Link: https://www.oecd.org/daf/fin/private-pensions/launch-publication-mortality-provision-retirement.htm

Graphic:

Video:

Excerpt:

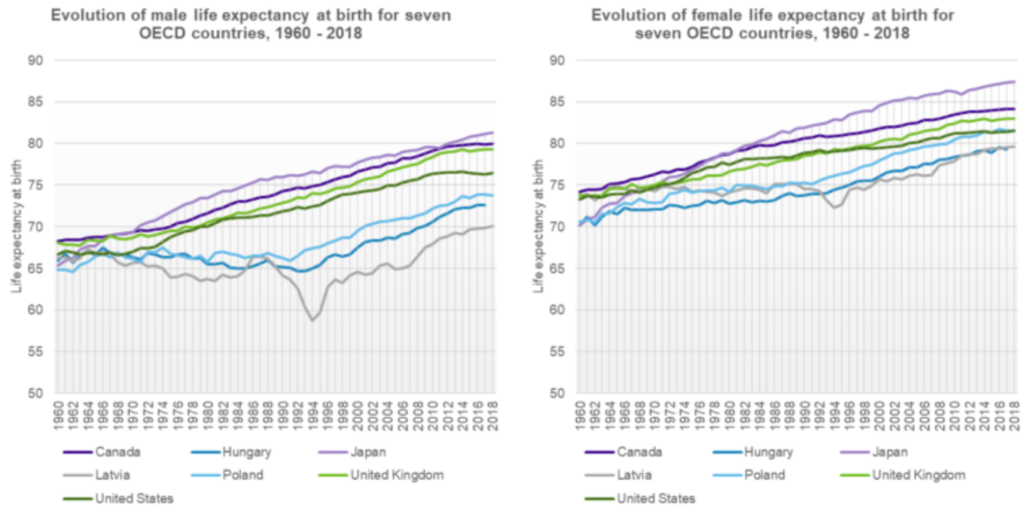

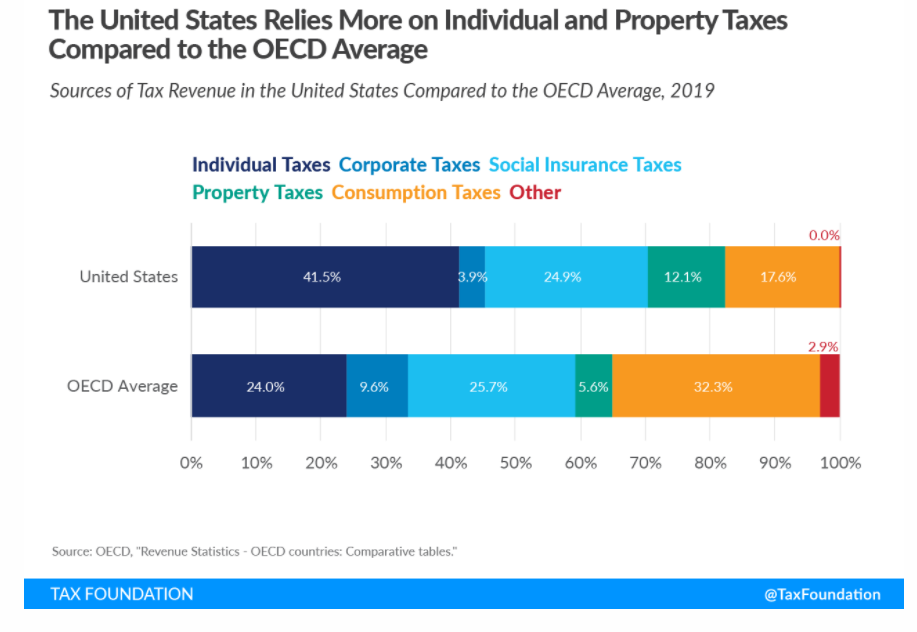

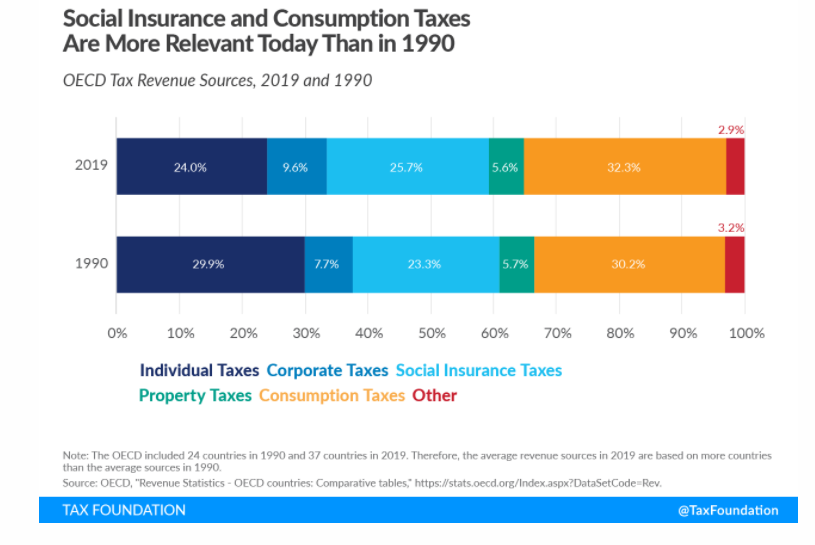

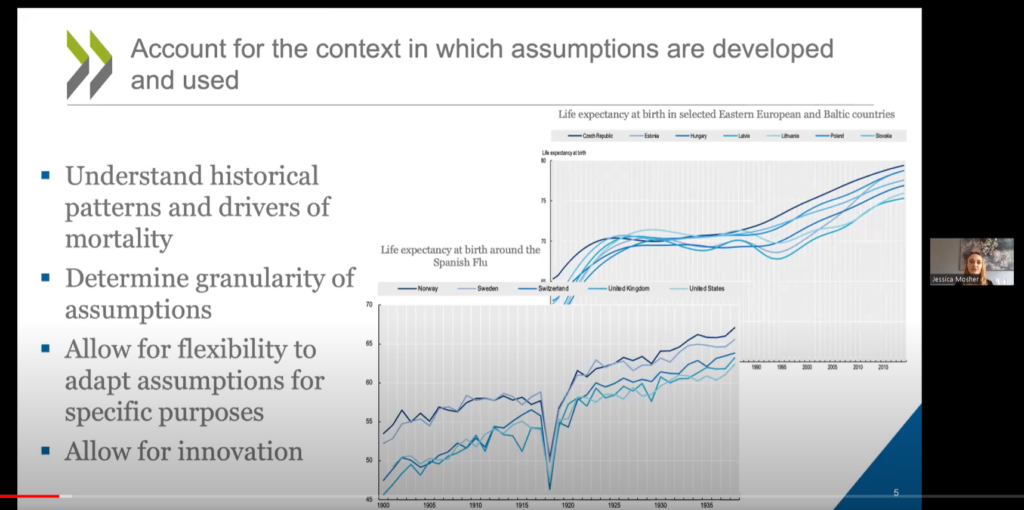

The report analyses the development of mortality assumptions to build mortality tables to better protect retirement income provision. It first provides an international overview of longevity trends and drivers over the last several decades, including the impact of the COVID-19 pandemic. It then explores considerations and traditional approaches for developing mortality tables, and details the standard mortality tables developed across OECD member countries. It concludes with guidelines to assist regulators and supervisors in assessing whether the mortality assumptions and tables used in the context of retirement income provision are appropriate.

The OECD will provide an overview of the publication, followed by a roundtable discussion with government and industry stakeholders. Topics discussed will include:

- Recent mortality trends and drivers

- How mortality trends/drivers can inform future expectations, and how to account for that in modelling

- The challenge of accounting for COVID in setting mortality assumptions

- Trade-offs for different modelling approaches

- The usefulness of the guidelines included in the report in practice

- How to better communicate around mortality assumptions to non-experts

Publication Date: 2 Feb 2023

Publication Site: OECD