Link: https://content.naic.org/research_moody.htm

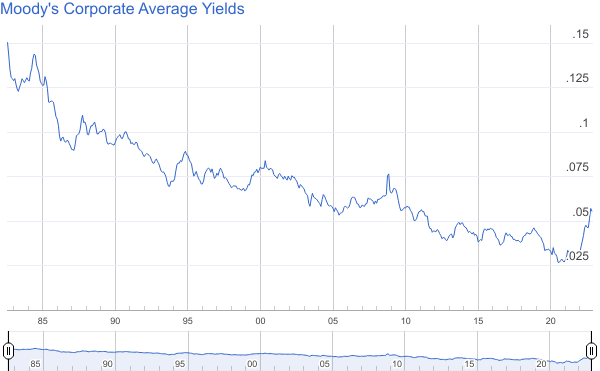

Excerpt: September 2023: 5.72%

Graphic:

Publication Date: accessed 11 Oct 2023

Publication Site: NAIC

All about risk

Link: https://content.naic.org/research_moody.htm

Excerpt: September 2023: 5.72%

Graphic:

Publication Date: accessed 11 Oct 2023

Publication Site: NAIC

Link: https://content.naic.org/sites/default/files/capital-markets-special-reports-bankloans-ye2022.pdf

Graphic:

Executive Summary:

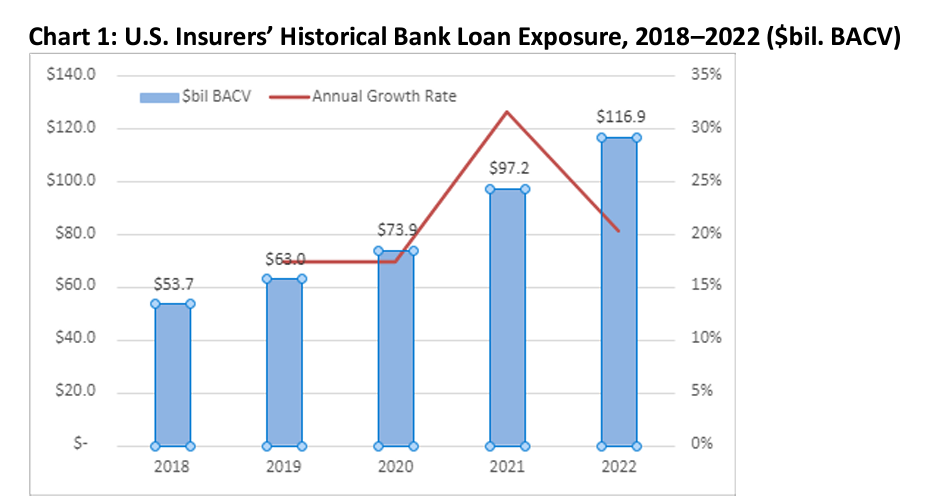

Bank loans were one of the fastest-growing asset types in 2022 for U.S. insurers, increasing by 21% to $117 billion in book/adjusted carrying value (BACV) from $97.2 billion in 2021.

Despite the double-digit growth, bank loans were under 2% of U.S. insurers’ total cash and invested assets at year-end 2022, and about 75% were acquired in market transactions; the remaining 25% were issued by the reporting entities.

Large life companies, or those with more than $10 billion in assets under management, accounted for almost 80% of U.S. insurers’ bank loan exposure, up from 74% in 2021; the top 10 insurance companies accounted for 60% of U.S. insurers’ total bank loan exposure at year-end 2022, up from 54% in 2021.

There was continued improvement in credit quality for U.S. insurer bank loans, evidenced in part by a decrease in those carrying NAIC 4 Designations—i.e., implying a B credit rating—to 26% of total bank loans in 2022 from 33% in 2021, and countered by an increase in bank loans carrying NAIC 1 Designations to 24% in 2022 from 18% in 2021.

Total U.S. leveraged bank loan volume was about $1.7 trillion in 2022, representing a 2% increase from 2021.

