Link: https://www.wsj.com/articles/gamestop-craze-puts-holders-of-retail-etf-on-wild-ride-11613923200

Excerpt:

GameStop mania has spilled over into a popular exchange-traded fund, as the WallStreetBets craze reaches beyond shares favored on social media.

The fund, State Street ’s SPDR S&P Retail ETF, was created in 2006 to give investors broad exposure to mall-store firms. Its shares have surged 23% this year, far outstripping a 4% gain in the S&P 500, despite the uncertain outlook for retail. Behind those gains are the traders who congregate on social-media platforms such as Reddit’s WallStreetBets forum and whose enthusiasm has turned this mundane investment into a roller coaster.

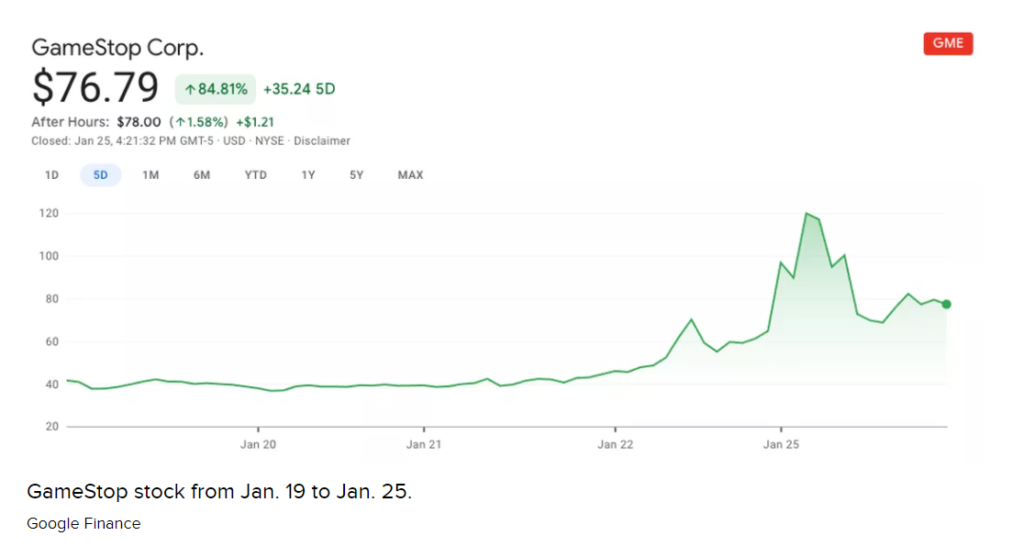

On Jan. 27, GameStop soared 135%, driven by events such as Tesla Inc. Chief Executive Elon Musk tweeting “Gamestonk.” The State Street fund jumped 42% the same day. The next day, GameStop shares tumbled 44% and the fund, known by its ticker XRT, dropped about 9%.

Author(s): Michael Wursthorn

Publication Date: 21 February 2021

Publication Site: Wall Street Journal