Graphic:

Excerpt:

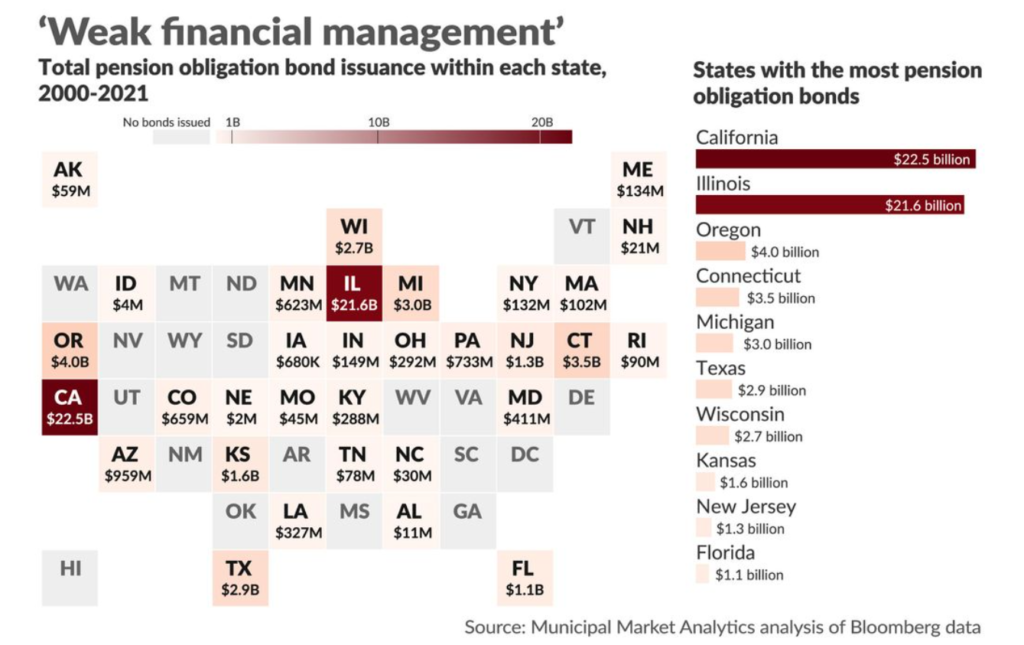

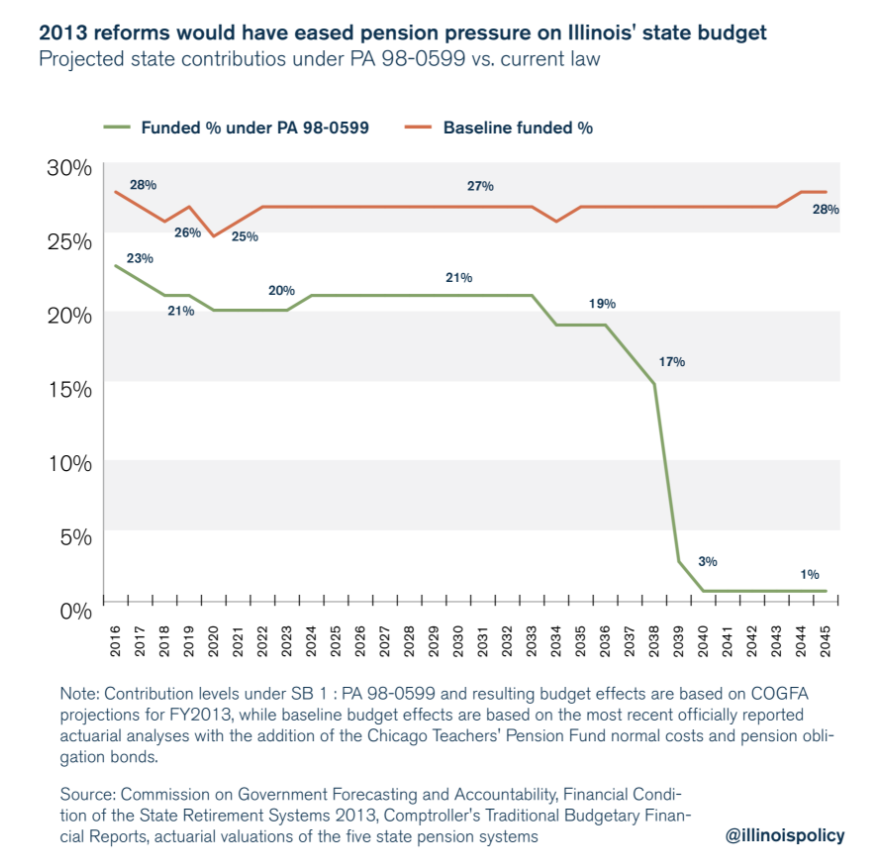

It is bad Illinois has the nation’s worst pension crisis, but state politicians have made it worse by using risky debt to delay the day of reckoning, and done so to the point that Illinois now owes 30% of the nation’s pension obligation bonds.