Author(s): Jennifer Johnson

Publication Date: 11 July 2023

Publication Site: NAIC Capital Markets Bureau

Graphic:

Excerpt:

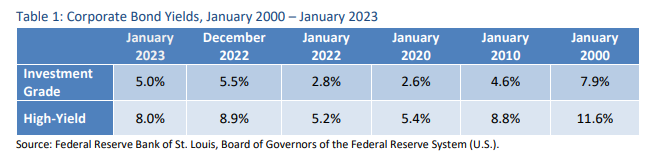

As corporate bonds are mainly fixed rate, their relative value will decrease as floating rate investments

become more attractive with higher benchmark rates. That is, bond prices will fall as yields rise to make

them more attractive, given that their fixed-rate coupons will be lower. About half of insurer bond

investments are corporate bonds, and the vast majority of U.S. insurer corporate bond investments are

investment grade credit quality. From January 2022 to January 2023, the ICE Bank of America (BofA)

Investment Grade Corporate Bond Index, which measures the performance of investment grade

corporate debt, was down by about 14%.

Corporate bond yields have increased significantly since the beginning of 2022 with rising interest rates

and widening credit spreads. As of year-end 2022, investment grade and high-yield corporate bond

yields averaged 5.5% and 8.9%, respectively (refer to Table 1). Investment grade yields increased by

approximately 270 bps during 2022, while speculative-grade yields increased by about 370 bps.

Author(s): Jennifer Johnson and Michele Wong

Publication Date: 23 Feb 2023

Publication Site: NAIC Capital Markets Special Report

Link: https://www.thinkadvisor.com/2022/12/16/insurtech-regs-dark-pattern-spottting-on-naics-to-do-list/

Excerpt:

In August [2022], Birny Birnbaum, the executive director of the Center for Economic Justice, asked the [NAIC] Market Regulation committee to train analysts to detect “dark patterns” and to define dark patterns as an unfair and deceptive trade practice.

The term “dark patterns” refers to techniques an online service can use to get consumers to do things they would otherwise not do, according to draft August meeting notes included in the committee’s fall national meeting packet.

Dark pattern techniques include nagging; efforts to keep users from understanding and comparing prices; obscuring important information; and the “roach motel” strategy, which makes signing up for an online service much easier than canceling it.

Author(s): Allison Bell

Publication Date: 16 Dec 2022

Publication Site: Think Advisor

Link: https://www.rstreet.org/2022/12/12/2022-insurance-regulation-report-card/

PDF link of report: https://www.rstreet.org/wp-content/uploads/2022/12/r-street-policy-study-no-272.pdf

Graphic:

Excerpt:

