Graphic:

Excerpt:

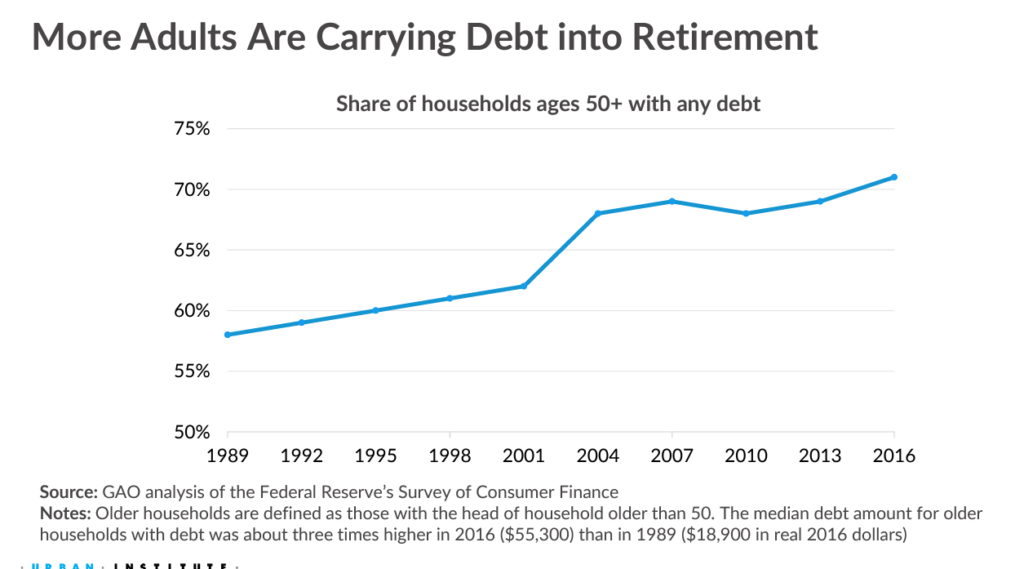

One factor undermining older Americans’ ability to prepare financially for retirement is the debt burden they carry. Increasingly, adults are carrying debt into retirement, according to Mingli Zhong, research associate, and Jennifer Andre, data scientist at the Urban Institute.

Their presentation on “Racial Differences in Debt Delinquencies and Implications for Retirement Preparedness” tracked some 4.8 million adults age 50+ who had credit bureau records. They found that the median debt amount for older households with debt was about three times higher in 2016 ($55,300) than in 1989 ($18,900 in real 2016 dollars).

The authors also reported racial disparities in debt levels. Compared to an older adult in a majority-white community, a typical older adult in a community of color is more likely to have any type of delinquent debt, carry a higher balance of total delinquent debt, and have a higher balance of medical debt in collections. The older adult living in a majority-white area has a higher balance of delinquent student loan debt and delinquent credit card debt, they also found.

Author(s): Olivia S. Mitchell, Sylvain Catherine

Publication Date: 6 June 2023

Publication Site: Knowledge at Wharton