Link:https://reason.com/2021/10/22/40-years-of-trillion-dollar-debt/?utm_medium=email

Graphic:

Excerpt:

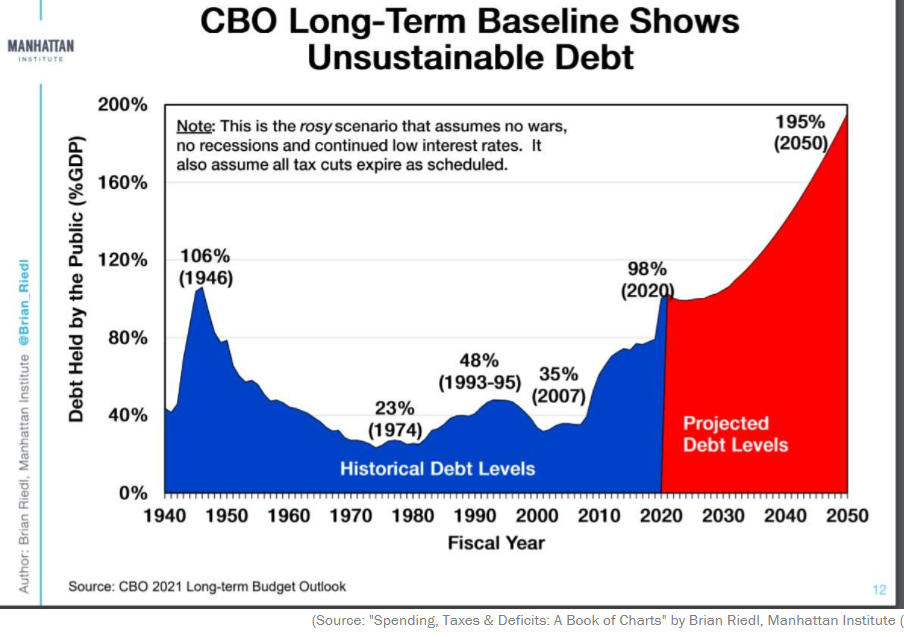

It’s true, of course, that $1 trillion doesn’t buy what it used to. That amount in 1981 would purchase about $3 trillion worth of stuff today. The best way to measure the national debt over long periods of time is to compare it to America’s gross domestic product (GDP), a rough estimate of the size of the country’s economy in a given year.

In the early 1980s, for example, even as the gross national debt exceeded $1 trillion for the first time, the national debt was less than 40 percent of GDP. The national debt is now equivalent to the country’s GDP and is on pace to be nearly 200 percent of GDP by the middle of the century, as this chart from Brian Riedl, a deficit hawk and former Republican Senate staffer now working at the Manhattan Institute, helpfully illustrates:

Author(s): Eric Boehm

Publication Date: 22 Oct 2021

Publication Site: Reason