Link: https://content.naic.org/sites/default/files/call_materials/Materials-BDAIWG.pdf

Graphic:

Excerpt:

Author(s): Tom Prince, FCAS, MAAA

Publication Date: 12 Nov 2024

Publication Site: NAIC

All about risk

Link: https://content.naic.org/sites/default/files/call_materials/Materials-BDAIWG.pdf

Graphic:

Excerpt:

Author(s): Tom Prince, FCAS, MAAA

Publication Date: 12 Nov 2024

Publication Site: NAIC

Link: https://ar.casact.org/modeling-the-casualty-exposures-in-epidemics/

Graphic:

Excerpt:

A casualty actuary might be forgiven for thinking that illness and disease are what those “other” actuaries worry about.

Though risk of illness is usually considered the province of the life-health actuary, a session at the 2017 CAS Annual Meeting in Anaheim, California, showed how epidemics can affect property-casualty risks. The session also described how to approach modeling those exposures.

….

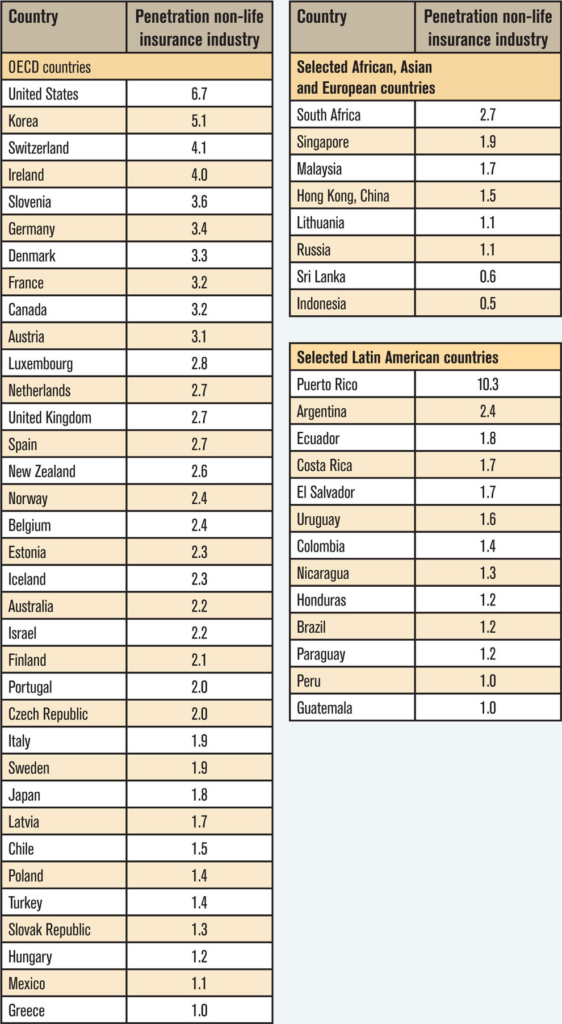

Milliman actuary Cody Webb, FCAS, began by demonstrating how big the insurance gap is, particularly in developing nations. He explained that the spectrum of losses ranges from minuscule (loss of a single strand of hair) to catastrophic (sudden, instant death) and can affect a single person or every entity in the universe across eons. But the insurable losses share some traits, Webb said, including:

In showing a chart of property-casualty insurance as a percentage of GDP — with the wealthier countries better insured than others — Webb noted that insurance companies need to “quantify and develop products that meet all criteria of insurability.” (See chart below.)

