Link: https://www.city-journal.org/multimedia/can-states-and-cities-dig-themselves-out

Excerpt:

David Schleicher: Yeah, absolutely. There’s an old joke that says, “The federal government is an insurance company with an army.” But anything you actually touch, can physically touch, any infrastructure of any sort, or services you consume and need to care about in one way or another are almost all directly provided by the state and local governments. They’re often funded sometimes with money from the federal government, but they are directly private and partially funded by state and local governments. The fiscal health of state and local governments is extremely important to, say, the question of state capacity in America.

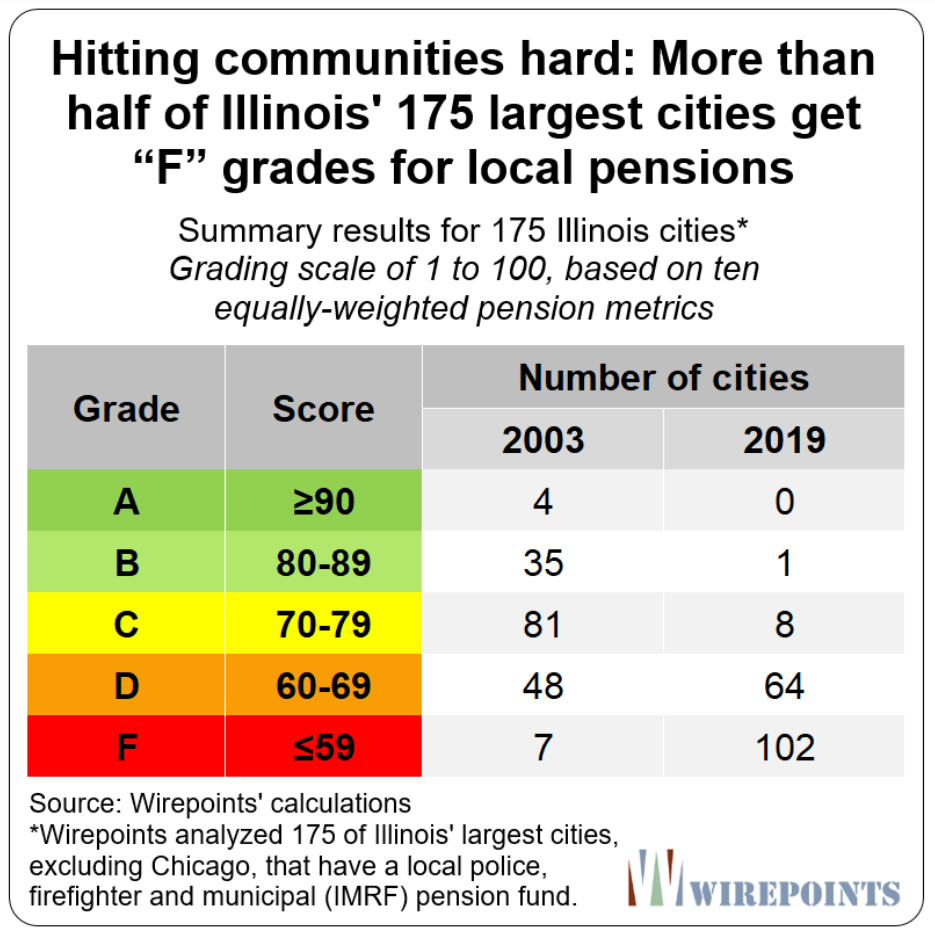

Allison Schrager: It seems like we don’t talk about it until you’re Illinois or if you’re a municipality, Detroit, but it seems like we’ve been talking about this big shoe to drop on state municipal bankruptcies for a while and it doesn’t come, but that doesn’t mean we should be complacent.

David Schleicher: Yeah, absolutely. Two things. One is that it definitely would’ve come in the last couple of years had the federal government not dropped a ton of money on state and local governments. The pandemic created huge fiscal problems for a number of jurisdictions. The federal government responded by providing a huge amount of aid. The effect of that is that has had benefits and costs, which I’m sure we’ll talk about, but you can’t just look through the defaults or absence of defaults, to ask the question of “Are states and cities in fiscal trouble?” State and fiscal budgets are very procyclical. We end up cutting really important things during recessions and spending too much during non-recessions. Then we have the question of federal bailouts.

Allison Schrager: Yeah, it’s a very complicated issue, so what to do about this. But you have a very sort of organized, clean way to think about it. You describe it as this trilemma.

David Schleicher: Yeah. When a state or city faces a fiscal problem, fiscal crisis, take New York City in the 1970s or Detroit, or Puerto Rico or whatever it is. We’ve had, over the course of American history from Hamilton’s assumption of state debts, we’ve had a series of state and local fiscal crises. We have a lot of governments and some of them are going to have crises. The question is, what should the federal government do? Well, the federal government has three things it would like to achieve, which are, it doesn’t want to have too severe cuts during recessions, because that creates even bigger recessions. It doesn’t want to encourage state and local governments to think that the federal government will always stand behind them, a problem we call moral hazard. It wants federal state and local governments to be able to continue to borrow because state and local governments need to borrow to build infrastructure.

Author(s): David N. Schleicher, Allison Schrager

Publication Date: 2 Jun 2023

Publication Site: City Journal