Excerpt:

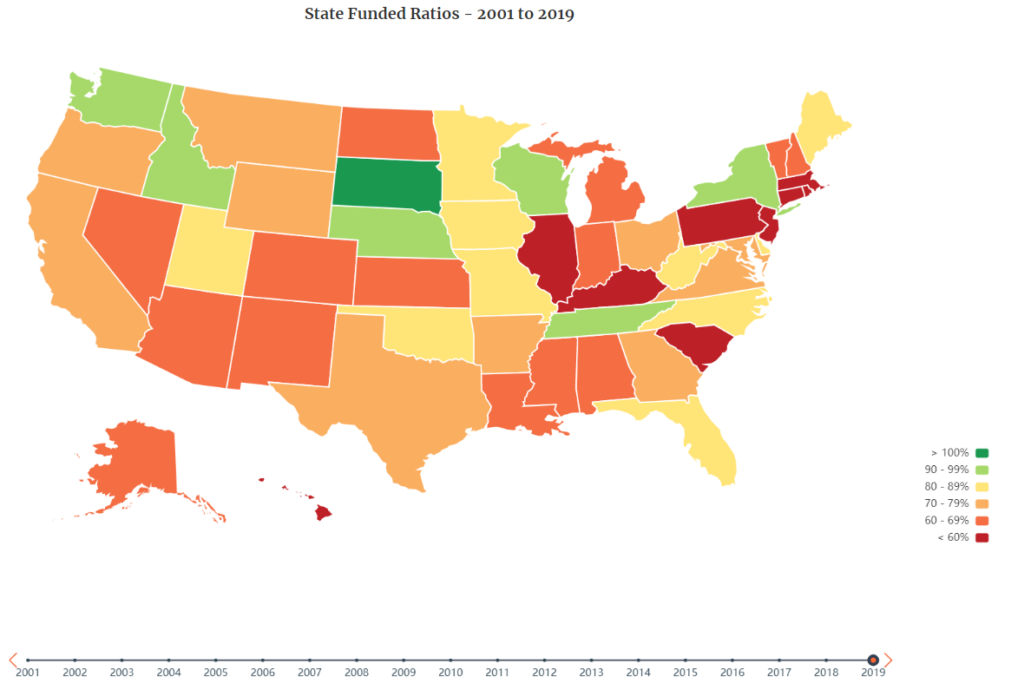

Using publicly available data and annual financial reports published by FRS, our quantitative team has built an actuarial model of the FRS system that has allowed our analysts to spotlight areas of systemic risk and inefficiencies that have resulted in not only the FRS defined benefit plan going from 118 percent funded and a surplus of $13.5 billion to 82 percent funded and holding over $36 billion in earned, yet unfunded, pension obligations that are implicitly protected by law, but also how the defined contribution Investment Plan, as currently built today, falls well short in providing adequate retirement security to public sector employees.

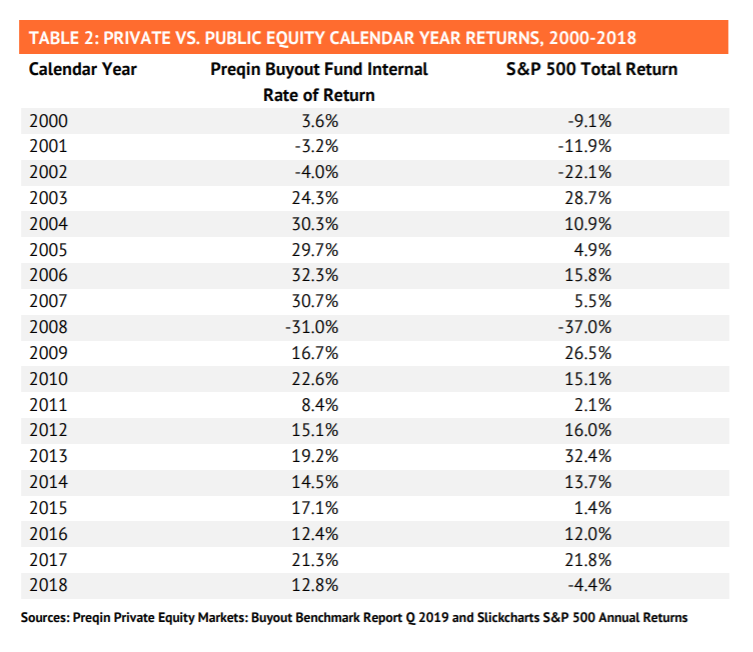

Regarding the current state of the FRS pension plan, underperforming investment returns have been the largest contributor to the unfunded liability, adding $17 billion in debt since 2008. Milliman Inc.—the actuaries hired by the system—warned for three straight years (2016, 2017, and 2018) that the system’s assumed rate of return was not reasonable, leading to its eventual reduction to 7.0 percent. Even with the reduced assumption, however, our analysis indicates that FRS still has a less than 40 percent probability of achieving or exceeding that rate over the next ten years. Market outcomes below FRS expectations will still likely be an issue generating unexpected costs for taxpayers, and the unfunded liabilities that exist today will continue to inhibit plan assets from compounding over decades, making paying down the $36 billion debt and honoring the state’s long-term obligations more difficult.

Author(s): Vittorio Nastasi

Publication Date: 4 February 2021

Publication Site: Reason