Author(s): James P. Lynch

Publication Date: 16 Jan 2018

Publication Site: Actuarial Review, Casualty Actuarial Society

Excerpt:

As consumers, regulators, and stakeholders demand more transparency and accountability with respect to how insurers’ business practices contribute to potential systemic societal inequities, insurers will need to adapt. One way insurers can do this is by conducting disparate impact analyses and establishing robust systems for monitoring and minimizing disparate impacts. There are several reasons why this is beneficial:

- Disparate impact analyses focus on identifying unintentional discrimination resulting in disproportionate impacts on protected classes. This potentially creates a higher standard than evaluating unfairly discriminatory practices depending on one’s interpretation of what constitutes unfair discrimination. Practices that do not result in disparate impacts are likely by default to also not be unfairly discriminatory (assuming that there are also no intentionally discriminatory practices in place and that all unfairly discriminatory variables codified by state statutes are evaluated in the disparate impact analysis).

- Disparate impact analyses that align with company values and mission statements reaffirm commitments to ensuring equity in the insurance industry. This provides goodwill to consumers and provides value to stakeholders.

- Disparate impact analyses can prevent or mitigate future legal issues. By proactively monitoring and minimizing disparate impacts, companies can reduce the likelihood of allegations of discrimination against a protected class and corresponding litigation.

- If writing business in Colorado, then establishing a framework for assessing and monitoring disparate impacts now will allow for a smooth transition once the Colorado bill goes into effect. If disparate impacts are identified, insurers have time to implement corrections before the bill is effective.

Author(s): Eric P. Krafcheck

Publication Date: 27 Sept 2021

Publication Site: Milliman

Link: https://www.theactuarymagazine.org/impact-of-covid-19-on-defined-benefit-pension-plan-funding/

Graphic:

Excerpt:

Higher interest rates already have translated into higher discount rates for solvency and accounting valuations, which means good news (lower liabilities) for DB pension plans. The sensitivity of a pension plan’s liabilities to the discount rate used to determine their value depends on the demographics of the plan members, the type of valuation and level of discount rates being used. Generally, the “duration” for most pension plan liabilities (defined here as the percentage decrease in liabilities for a 1% increase in discount rates) will range from 10 to 25.

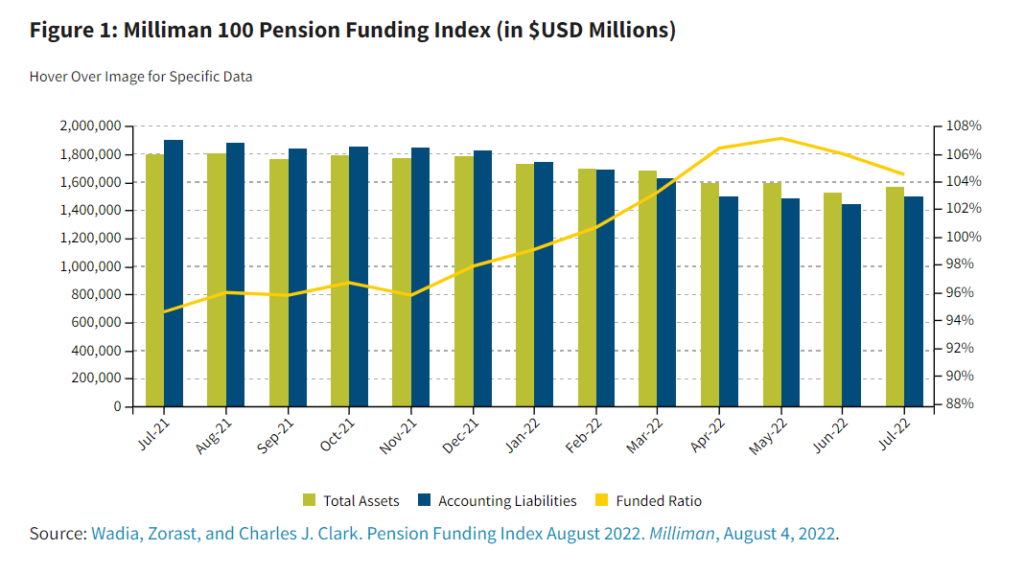

In the United States, the average accounting funded ratio increased from 94.6% in July 2021 to 104.5% in July 2022, according to the Milliman 100 Pension Funding Index, despite significant decreases in plan assets during that time. This is because the average accounting discount rate (typically based on long-term, high-quality bond yields) increased from 2.59% to 4.25% during that same period, driving down accounting liabilities at a faster pace than asset losses. Figure 1 demonstrates this effect in more detail.