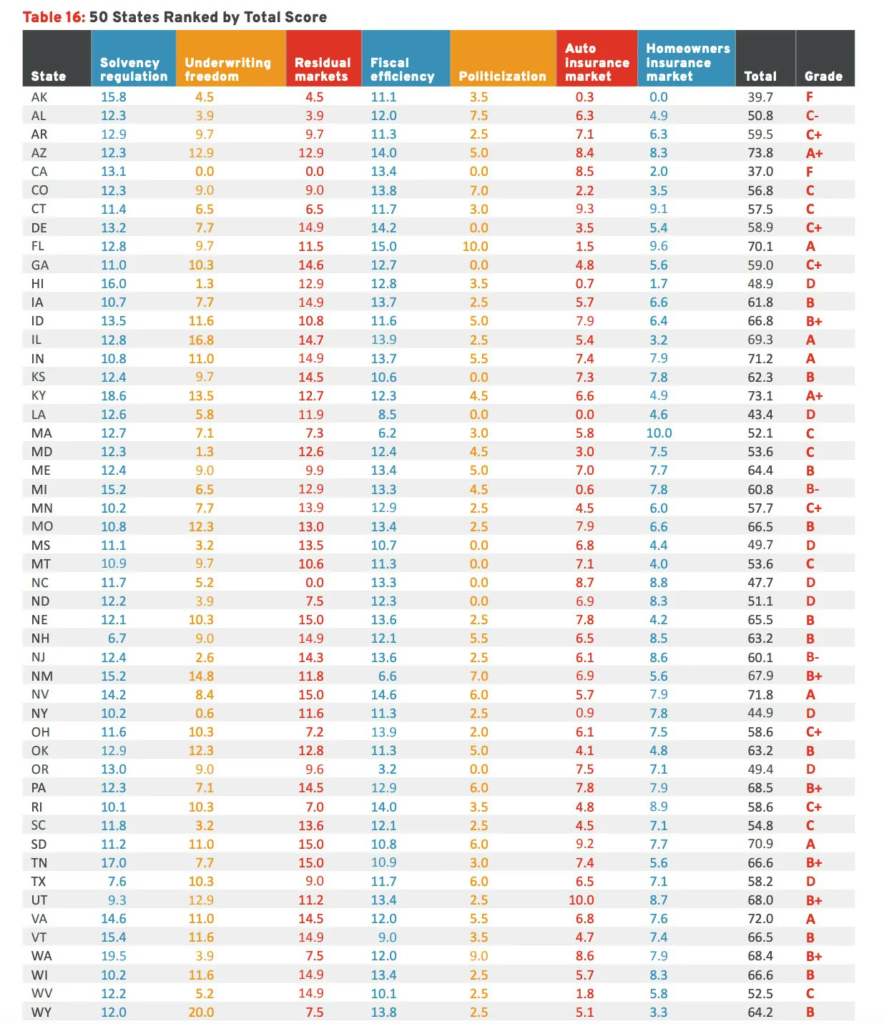

Executive Summary

We are pleased to present the 10th edition of R Street’s Insurance Regulation Report Card, which analyzes and evaluates the effectiveness of U.S. insurance regulation of property and casualty insurance. The first iteration of this report was published in June 2012, and this 2022 edition largely follows the format of prior reports. It begins with a brief introduction on the current landscape of U.S. insurance regulation; reviews recent, relevant federal and state-based regulatory changes; presents a detailed evaluation of the effectiveness of each state’s regulation of insurance in seven key categories; and synthesizes those category evaluations by offering a “report card” grade for each state for analysis and comparison purposes.This report draws on 2021 year-end statutory insurance financial statistics and the most recent datasets available for non-financial information. Sources include data and reports from the National Association of Insurance Commissioners (NAIC), S&P Global Market Intelligence, National Conference of State Legislatures, R Street analyses and others, all of which were accessed through Sept. 30, 2022.

In this report, we seek to shed light on the same three foundational issues we have focused on in past iterations of this report card:

• How free are consumers to choose the insurance products they want?

• How free are insurers to provide the insurance products consumers want?

• How effectively are states discharging their duties to monitor insurer solvency and foster competitive, private insurance markets?

Author(s): Jerry Theodorou

Publication Date: 12 Dec 2022

Publication Site: R Street

Link: https://content.naic.org/research_moody.htm

Historical record: https://docs.google.com/spreadsheets/d/1Sgi6XVzK0_sCtAWuCnUD02eObOTC3S4xlQgMep32OeU/edit?usp=sharing

Graphic:

Publication Date: accessed 9 Dec 2022

Publication Site: NAIC

Link: https://content.naic.org/sites/default/files/capital-markets-special-reports-hy-ye2021_0.pdf

Graphic:

Excerpt:

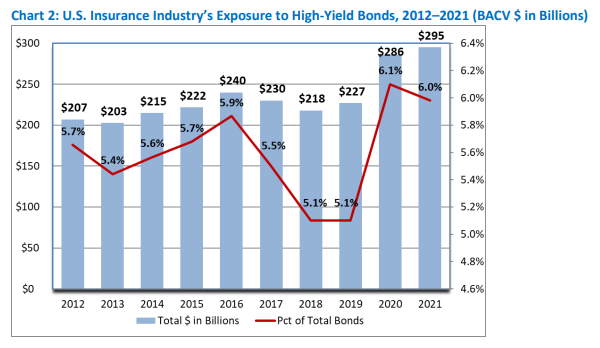

The U.S. insurance industry’s high-yield bond exposure of almost $300 billion at year-end 2021 is the

highest BACV reported over the last decade. (See Chart 2.) From 2012 to 2021 , high-yield bond

exposure increased approximately 42% while total bond exposure grew approximately 34% as insurance

companies sought higher relative yields offered by high-yield bonds, among other asset classes, amid

the low interest rate environment of the past decade. In addition, most recently, credit quality

deterioration from the impact of the COVID-19 pandemic resulted in some migration of the industry’s

investment grade bond exposure into high-yield territory, particularly in 2020.

