Link: https://oig.hhs.gov/oei/reports/OEI-02-20-00490.pdf

Graphic:

Excerpt:

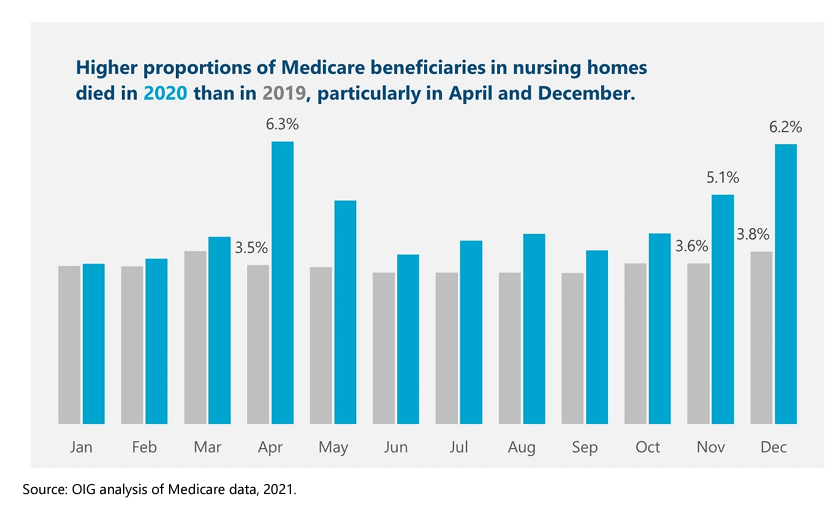

The overall mortality rate in nursing homes rose 32 percent in 2020. The pandemic had far-reaching implications for all nursing home beneficiaries, beyond those who had or likely had COVID-19. Among all Medicare beneficiaries in nursing homes, 22.5 percent died in 2020, which is an increase of one-third from 2019 when 17.0 percent of Medicare beneficiaries in nursing homes died. This 32-percent increase amounts to 169,291 more deaths in 2020 than if the mortality rate had remained the same as in 2019. Each month of 2020 had a higher mortality rate than the corresponding month a year earlier.

Almost 1,000 more beneficiaries died per day in April 2020 than in the previous year. In April 2020 alone, a total of 81,484 Medicare beneficiaries in nursing homes died. This is almost 30,000 more deaths—an average of about 1,000 per day—compared to the previous year. This increase in number occurred even though the nursing home population was smaller in April 2020. Overall, Medicare beneficiaries in nursing homes were almost twice as likely to die in April 2020 than in April 2019. In April 2020, 6.3 percent of all Medicare beneficiaries in nursing homes died, whereas 3.5 percent died in April 2019.

The mortality rates also rose at the end of 2020. In November, 5.1 percent of all Medicare beneficiaries in nursing homes died, and in December that increased to 6.2 percent. Again, these rates are markedly higher than the previous year. In November 2019, 3.6 percent of all Medicare beneficiaries in nursing homes died, and, in December 2019, 3.8 percent did.

Author(s): Jenell Clarke-Whyte and team

Publication Date: June 2021

Publication Site: Office of Inspector General, HHS