Link: https://taxfoundation.org/property-taxes-by-state-county-2022/

Graphic:

Excerpt:

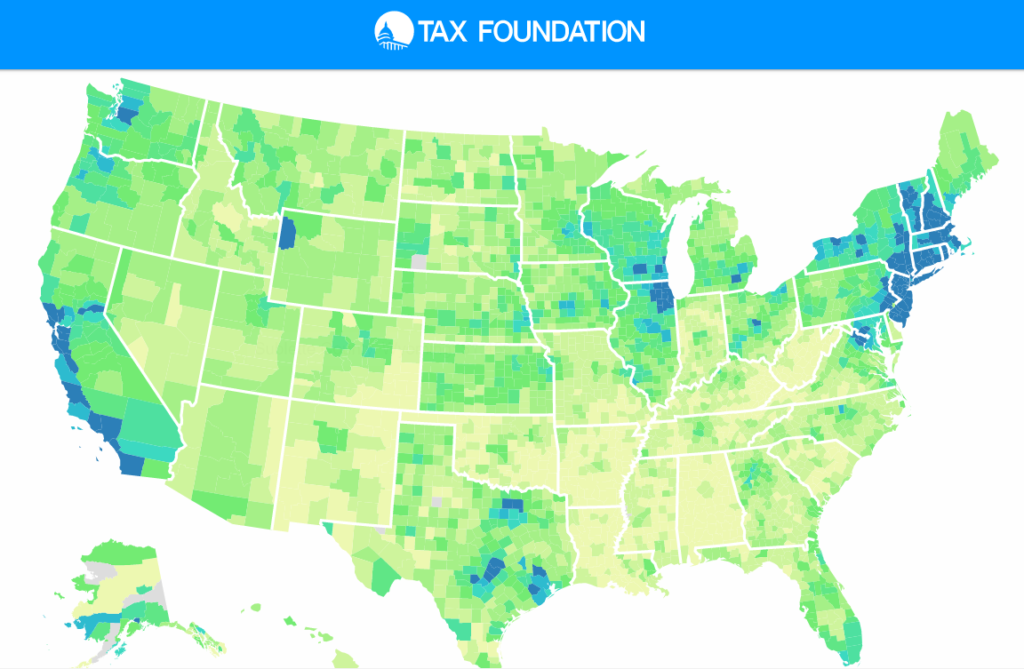

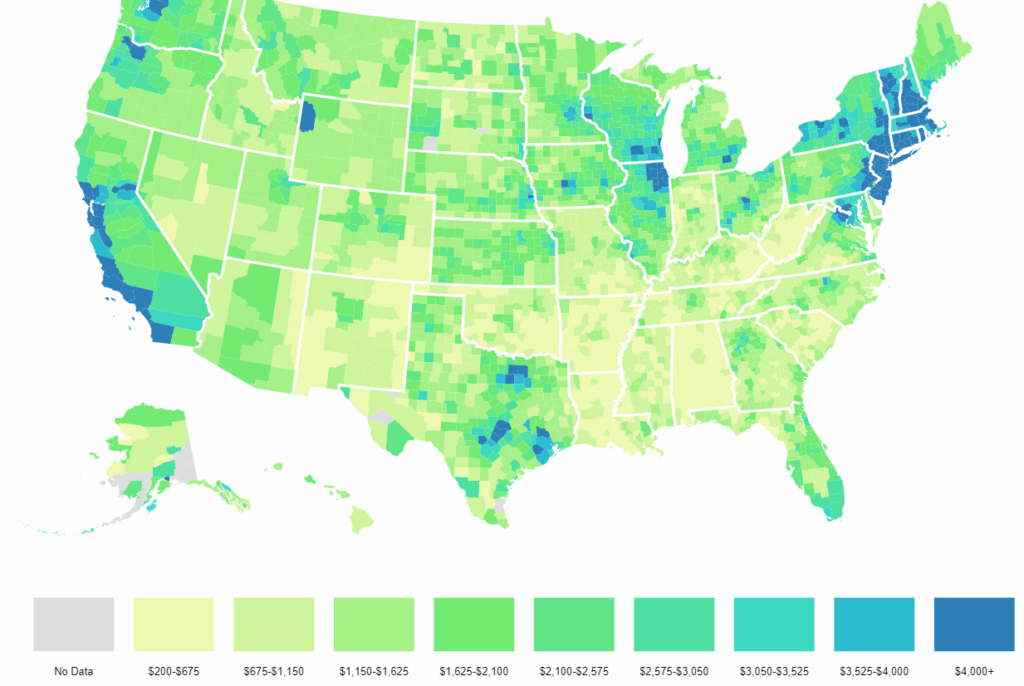

Median property taxes paid vary widely across (and within) the 50 states. The lowest bills in the country are in six counties or county equivalents with median property taxes of less than $200 a year:

- Northwest Arctic Borough and the Kusivlak Census Area (Alaska)*

- Avoyelles, East Carroll, and Madison (Louisiana)

- Choctaw (Alabama)

(*Significant parts of Alaska have no property taxes, though most of these areas have such small populations that they are excluded from federal surveys.)

The next-lowest median property tax of $201 is found in Allen Parish, near the middle of Louisiana, followed by $218 in McDowell County, West Virginia, in the southernmost part of the state.

The eight counties with the highest median property tax payments all have bills exceeding $10,000:

- Bergen, Essex, and Union (New Jersey)

- Nassau, New York, Rockland, and Westchester (New York)

- Falls Church (Virginia)

All but Falls Church are near New York City, as is the next highest, Passaic County, New Jersey ($9,999).

Author(s): Janelle Fritts

Publication Date: 13 Sept 2022

Publication Site: Tax Foundation