On a percentage basis, high-yield exposure accounted for 6% of total bonds at year-end 2021, the

second highest point over the 10 years ending 2021. While exposure declined modestly from 6.1% at

year-end 2020, as a percentage of total bonds, it remains elevated relative to the last 10 years. The most

recent period when U.S. insurers’ high-yield-bond exposure exceeded 6% of total bonds was in 2009

during the financial crisis when it reached 6.3%

Author(s): Michele Wong

Publication Date: 13 Oct 2022

Publication Site: NAIC Capital Markets Special Report

Link: https://content.naic.org/sites/default/files/publication-fah-zu-financial-analysis-handbook.pdf

Graphic:

Excerpt:

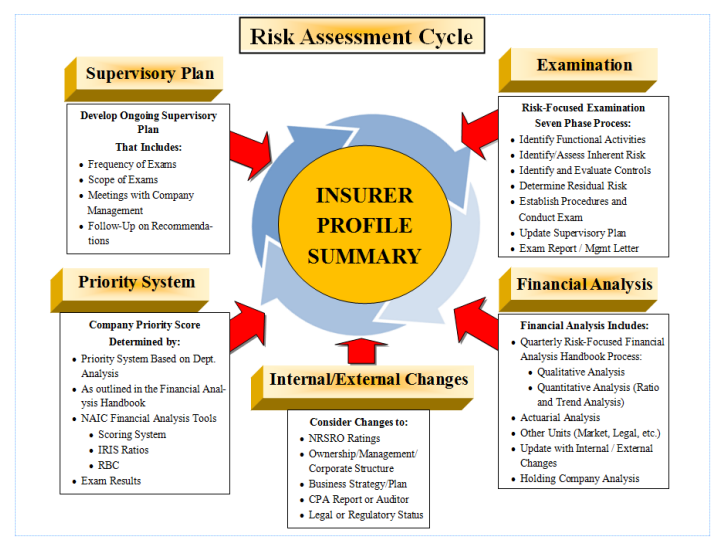

The risk-focused surveillance framework is designed to provide continuous regulatory oversight. The risk-focused approach requires fully coordinated efforts between the financial examination function and the financial analysis function. There should be a continuous exchange of information between the field examination function and the financial analysis function to ensure that all members of the state insurance department are properly informed of solvency issues related to the state’s domestic insurers.

The regulatory Risk-Focused Surveillance Cycle involves five functions, most of which are performed under the current financial solvency oversight role. The enhancements coordinate all of these functions in a more integrated manner that should be consistently applied by state insurance regulators. The five functions of the risk assessment process are illustrated within the Risk-Focused Surveillance Cycle.

As illustrated in the Risk-Focused Surveillance Cycle diagram, elements from the five identified functions

contribute to the development of an IPS. Each state will maintain an IPS for its domestic companies. State

insurance regulators that wish to review an IPS for a non-domestic company will be able to request the IPS from the domestic or lead state. The documentation contained in the IPS is considered proprietary, confidential information that is not intended to be distributed to individuals other than state insurance regulators.Please note that once the Risk-Focused Surveillance Cycle has begun, any of the inputs to the IPS can be changed at any time to reflect the changing environment of an insurer’s operation and financial condition.

Author(s): NAIC staff

Publication Date: 1 Jan 2022

Publication Site: NAIC

Excerpt:

On September 8, 2022, the U.S. Senate Committee on Banking, Housing and Urban Affairs (“Senate Banking Committee”) held a hearing to consider “Current Issues in Insurance.” One of the items discussed at the hearing was Senator Sherrod Brown’s (D-OH) March 2022 letter to the National Association of Insurance Commissioners (the “NAIC”) and U.S. Department of the Treasury’s Federal Insurance Office (“FIO”) regarding private equity-controlled insurers.1