Pension obligation bonds are a form of debt used by state or local governments to fund their pension deficits. Illinois holds $21.6 billion of the nation’s $72 billion pension obligation bond debt.

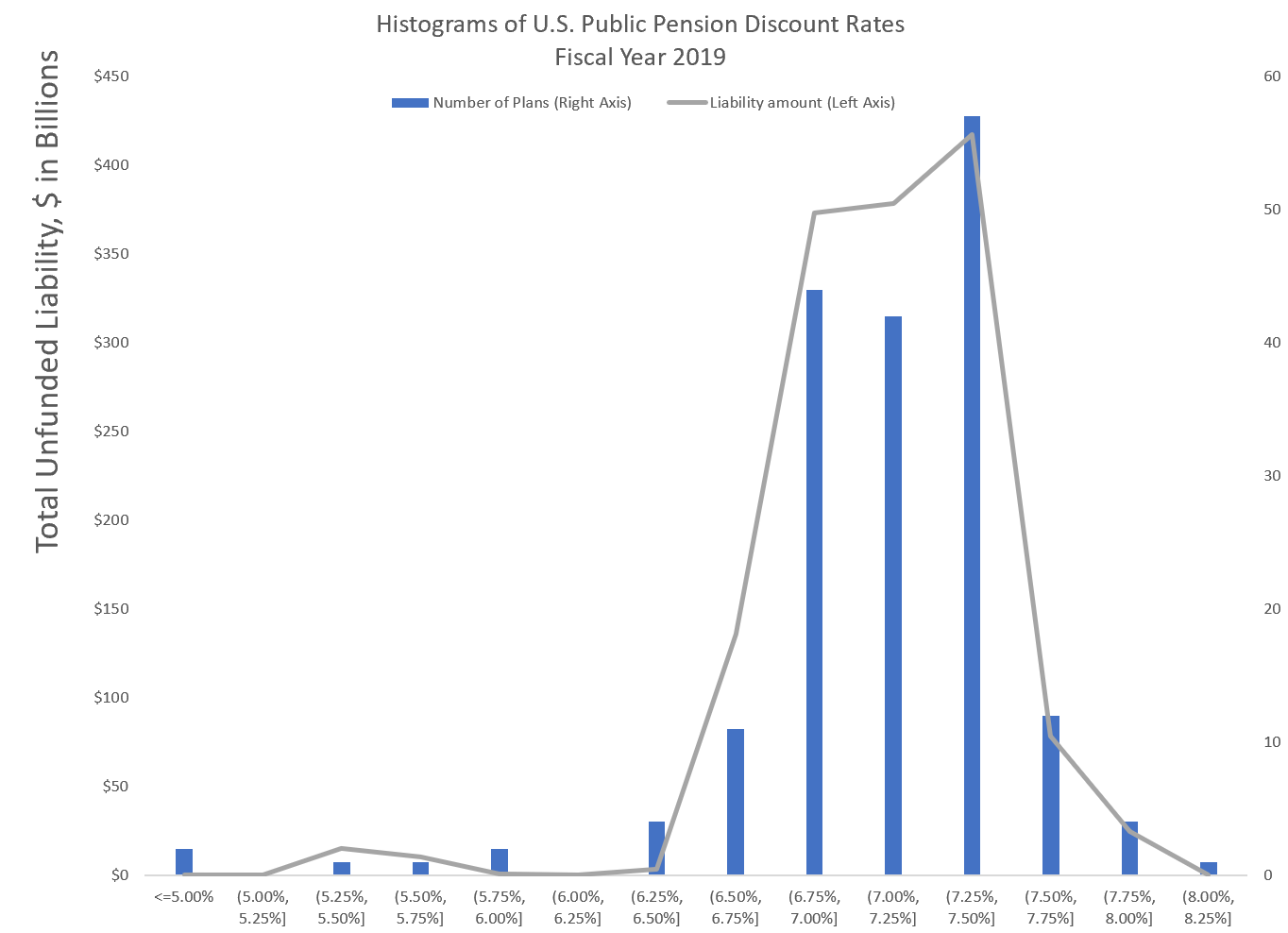

The theory behind the bonds is that if a pension system can borrow money at a lower rate by selling bonds and earn a higher percentage from investing those funds, then it has realized a net gain using them. The issue is the gamble rarely works out that way, as the Government Finance Officers’ Association points out. Pension obligation bonds place taxpayer money at risk and often leave governments saddled with more debt rather than less. They often do not achieve a high enough return to justify their use.

Illinois’ five statewide retirement systems hold $144 billion in debt, according to official state reporting based on optimistic investment estimates. But Moody’s Investors Service says the true debt is $317 billion, which it calculates using more accurate methods common in the private sector.

Author(s): Adam Schuster, Aneesh Bafna

Publication Date: 10 Sept 2021

Publication Site: Illinois Policy Institute