Excerpt:

At the top of the Nov. 8 ballot is a proposal to change the Illinois Constitution called Amendment 1, which union backers are calling the “Workers’ Rights Amendment.” Just like the controversial decision to include rigid rules about pensions in the 1970 state constitution, Amendment 1 proposes rigid rules regarding how government unions are treated and makes their powers virtually untouchable.

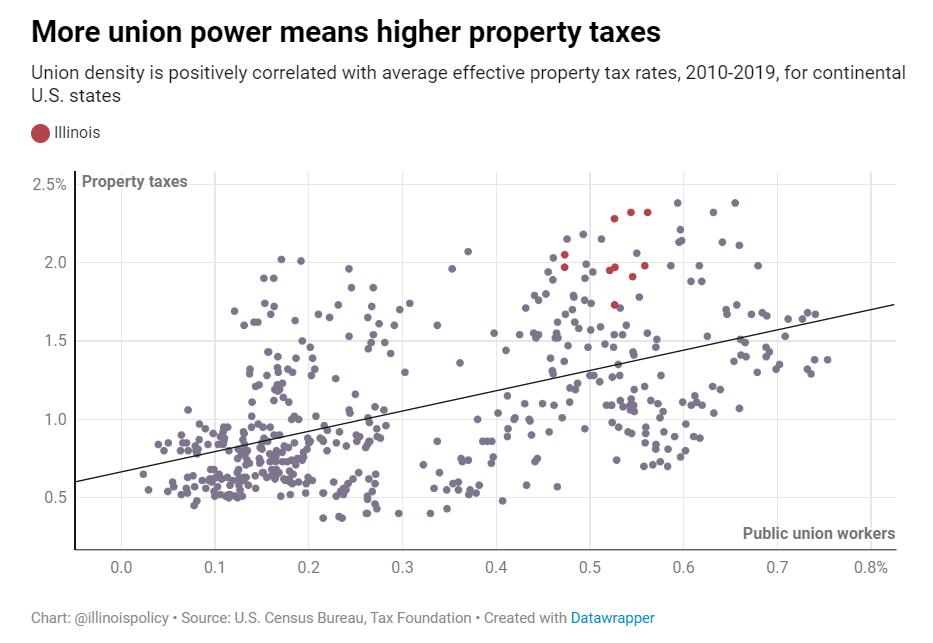

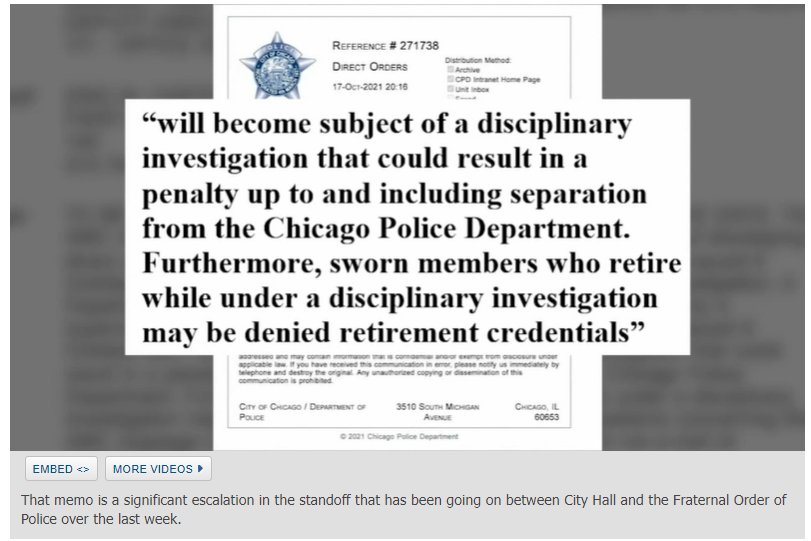

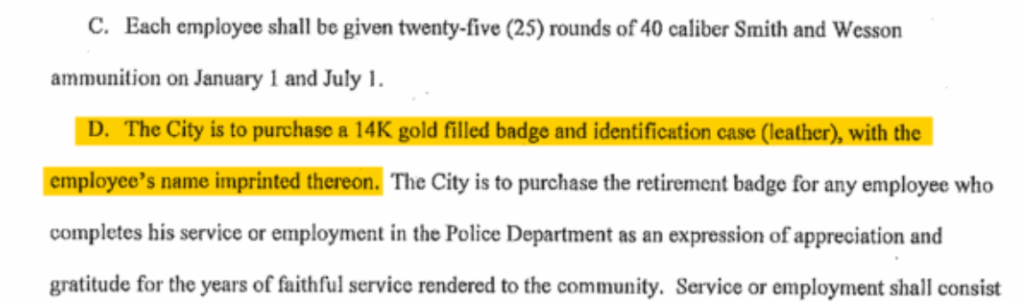

State lawmakers cannot control soaring pension costs without changing the state constitution. Amendment 1 would similarly make it impossible for them to curb government union negotiating powers, and unchecked union power means an unchecked ability to make demands that taxpayers would have no choice but to fund. The cost of those demands is conservatively estimated at $2,100 for the typical Illinois family during the next four years if voters pass Amendment 1, but the tax damage could be far worse.

Looking back, the adoption of the pension protection clause in the 1970 Illinois Constitution started many of the problems Illinois faces today. Illinois’ pension protection clause has been interpreted to be more rigid than any similar provision in any state constitution. With no ability to rein in the cost of public pensions, payments have crowded out spending on education and public services even as Illinoisans bear some of the highest tax burdens in the country.

The state holds the lowest credit ratings in the country, and residents are consistently leaving for states unrestrained by an unyielding pension clause in their constitutions. State lawmakers made attempts to correct the problem in 2013, but the Illinois Supreme Court struck down most of those reforms. The only option left is to change the state constitution, which could let the state regain fiscal sanity.

Instead, state lawmakers went in the opposite direction and handed voters Amendment 1. Instead of giving Illinois more flexibility to handle its money problems, the proposal takes away options and is potentially more restrictive than even the 1970 constitution’s pension protection clause.

Author(s): Joe Tabor

Publication Date: 14 Sept 2022

Publication Site: Illinois Policy Institute