In his letter, Senator Brown requested that FIO, in consultation with the NAIC, prepare a report for Congress that evaluates the investment strategies pursued by private equity-controlled insurers, the impact on protections for pension plan beneficiaries following pension risk transfer arrangements, and whether state regulatory regimes are capable of assessing and managing risks related to private equity-controlled insurers. In the early summer, the NAIC and the U.S. Department of the Treasury (on behalf of FIO) each provided substantive responses to Senator Brown.2

Author(s): Kara Baysinger | Leah Campbell | Jane Callanan | Matthew J. Gaul

Donald B. Henderson, Jr. | David G. Nadig | Allison J. Tam

Publication Date: 27 Sept 2022

Publication Site: Willkie Farr & Gallagher

Link: https://content.naic.org/sites/default/files/capital-markets-special-reports-CLO-YE%202021.pdf

Graphic:

Excerpt:

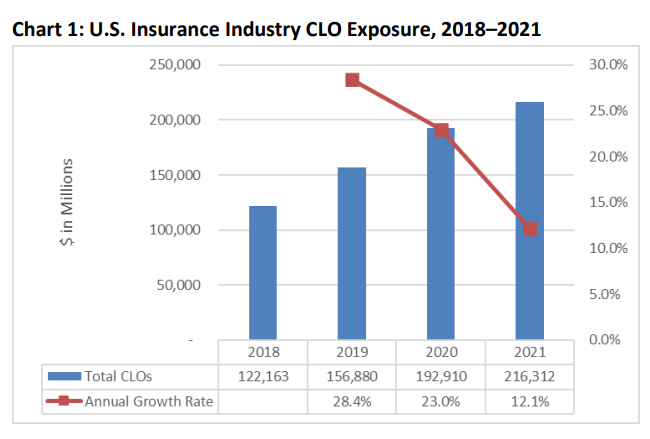

U.S. insurers’ exposure to CLOs increased significantly over the last few years, as they have represented

an attractive alternative investment with higher yields than traditional investments. As of year-end

2021, U.S. insurers’ exposure to CLOs collateralized predominantly by leveraged bank loans and middle

market loans increased by 12% to $216.3 billion in BACV from $192.9 billion at year-end 2020 and $156.9 billion at year-end 2019 (see Chart 1). However, the pace of growth has slowed from 23% and

28% at year-end 2020 and year-end 2019, respectively.

Author(s): Jennifer Johnson, Michele Wong, Jean-Baptiste Carelus

Publication Date: 15 Sept 2022

Publication Site: NAIC Capital Markets Bureau

Link: https://www.banking.senate.gov/imo/media/doc/brown_letter_on_insurance_031622.pdf

Excerpt:

Author(s): Sen. Sherrod Brown

Publication Date: 16 March 2022

Publication Site: U.S. Senate Banking Committee

Link: https://news.ambest.com/articlecontent.aspx?AltSrc=104&RefNum=317587

Excerpt:

A new set of revisions to the National Association of Insurance Commissioners requirements that govern real estate investments on the part of life insurers could be teeing up the asset class for growth in the future, as barriers to entry are lowered.

Late last year, the NAIC released a set of changes to its risk-based capital requirements that, for life insurers, lowered the factor for life and health companies. For so-called Schedule A investments—properties owned outright by carriers—the required set-aside was lowered to 11% from 15%. In the case of Schedule BA investments, such as partnerships and funds where the carrier isn’t the sole owner, that figure went down to 13% from 23%.

….

As of 2020, life and annuity insurers had $8.15 trillion in invested assets, with an overall net return on that sum of 4.1%, according to Best’s Rankings US Life/Health—2020 Asset Distribution. Meanwhile, Best’s Rankings US Life/Health—Industry 2020 Investment Returns—2021 Edition reports mortgages had a return of 4.42% compared to 4.22% for bonds.

George Hansen, senior industry research analyst, AM Best, said life insurers traditionally have only placed about 6% of their portfolios in Schedule BA real estate products and less than 1% in Schedule A real estate investments. Whether there’s any increase and by how much will likely be tied to which segments of the industry carriers are in, but Hansen said he doesn’t expect a huge increase.

Author(s): Terence Dopp

Publication Date: March 2022

Publication Site: Best’s Review