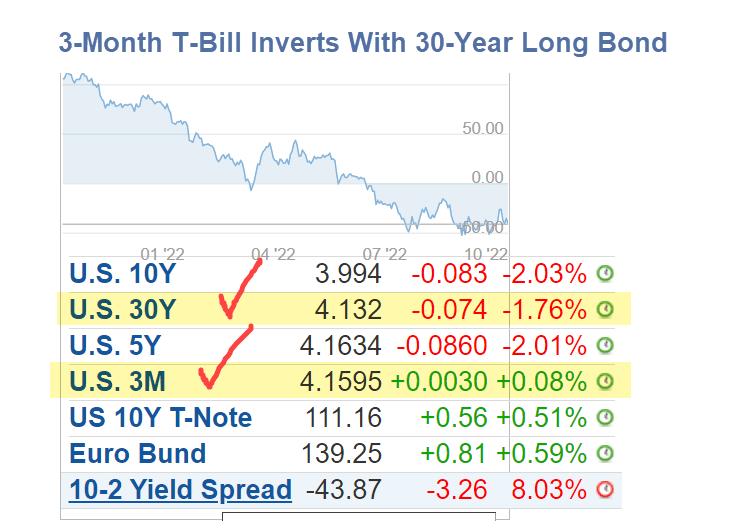

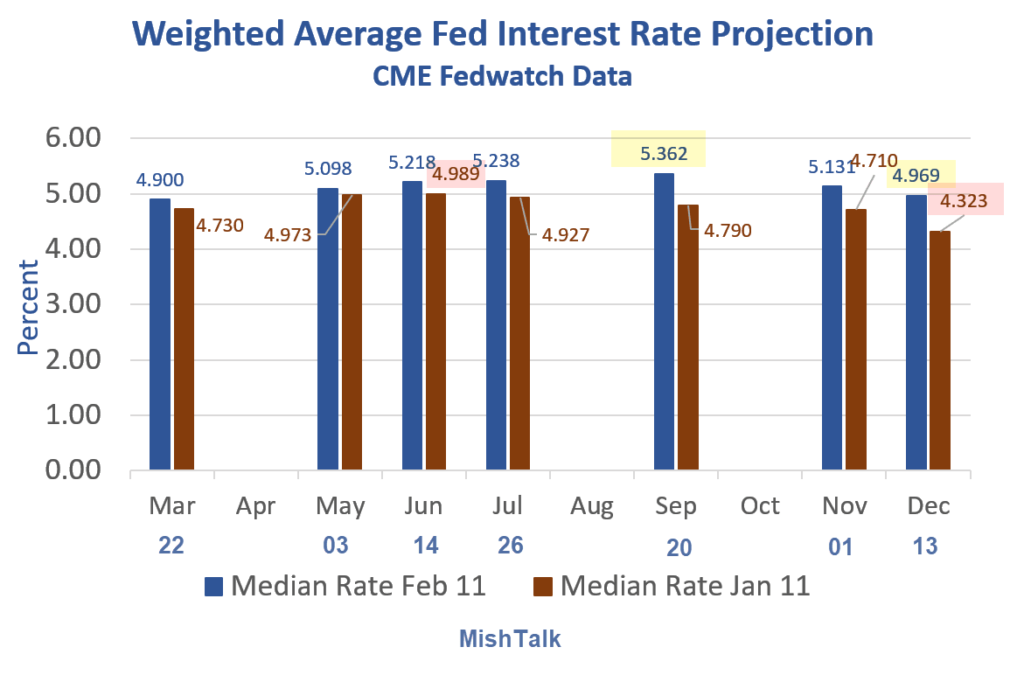

Now Vs a Month Ago

- The market now sees a terminal rate of 5.36 percent in September, call it 5.25-5.50 percent.

- A month ago the market thought the terminal rate was 5.00 percent in June.

- Previously, the market expected a peak in June followed by two or three 25-basis point cuts all the way to 4.32 percent.

- The market now sees a a cut from 5.36 percent to 5.0 percent.

Author(s): Mike Shedlock

Publication Date: 11 Feb 2023

Publication Site: Mish Talk