Excerpt:

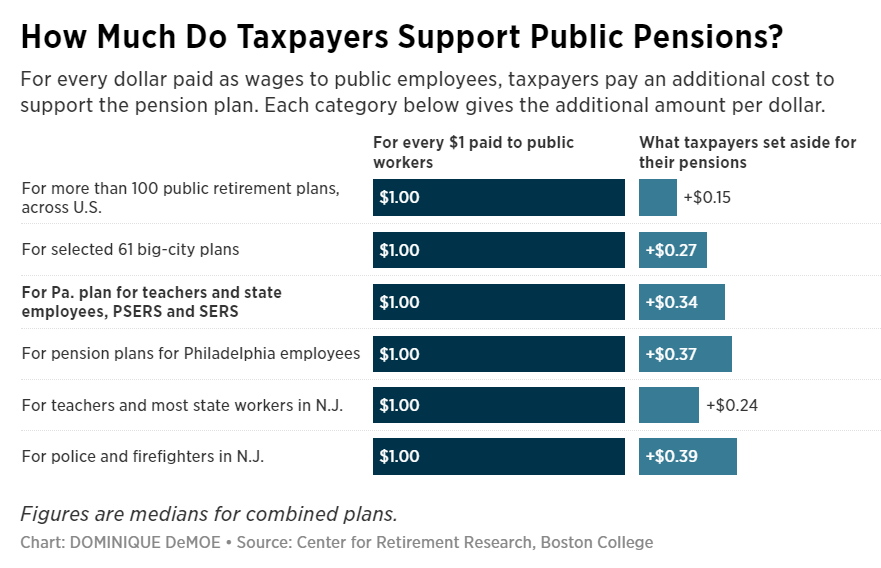

The primary responsibility of the $8.4 billion Philadelphia pension fund is to assure the continuing financial security promised to city workers upon retirement. The welfare of city employees, along with all Philadelphians, depends on the economic and social well-being of the city itself. Therefore, the Philadelphia Public Banking Coalition has proposed that the city pension fund invest $168 million, 2% of its portfolio, in local economically targeted investments to fund projects that benefit Philadelphians.

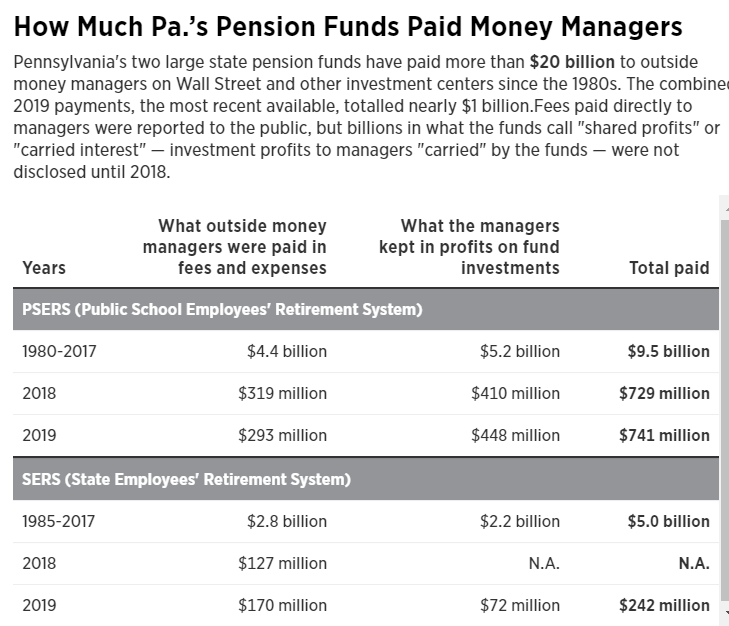

These investments would address policy goals while achieving returns as high or higher than many of the fund’s current asset classes. Currently, the 2023 pension fund investment policy describes risky investments in options, futures, forwards, and swap agreements. And there’s a precedent for public policy considerations, for example, in limitations on investments in Russian companies, private prisons, and arms manufacturers. The current portfolio exhibits a strong real estate focus but without preference for Philadelphia projects.

Below are just a few of the possible opportunities for targeted investments that would strengthen the health of Philadelphia’s economy.

Author(s): Stan Shapiro and Peter Winslow, For The Inquirer

Publication Date: 14 Feb 2024

Publication Site: The Philadelphia Inquirer