Graphic:

Excerpt:

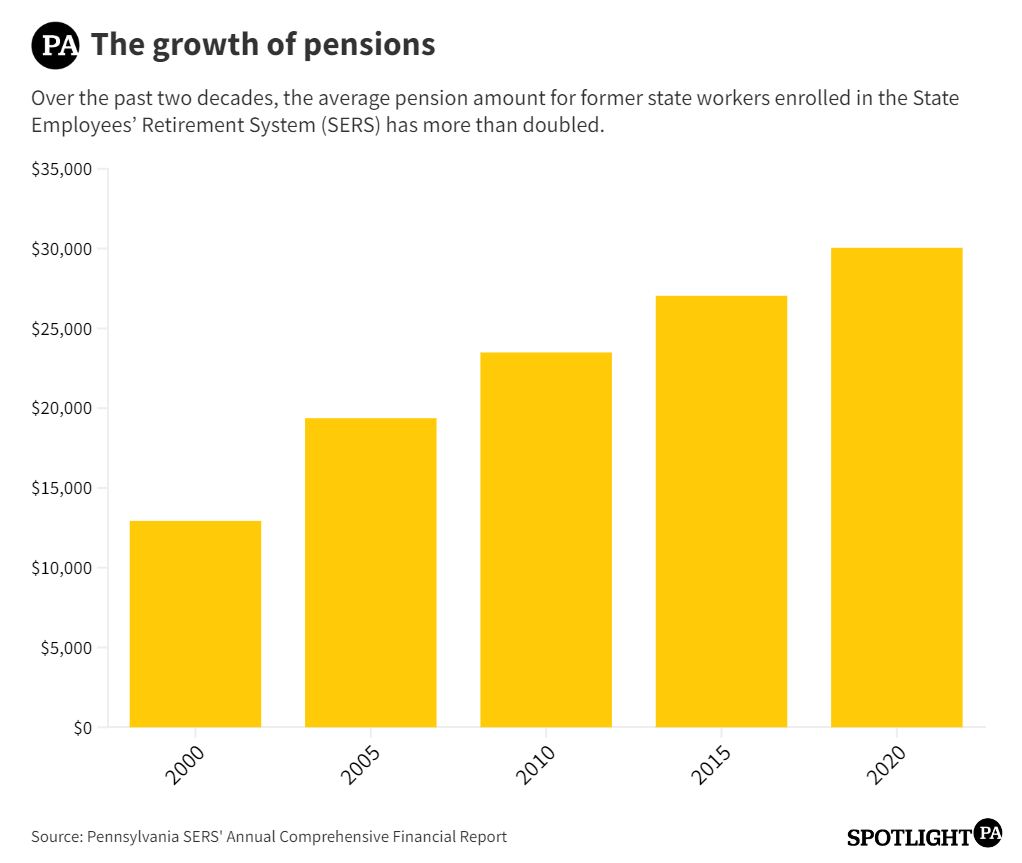

Enrollees in Pennsylvania’s two public sector pension funds — the State Employees’ Retirement System (SERS) and the Public School Employees’ Retirement System (PSERS) — haven’t seen a cost of living adjustment, or COLA, since 2004. Nearly 40 other states grant some sort of COLA to retirees.

Particularly hard hit by this lack of a COLA are the almost 69,000 former public school teachers, state government workers, and other public sector employees who retired before 2001, like McVay. On average, these retirees are in their early 80s.

They retired before the legislature increased pension benefits by 25%. The average pension for a SERS enrollee who retired before 2001 is under $15,000 annually, according to the system. That number for a 2022 retiree is more than $30,000, thanks to the increase as well as a rise in average salaries for workers.

There’s a similar gap for PSERS enrollees. A person who worked for 30 years and ended with a $30,000 salary would have a pension of $18,000 if they retired pre-2001, according to Chris Lilienthal, a spokesperson for the Pennsylvania State Education Association. Under the same circumstances, a person who retired post-2001 would have a pension of $22,500.

Author(s): DaniRae Renno

Publication Date: 27 July 2023

Publication Site: Spotlight PA