Author(s): John Melinte

Publication Date: November 2022

Publication Site: The Actuary at SOA

Excerpt:

Milliman, Inc., a premier global consulting and actuarial firm, today released the results of its latest Milliman 100 Pension Funding Index (PFI), which analyzes the 100 largest U.S. corporate pension plans.

During October, the Milliman 100 PFI funded ratio rose from 108.8% on September 30 to 112.8% on October 31, reaching a new high for the year. The change was driven by a 35-basis-point hike in the monthly discount rate. The PFI projected benefit obligation decreased to $1.266 trillion as the discount rate rose from 5.36% in September to 5.71% for October—the highest rate since March 2010. This increase helped to offset October’s flat investment returns of 0.21%, which lowered the Milliman 100 PFI asset value by $4 billion.

Publication Date: 4 Nov 2022

Publication Site: PRNEWSWIRE

Link: https://www.milliman.com/en/insight/2021-Milliman-Variable-Annuity-Mortality-Study

Excerpt:

Milliman Variable Annuity Mortality Study shows mortality increases of 11% as a result of COVID-19 pandemic

Life insurers and annuity writers are now beginning to understand the impact of the COVID-19 pandemic on their lines of business, as mortality data for the year 2020 is reported and analyzed. While the pandemic has affected different carriers in different ways, future mortality rates are a key assumption for annuity writers.

With Milliman’s acquisition of Ruark Consulting in December 2021, the industry’s leading variable annuity mortality study has been rebranded as the Milliman Variable Annuity Mortality Study. The study is based on data from 2008 through 2020, totaling $674 billion in account value as of the end of the study period, with over 1 million deaths across 19 companies.

Author(s): Timothy Paris

Publication Date: 14 Mar 2022

Publication Site: Milliman

PDF: https://www.milliman.com/-/media/milliman/pdfs/2022-articles/3-28-22-bermuda.ashx

Graphic:

Description:

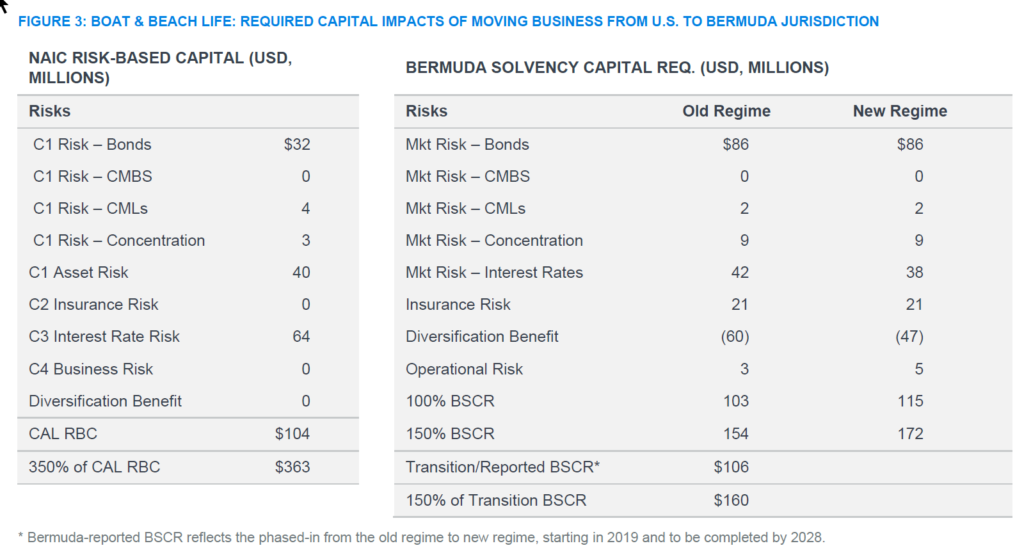

We review the history of life insurance in Bermuda, reflect on how we have gotten to where we are today, and look forward to what may be ahead. We present a hypothetical—yet realistic—case study to illustrate some of the factors that can lead to a strategic decision do business Bermuda. From an embedded-value perspective, we highlight potentially considerable benefits from a move from a U.S. statutory basis to a Bermudian economic balance sheet.

