Graphic:

Excerpt:

The recent op-ed in Crain’s New York Business by former City Comptrollers Jay Goldin and Elizabeth Holtzman (“Affordable housing initiative worked in the past and can work again today”) recalled a city pension fund program, initiated in 1983, that was specifically designed to finance the renovation of deteriorated rental apartment buildings in lower income neighborhoods. Supported by New York State mortgage insurance, the pension investments financed the restoration of a wide range of apartment buildings and worked uniquely well for small buildings with owners of limited resources. Two percent of the pension funds’ assets were committed for long-term, fixed-rate mortgages, with an interest rate priced at the market, with a two-year rate lock while the capital improvements were made.

Recognizing that these buildings would need some public subsidy—and that many owners lacked the experience to deal with complex government processing—a system evolved whereby these investments were coupled with streamlined city subsidy programs. The program’s goal: to restore a building’s physical and economic health while keeping its apartments affordable.

The pension funds filled a critical gap as most conventional long-term lenders viewed this market as too complicated and too unprofitable. For many years after its inception, the Community Preservation Corporation was the primary user of the program, using its “one-stop-shop” to originate construction loans for predominantly small properties. Upon construction completion, the long-term mortgage was provided by the pension funds. Over time, other banks were approved to originate loans for the funds, with their focus mainly on financing the renovation of larger buildings.

….

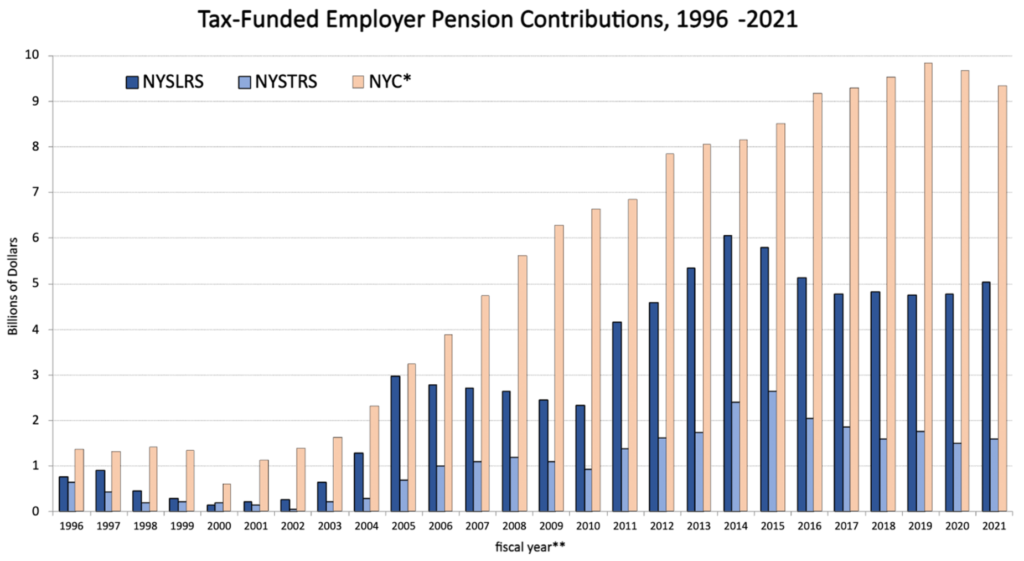

Fourth, the pension funds should recommit to investing up to 2 percent of their assets (now $5 billion) for long-term financing at a market rate, insured by the State Mortgage Insurance Fund. In the long history of the program, the funds have experienced no losses, the state insurance fund covering the few losses that had occurred.

Efficient implementation can minimize the use of public funds and provide a large pool of fixed-rate, long-term financing for these properties. Doing so is within the purview of the city’s comptroller and the pension fund trustees.

Author(s):Michael D. Lappin

Publication Date: 8 Feb 2022

Publication Site: City Limits