Excerpt:

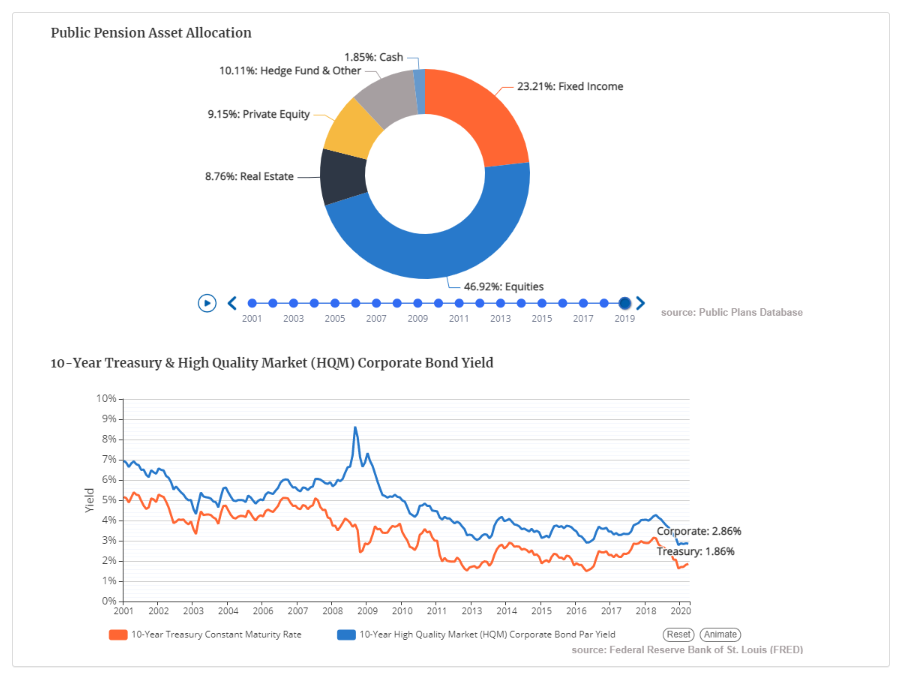

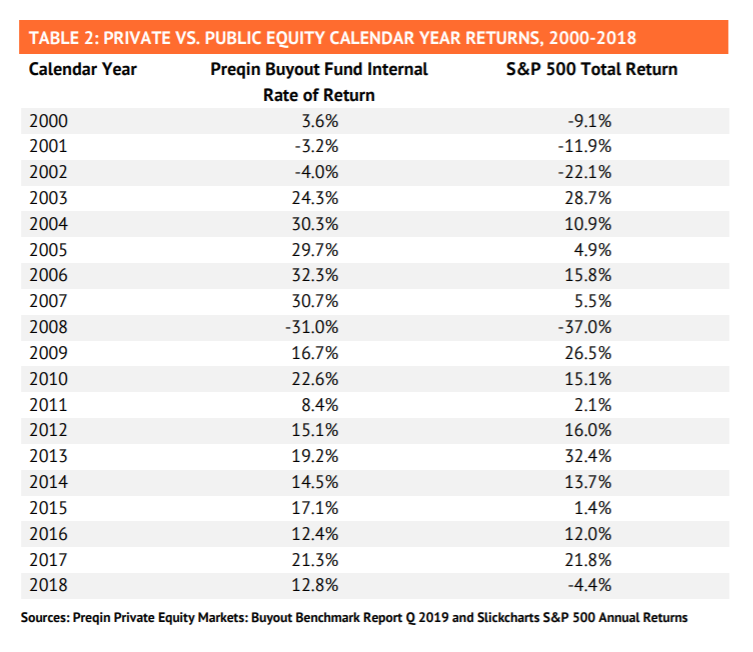

For fiduciaries overseeing other people’s money, private equity’s disparate treatment of investors, abusive industry practices and alarming lack of transparency should be deal-breakers. To the contrary, pensions in recent years have dramatically increased their allocations to private equity funds—either because they don’t understand the dangers lurking in the shadows or simply don’t care as long as above-market returns are promised (which will supposedly reduce severe pension underfunding).

….

Securities and pension regulators have paid little attention to the “side letter” agreements private equity funds enter into with investors granting preferential treatment. It’s no secret that these agreements exist—the practice of entering into them is disclosed in offering memoranda and is openly discussed throughout the industry. As a result of increasing institutional investor domination of private equity, and the regulation applicable to these investors, it is now standard practice in the industry for each investor to demand its own side letter. As a consequence, there has been a proliferation of the number of side letters being negotiated with investors, as well as the kinds of arrangements and provisions included in them.

Author(s): Edward Siedle

Publication Date: 28 February 2021

Publication Site: Forbes