Author(s): Tony Dardis, William C. Hines, and Su Meng Lee

Publication Date: 28 March 2022

Publication Site: Milliman

Excerpt:

In a year filled with gloomy news of economic hardships and the ongoing pandemic, there’s a bright spot: the funded ratio of the 100 largest U.S. public pensions is up by more than 15 percent this year, according to Milliman’s annual analysis.

“Surging market returns have propelled pension assets far beyond previous levels, driving the estimated funding deficit below $1 trillion for the first time since 2012,” the report says. “We estimate that nearly half of the plans in the study stood above 90 percent funded as of June 30.”

Only 13 public pension plans were above 90 percent funded based on Milliman’s 2020 analysis.

Author(s): Andy Castillo

Publication Date: 28 Oct 2021

Publication Site: American City and County

Document Link: https://drive.google.com/file/d/1-lIsmyzEIiDvYXnYJtWw5kaCI25euLFk/view

Snippet:

Date Accessed: 21 April 2021

Shared by: Cate Long

Publication Site: Twitter and Google Drive

Excerpt:

In 2021, public pensions have continued their strong recovery from a year prior, with the funded status of the Milliman 100 plans increasing to 79.0% as of March 31, up from 78.6% at the end of December 2020 and 66.0% in Q1 2020. The Q1 2021 funded ratio is the highest recorded in the history of Milliman’s Public Pension Funding Study.

“While 2021 has proven to be a strong year for public pensions so far, there are still lingering questions around the impact of the COVID-19 pandemic on these plans,” said Becky Sielman, author of Milliman’s Public Pension Funding Study. “The past year has seen workforce volatility and strain on state budgets which could put downward pressure on funding in the future.”

Author(s): Milliman

Publication Date: 19 April 2021

Publication Site: PRNewswire

Graphic:

Excerpt:

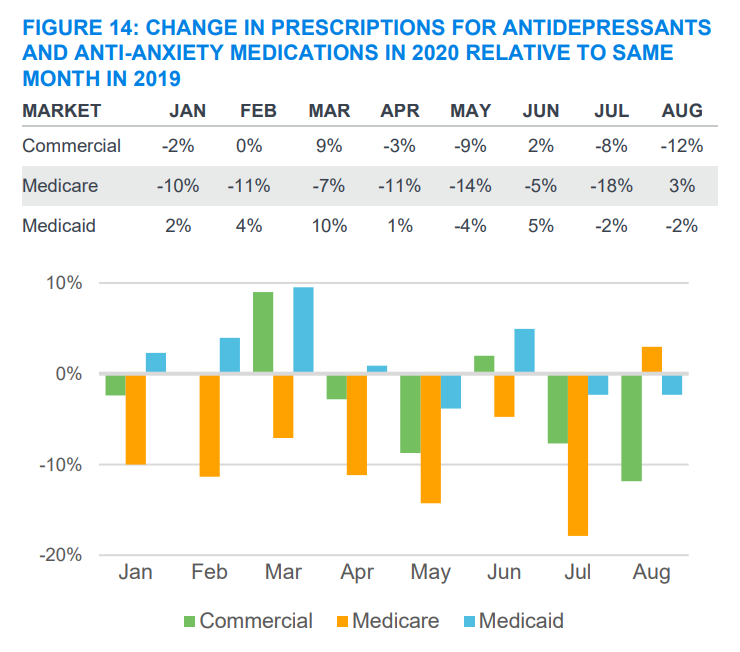

Like utilization for non-Covid-related physical health care, utilization of mental health services dropped significantly when COVID-19 took hold in the United States in early 2020. However, in evaluating those dips, the use of care involving mental health conditions fell less than other kinds of care.

