Link: https://arxiv.org/abs/2105.07554

Cite:

arXiv:2105.07554 [econ.GN] |

Graphic:

Abstract:

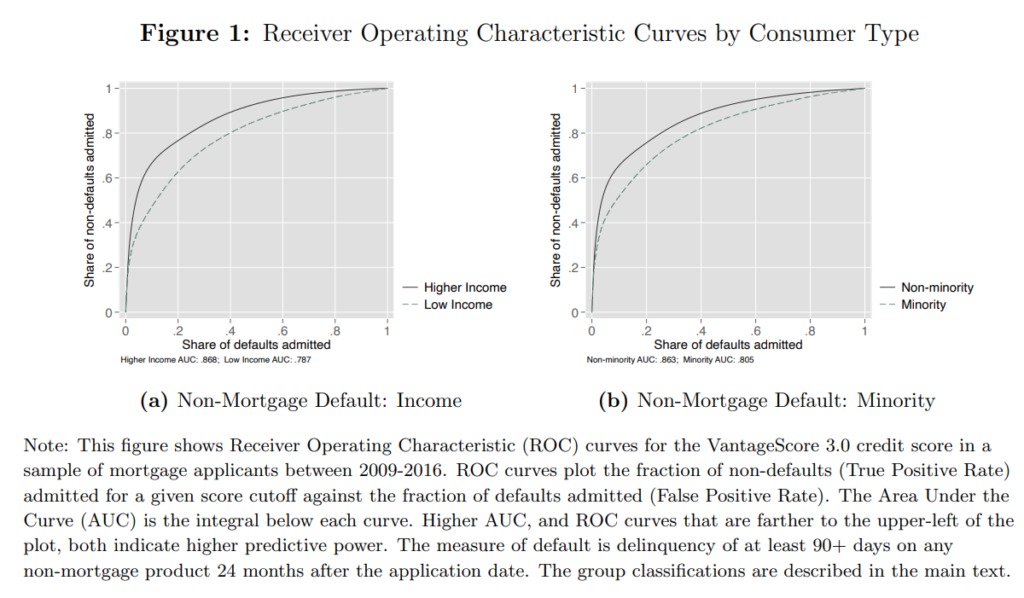

We show that lenders face more uncertainty when assessing default risk of historically under-served groups in US credit markets and that this information disparity is a quantitatively important driver of inefficient and unequal credit market outcomes. We first document that widely used credit scores are statistically noisier indicators of default risk for historically under-served groups. This noise emerges primarily through the explanatory power of the underlying credit report data (e.g., thin credit files), not through issues with model fit (e.g., the inability to include protected class in the scoring model). Estimating a structural model of lending with heterogeneity in information, we quantify the gains from addressing these information disparities for the US mortgage market. We find that equalizing the precision of credit scores can reduce disparities in approval rates and in credit misallocation for disadvantaged groups by approximately half.

Author(s): Laura Blattner, Scott Nelson

Publication Date: 17 May 2021

Publication Site: arXiv