Graphic:

Abstract:

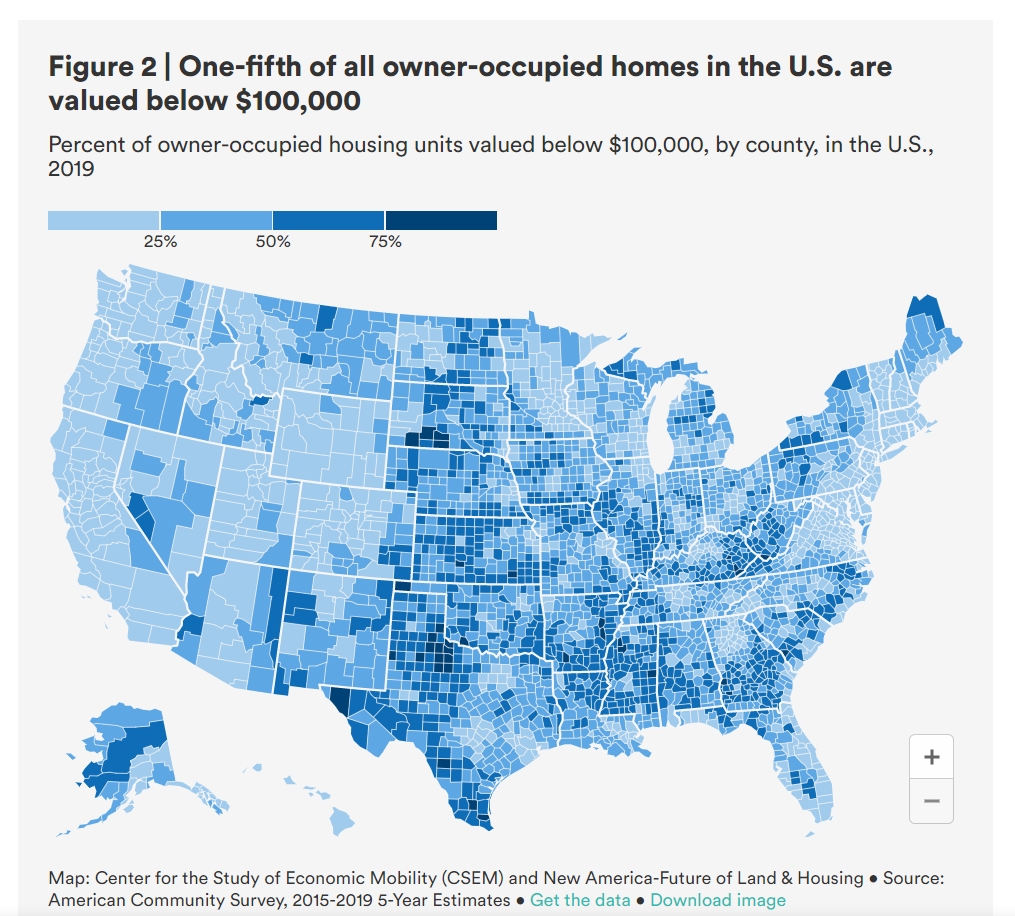

While conventional wisdom maintains that high home prices are to blame for declining homeownership rates, there is another elusive barrier stopping millions of would-be homeowners: banks are increasingly unwilling to write small dollar mortgages. One fifth of owner-occupied homes in the United States cost less than $100,000, but due to unintended consequences of the Dodd-Frank Act, among other factors, banks are opting out of writing small dollar loans. Instead, more than three quarters of small dollar homes are purchased in cash, often by investors or well-off individuals. This lending gap locks millions of low-and-moderate income families out of homeownership, and exacerbates the racial homeownership gap as these small dollar homes are a critical source of homeownership for many first-time buyers in Black and Hispanic communities.

In this report, the Future of Land and Housing program at New America and the Center for the Study of Economic Mobility (CSEM) at Winston-Salem State University (WSSU) focus on three dimensions of this problem: 1) the unavailability of financing for small dollar loans; 2) the catch-22 of “mortgage standards”; and 3) competition with all-cash buyers at a national level and through a local case study of Winston-Salem and Forsyth County, North Carolina.

Author(s): Sabiha Zainulbhai, Zachary D. Blizard, Craig J. Richardson, Yuliya Panfil

Publication Date: 9 Nov 2021

Publication Site: New America