People with a mental health diagnosis were less willing to forego care during COVID-19’s peak. When restrictions began to be lifted in June 2020, visits to primary care offices by those with a mental health diagnosis actually rose above 2019 levels.

With the exception of Medicare beneficiaries, when remote health care utilization was factored into individuals’ overall behavioral health care utilization numbers, there were primarily year-over-year increases across all insured populations. Mental health care utilization increased among the Medicaid population between 2019 and 2020, and only decreased by 1% in March and May among the commercially insured population.

Publication Date: 16 March 2021

Publication Site: Well Being Trust

Link: https://www.soa.org/resources/experience-studies/2021/covid-impact-ltc-2020-survey/

Graphic:

Excerpt:

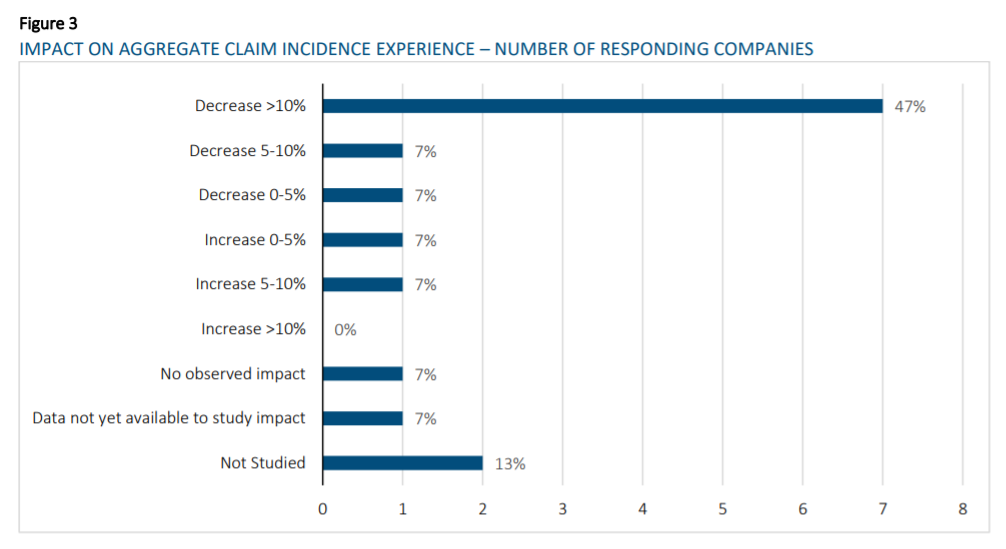

Overall, the survey results show that COVID-19 has had an impact on emerging LTC insurance experience through

higher mortality (for both active and disabled lives) and lower claim incidence. Results on voluntary lapse rates were

mixed; however, premium grace period extensions due to COVID-19 may have contributed to differences in

reporting. The survey results also indicated that, in many cases, the impact of COVID-19 has not yet been studied or

there is not yet data available. This was especially true in relation to studying COVID-19’s impact across various

characteristics (gender, attained age, marital status, situs).

For questions studying the impact of COVID-19 on specific assumptions, the effect was measured on a multiplicative

basis compared to the expectation without COVID-19, except for voluntary lapse, which was measured on an

additive basis. See examples in the full survey questions in Appendix A for additional detail.

Authors: Mike Bergerson, FSA, MAAA, Principal and Consulting Actuary

Andrew Dalton, FSA, MAAA, Principal and Consulting Actuary

Robert Eaton, FSA, MAAA, Principal and Consulting Actuary

James Stoltzfus, FSA, MAAA, Principal and Consulting Actuary

Milliman

Publication Date: March 2021

Publication Site: Society of Actuaries